E Filing of Individual Income Tax Returns with Homestead 2022

Key elements of the NJ 1065 instructions

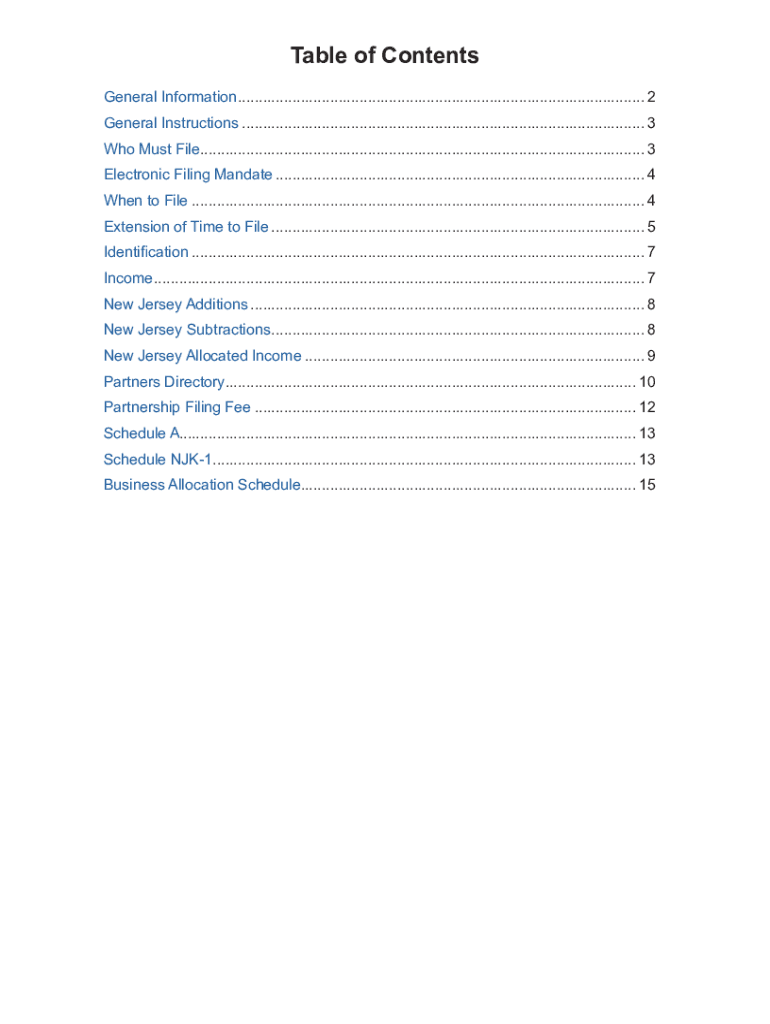

The NJ 1065 instructions are essential for partnerships filing their tax returns in New Jersey. Understanding the key elements ensures accurate completion and compliance. The form requires specific information about the partnership, including:

- Partnership Information: This includes the name, address, and federal employer identification number (EIN).

- Partner Details: Each partner's name, address, and percentage of ownership must be clearly stated.

- Income and Deductions: Accurate reporting of the partnership's income, deductions, and credits is crucial for tax calculations.

- Signature Requirements: The form must be signed by an authorized partner, ensuring accountability and legal compliance.

Steps to complete the NJ 1065 instructions

Completing the NJ 1065 instructions involves a series of methodical steps to ensure accuracy and compliance with state regulations. Here’s a simplified process:

- Gather all necessary documents, including financial statements and partner information.

- Fill out the partnership information section, ensuring all details are accurate.

- Report the income and deductions, using supporting documents to verify amounts.

- Complete the partner details section, listing each partner's contributions and ownership percentages.

- Review the form for completeness and accuracy before signing.

- Submit the form electronically or via mail, adhering to the submission guidelines.

Filing deadlines / Important dates

Timely filing of the NJ 1065 is crucial to avoid penalties. The following deadlines are important:

- Original Filing Deadline: Typically, the NJ 1065 must be filed by the 15th day of the fourth month following the close of the tax year.

- Extension Requests: If additional time is needed, partnerships can request an extension, which usually extends the deadline by six months.

- Payment Due Dates: Any taxes owed must be paid by the original filing deadline to avoid interest and penalties.

Required documents

To accurately complete the NJ 1065 instructions, several documents are necessary. These include:

- Financial Statements: Income statements, balance sheets, and cash flow statements provide a clear picture of the partnership's financial status.

- Partner Agreements: Documentation outlining the terms of partnership and ownership percentages is essential for clarity.

- Prior Year Tax Returns: Previous filings can serve as a reference to ensure consistency and accuracy in reporting.

- Supporting Documentation: Any additional records that substantiate income, deductions, and credits claimed on the form.

Legal use of the NJ 1065 instructions

The NJ 1065 instructions serve a legal purpose in the context of tax compliance for partnerships. Filing this form correctly is essential to:

- Meet State Requirements: New Jersey mandates that partnerships file this form to report income and pay taxes accordingly.

- Avoid Penalties: Non-compliance can result in fines and interest on unpaid taxes, making accurate completion vital.

- Establish Legal Standing: Properly filed tax returns can protect partnerships in legal matters, demonstrating compliance with state laws.

Examples of using the NJ 1065 instructions

Understanding practical applications of the NJ 1065 instructions can enhance clarity. Here are a few scenarios:

- New Partnerships: A newly formed partnership can use the NJ 1065 instructions to navigate their first filing, ensuring they meet all requirements.

- Changes in Partnership Structure: If a partner leaves or joins, the NJ 1065 instructions help in accurately reporting changes in ownership and income distribution.

- Tax Planning: Partnerships can utilize the instructions to strategize deductions and credits, optimizing their tax liability.

Quick guide on how to complete e filing of individual income tax returns with homestead

Effortlessly Complete E Filing Of Individual Income Tax Returns With Homestead on Any Device

Managing documents online has gained traction with enterprises and individuals alike. It offers a flawless environmentally friendly alternative to conventional printed and signed papers, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Handle E Filing Of Individual Income Tax Returns With Homestead on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to Update and eSign E Filing Of Individual Income Tax Returns With Homestead with Ease

- Obtain E Filing Of Individual Income Tax Returns With Homestead and click Get Form to initiate the process.

- Utilize the tools provided to complete your form.

- Emphasize key sections of the documents or redact sensitive details using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign E Filing Of Individual Income Tax Returns With Homestead while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct e filing of individual income tax returns with homestead

Create this form in 5 minutes!

How to create an eSignature for the e filing of individual income tax returns with homestead

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the nj 1065 instructions for filing a partnership return?

The nj 1065 instructions provide detailed guidelines for partnerships in New Jersey to file their income tax returns. These instructions outline what forms are needed, how to report income, deductions, and credits, and important deadlines for submissions.

-

How can airSlate SignNow assist with nj 1065 instructions?

airSlate SignNow streamlines the process of signing and sending documents required for nj 1065 instructions. With our easy-to-use features, you can ensure that all necessary forms are completed and signed electronically, simplifying the filing process.

-

Are there any costs associated with using airSlate SignNow for nj 1065 instructions?

airSlate SignNow offers a cost-effective solution with various pricing plans tailored to your needs. You can choose the plan that suits your business, ensuring you have all the necessary tools to manage nj 1065 instructions without breaking the bank.

-

What features does airSlate SignNow provide for managing nj 1065 instructions?

airSlate SignNow includes essential features such as document templates, eSignature capabilities, and workflow automation. These features help you efficiently manage the paperwork involved in nj 1065 instructions, saving time and reducing errors.

-

Can airSlate SignNow integrate with other tools for nj 1065 instructions?

Yes, airSlate SignNow integrates easily with various popular applications, enhancing your workflow for nj 1065 instructions. By connecting with tools like Google Drive, Dropbox, and others, you can streamline document management and storage.

-

What are the benefits of using airSlate SignNow for nj 1065 instructions?

Using airSlate SignNow for nj 1065 instructions provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security for your documents. Our platform ensures that your filings are accurate and timely, giving you peace of mind.

-

Is airSlate SignNow user-friendly for navigating nj 1065 instructions?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and use the platform for nj 1065 instructions. With intuitive controls and helpful guides, you can quickly familiarize yourself with the process.

Get more for E Filing Of Individual Income Tax Returns With Homestead

Find out other E Filing Of Individual Income Tax Returns With Homestead

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe