Nj 1065 Instructions 2019

What are the NJ 1065 Instructions?

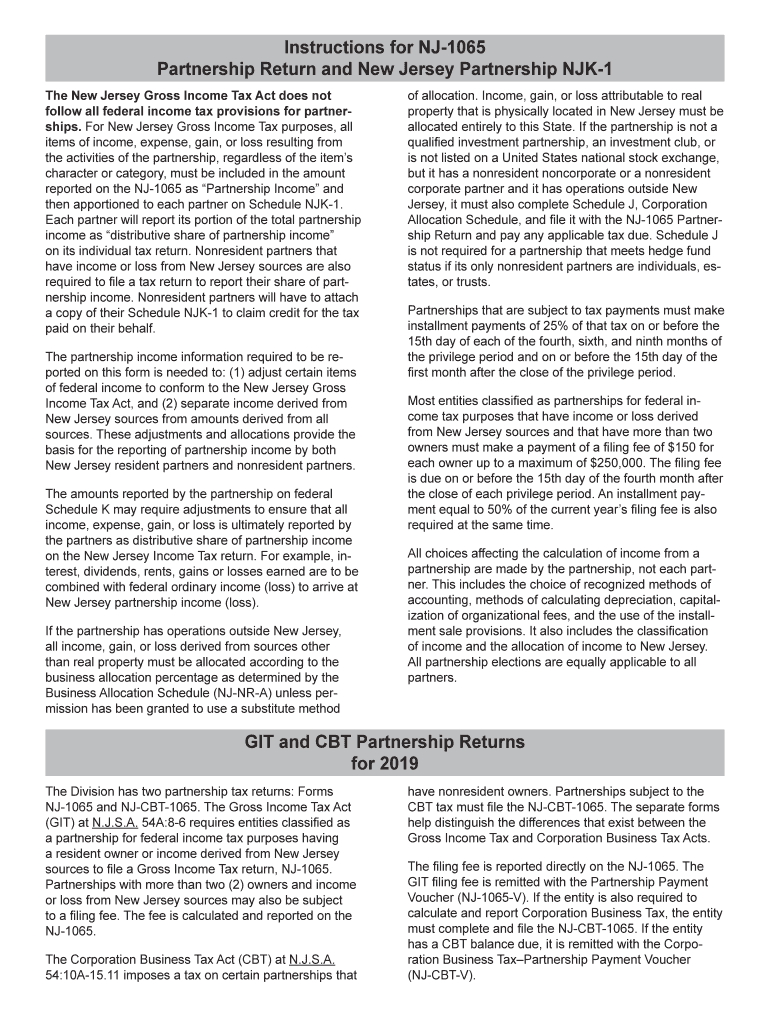

The NJ 1065 Instructions provide detailed guidance for partnerships operating in New Jersey. This form is essential for reporting income, deductions, and credits for partnerships. It outlines how to accurately complete the form, ensuring compliance with state tax regulations. The instructions cover various aspects, including eligibility criteria, required documentation, and specific calculations necessary for accurate reporting.

Steps to Complete the NJ 1065 Instructions

Completing the NJ 1065 Instructions involves several key steps:

- Gather necessary documentation, including financial records and partner information.

- Follow the outlined sections of the NJ 1065 form, ensuring all required fields are filled accurately.

- Calculate the partnership's income, deductions, and credits as specified in the instructions.

- Review the completed form for accuracy before submission.

Legal Use of the NJ 1065 Instructions

The NJ 1065 Instructions are legally binding when completed correctly. They must adhere to New Jersey's tax laws and regulations. The instructions provide clarity on what constitutes a valid submission, including the necessity of signatures and the implications of electronic filing. Understanding these legal requirements helps ensure that partnerships remain compliant and avoid potential penalties.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the NJ 1065 form. Typically, the due date aligns with the federal tax return deadlines, which is the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. It is crucial to stay informed about any changes to these deadlines to avoid late penalties.

Required Documents

To complete the NJ 1065 Instructions, partnerships must gather several required documents, including:

- Financial statements, such as income statements and balance sheets.

- Partner information, including Social Security numbers and ownership percentages.

- Documentation for any deductions or credits claimed, such as receipts and invoices.

Form Submission Methods

The NJ 1065 form can be submitted through various methods, including:

- Online filing through the New Jersey Division of Taxation's website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Penalties for Non-Compliance

Failure to comply with the NJ 1065 Instructions can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits. It is essential for partnerships to understand these risks and ensure timely and accurate submissions to avoid complications with the New Jersey Division of Taxation.

Quick guide on how to complete section 1835 13 partnerships and partners nj admin

Effortlessly Prepare Nj 1065 Instructions on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Nj 1065 Instructions across any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The simplest way to modify and electronically sign Nj 1065 Instructions with ease

- Obtain Nj 1065 Instructions and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize essential parts of your documents or redact confidential information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Nj 1065 Instructions to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct section 1835 13 partnerships and partners nj admin

Create this form in 5 minutes!

How to create an eSignature for the section 1835 13 partnerships and partners nj admin

How to create an electronic signature for the Section 1835 13 Partnerships And Partners Nj Admin in the online mode

How to generate an eSignature for your Section 1835 13 Partnerships And Partners Nj Admin in Chrome

How to create an electronic signature for signing the Section 1835 13 Partnerships And Partners Nj Admin in Gmail

How to make an electronic signature for the Section 1835 13 Partnerships And Partners Nj Admin straight from your smart phone

How to create an eSignature for the Section 1835 13 Partnerships And Partners Nj Admin on iOS devices

How to make an electronic signature for the Section 1835 13 Partnerships And Partners Nj Admin on Android

People also ask

-

What is NJ instructions partnership in the context of airSlate SignNow?

NJ instructions partnership refers to the specific guidelines and steps for implementing eSignature solutions tailored for businesses in New Jersey. Using airSlate SignNow, your organization can streamline document signing processes while ensuring compliance with state regulations.

-

How much does airSlate SignNow cost for NJ instructions partnership users?

Pricing for airSlate SignNow varies based on the package you choose; however, it is designed to be cost-effective, especially for those following NJ instructions partnership. You can explore different plans on our website to find one that suits your business needs and budget.

-

What features does airSlate SignNow offer for NJ instructions partnership?

AirSlate SignNow includes features that are essential for NJ instructions partnership, such as customizable templates, advanced security, and mobile access. These functionalities help businesses create, manage, and sign documents seamlessly while adhering to New Jersey's legal requirements.

-

Can I integrate airSlate SignNow with other software for NJ instructions partnership?

Yes, airSlate SignNow offers various integrations with popular business tools, making it easier for users to implement NJ instructions partnership effectively. You can connect our solution with CRM systems, cloud storage, and productivity applications to enhance your document management workflow.

-

How does airSlate SignNow benefit businesses implementing NJ instructions partnership?

Implementing NJ instructions partnership with airSlate SignNow allows businesses to save time, reduce paper usage, and increase productivity. Moreover, the platform ensures a secure and legally binding process for document signing, which is crucial for maintaining compliance in New Jersey.

-

Is there customer support available for NJ instructions partnership users?

Absolutely! AirSlate SignNow provides comprehensive customer support specifically for users handling NJ instructions partnership. Our team is available via chat, email, and phone to assist you with any questions or challenges you may encounter.

-

What is the setup process for NJ instructions partnership with airSlate SignNow?

Setting up for NJ instructions partnership with airSlate SignNow is straightforward and user-friendly. Once you sign up, our platform guides you through the necessary steps to create your account and customize your document workflows according to New Jersey regulations.

Get more for Nj 1065 Instructions

- Renewal new multi tenant registration application city of dallas dallascityhall form

- 311t contracts city of dallas form

- To view the application for alarm registration windsor police service form

- Homecoming queen and king nomination form student lr

- Cif 206 form

- Vat101 form

- Public defenders in westmoreland county pa form

- Application for demolition permit city of ocala ocalafl form

Find out other Nj 1065 Instructions

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple