Sekeoko Olu Reset Form Michigan Department of Treasury 4884 Rev 0821, Page 1 of 2Include with Form MI1040 and Schedule 1 MICHIGA 2021

Understanding the Michigan Form 4884

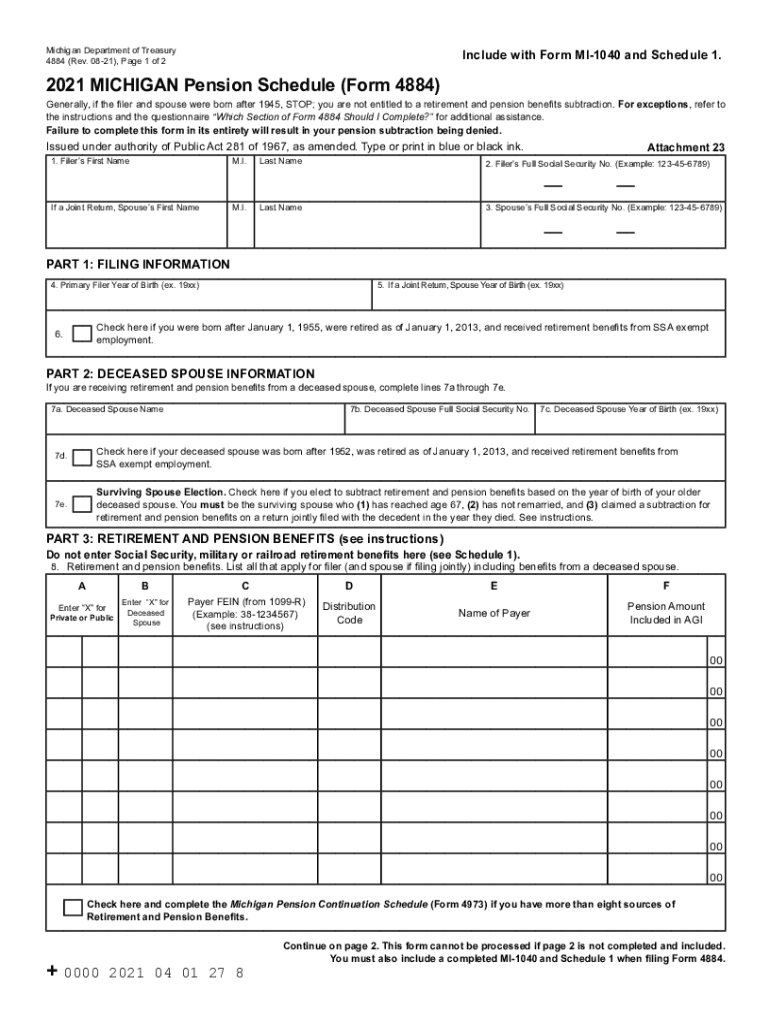

The Michigan Form 4884, also known as the Michigan Pension Schedule, is essential for individuals seeking to report pension and retirement income. This form is typically included with the MI-1040 tax return. It allows filers to claim exemptions for certain types of retirement income, which can significantly affect their overall tax liability. Understanding the specific requirements and sections of this form is crucial for accurate completion and compliance with state tax laws.

Steps to Complete the Michigan Form 4884

Completing the Michigan Form 4884 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary documents, including your pension statements and any other relevant tax documents.

- Begin by filling out your personal information at the top of the form, including your name, address, and Social Security number.

- Detail your pension income in the designated sections, clearly indicating the type of income and the amounts received.

- Claim any exemptions applicable to your situation, ensuring you meet the eligibility criteria outlined by the Michigan Department of Treasury.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Michigan Form 4884

The Michigan Form 4884 is legally binding when completed correctly and submitted to the appropriate state authorities. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or audits. The form must be filed in accordance with Michigan tax laws, which dictate the types of retirement income eligible for exemption and the necessary documentation required to support your claims.

Filing Deadlines for the Michigan Form 4884

Timely submission of the Michigan Form 4884 is crucial to avoid penalties. The form is typically due on April 15 each year, coinciding with the federal tax filing deadline. If you require additional time, you may file for an extension, but it is important to check specific state guidelines to ensure compliance with all requirements.

Eligibility Criteria for Exemptions on the Michigan Form 4884

To qualify for exemptions on the Michigan Form 4884, filers must meet specific eligibility criteria. Generally, these exemptions apply to individuals receiving pension income from qualified retirement plans. Factors such as age, type of pension, and residency status can influence eligibility. It is advisable to review the detailed guidelines provided by the Michigan Department of Treasury to ensure you meet all necessary conditions.

Form Submission Methods for the Michigan Form 4884

The Michigan Form 4884 can be submitted through various methods, providing flexibility for filers. Options include:

- Online submission through the Michigan Department of Treasury's e-file system.

- Mailing a paper copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Each method has specific instructions and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete sekeoko olu reset form michigan department of treasury 4884 rev 0821 page 1 of 2include with form mi1040 and schedule 12021

Complete Sekeoko Olu Reset Form Michigan Department Of Treasury 4884 Rev 0821, Page 1 Of 2Include With Form MI1040 And Schedule 1 MICHIGA effortlessly on any device

Online document management has become popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Sekeoko Olu Reset Form Michigan Department Of Treasury 4884 Rev 0821, Page 1 Of 2Include With Form MI1040 And Schedule 1 MICHIGA on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Sekeoko Olu Reset Form Michigan Department Of Treasury 4884 Rev 0821, Page 1 Of 2Include With Form MI1040 And Schedule 1 MICHIGA with ease

- Locate Sekeoko Olu Reset Form Michigan Department Of Treasury 4884 Rev 0821, Page 1 Of 2Include With Form MI1040 And Schedule 1 MICHIGA and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as an ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Sekeoko Olu Reset Form Michigan Department Of Treasury 4884 Rev 0821, Page 1 Of 2Include With Form MI1040 And Schedule 1 MICHIGA and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sekeoko olu reset form michigan department of treasury 4884 rev 0821 page 1 of 2include with form mi1040 and schedule 12021

Create this form in 5 minutes!

People also ask

-

What is michigaas and how does it relate to airSlate SignNow?

Michigaas is a term referring to record-keeping and document management in the state of Michigan. airSlate SignNow helps businesses streamline their michigaas processes by providing a secure platform to send and electronically sign documents, ensuring compliance and efficiency.

-

How does airSlate SignNow improve michigaas document management?

AirSlate SignNow simplifies michigaas document management by enabling users to create, send, and track electronic documents easily. Its user-friendly interface reduces the time spent on document handling, making it an ideal solution for businesses looking to optimize their michigaas operations.

-

What are the pricing options for airSlate SignNow for michigaas users?

AirSlate SignNow offers flexible pricing plans tailored to fit the needs of michigaas users, from small businesses to enterprise-level solutions. Each plan includes essential features that cater to document signing and management needs, ensuring that every user finds a suitable option.

-

What features does airSlate SignNow offer for michigaas documentation?

airSlate SignNow includes features essential for michigaas documentation, such as templates, bulk sending, and custom branding. These features enable users to create professional documents quickly while maintaining compliance with Michigan's regulations.

-

Can airSlate SignNow integrate with other software for michigaas tasks?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing its functionality for michigaas tasks. Integrations with platforms like Google Workspace, Salesforce, and others ensure that your workflows remain efficient and interconnected.

-

What are the benefits of using airSlate SignNow for michigaas?

Using airSlate SignNow for michigaas provides many benefits, including increased efficiency, reduced paper usage, and improved tracking of documents. These advantages support businesses in Michigan to stay organized and compliant while saving time and resources.

-

Is airSlate SignNow compliant with Michigan laws regarding michigaas?

Absolutely, airSlate SignNow is designed to comply with all applicable Michigan laws regarding michigaas and electronic signatures. The platform ensures that your documents are legally binding, giving you peace of mind that you are adhering to state regulations.

Get more for Sekeoko Olu Reset Form Michigan Department Of Treasury 4884 Rev 0821, Page 1 Of 2Include With Form MI1040 And Schedule 1 MICHIGA

- Mississippi deed trust form

- Second deed of trust mississippi form

- Mississippi affidavit document form

- Conditional assignment of rentals mississippi form

- Consent and acknowledgment of subordinate mortgage mississippi form

- Agreement subordinated debt sample form

- Affidavit of administrator regarding attempts to find creditors mississippi form

- Mississippi failure online form

Find out other Sekeoko Olu Reset Form Michigan Department Of Treasury 4884 Rev 0821, Page 1 Of 2Include With Form MI1040 And Schedule 1 MICHIGA

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT