Unknown Article Translation Michigan Form 4884 2023-2026

Understanding the 2022 Michigan Form 4884

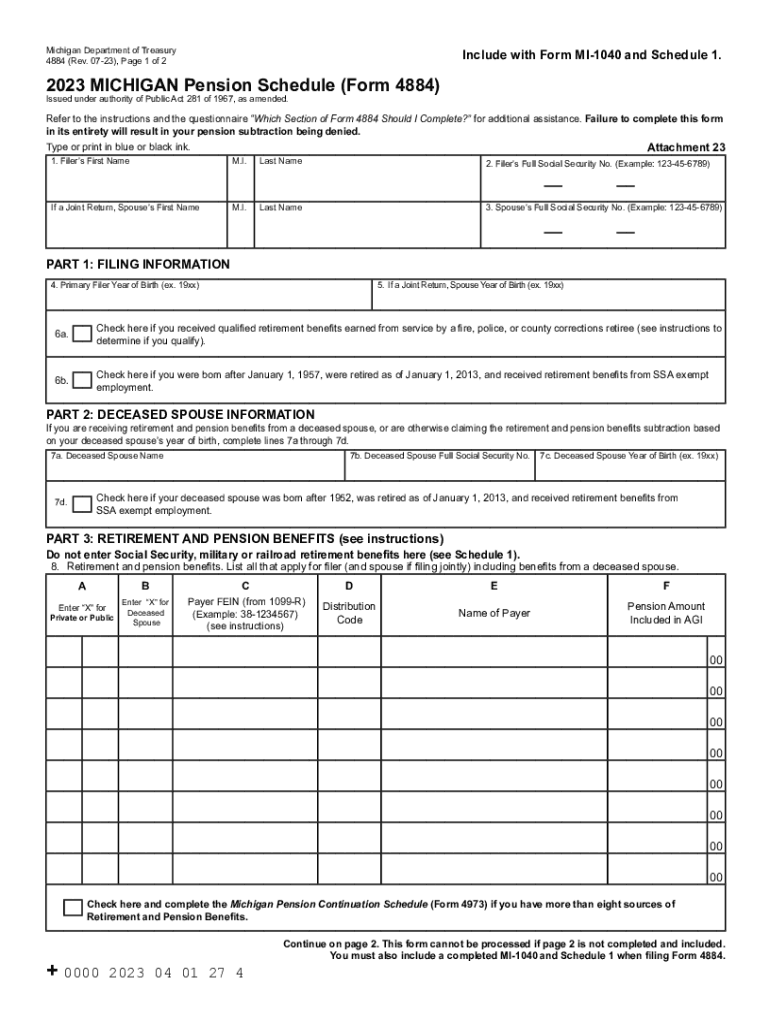

The 2022 Michigan Form 4884 is a tax form used primarily for reporting pension income for residents of Michigan. This form is essential for individuals who receive pension distributions and wish to claim a tax exemption on their state income tax. The form allows taxpayers to report various types of pension income, ensuring compliance with state tax regulations. Understanding the specific requirements and sections of this form is crucial for accurate filing and potential tax savings.

Steps to Complete the 2022 Michigan Form 4884

Completing the 2022 Michigan Form 4884 involves several key steps:

- Gather necessary documentation, including your pension statements and any other relevant income information.

- Fill out the personal information section, ensuring accuracy in your name, address, and Social Security number.

- Report your total pension income in the designated section, including any taxable and non-taxable amounts.

- Calculate your allowable exemptions based on your age and the type of pension income received.

- Review the completed form for accuracy before submitting it.

Filing Deadlines for the 2022 Michigan Form 4884

It is important to be aware of the filing deadlines associated with the 2022 Michigan Form 4884. Typically, this form must be submitted by April 15 of the following year, aligning with the federal tax filing deadline. If you require additional time, you may file for an extension, but ensure that any taxes owed are paid by the original deadline to avoid penalties.

Required Documents for the 2022 Michigan Form 4884

To accurately complete the 2022 Michigan Form 4884, you will need several documents:

- Pension statements that detail your income for the tax year.

- Any IRS forms related to your pension, such as 1099-R forms.

- Identification documents, including your Social Security number.

- Previous year’s tax return for reference, if necessary.

Form Submission Methods for the 2022 Michigan Form 4884

The 2022 Michigan Form 4884 can be submitted through various methods to accommodate different preferences:

- Online submission through the Michigan Department of Treasury’s e-file system.

- Mailing a printed copy of the completed form to the appropriate state tax office.

- In-person submission at designated state tax offices, if necessary.

Eligibility Criteria for the 2022 Michigan Form 4884

To be eligible to file the 2022 Michigan Form 4884, taxpayers must meet certain criteria:

- Must be a resident of Michigan for the tax year in question.

- Must receive pension income from qualified sources.

- Must be able to provide documentation supporting the pension income claimed.

Quick guide on how to complete unknown article translation michigan form 4884

Prepare Unknown Article Translation Michigan Form 4884 effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Unknown Article Translation Michigan Form 4884 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and electronically sign Unknown Article Translation Michigan Form 4884 seamlessly

- Obtain Unknown Article Translation Michigan Form 4884 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Unknown Article Translation Michigan Form 4884 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct unknown article translation michigan form 4884

Create this form in 5 minutes!

How to create an eSignature for the unknown article translation michigan form 4884

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 2023 Michigan Form 4884?

The 2023 Michigan Form 4884 is used to report corporate income tax liabilities in Michigan. It helps businesses calculate their tax obligations and ensures compliance with state tax laws. Understanding this form is crucial for any company operating in Michigan.

-

How can airSlate SignNow assist with completing the 2023 Michigan Form 4884?

airSlate SignNow simplifies the process of completing the 2023 Michigan Form 4884 by allowing users to fill out, sign, and send the document electronically. Our platform ensures accuracy and compliance, helping businesses avoid common mistakes. You can easily store and access your forms for future reference.

-

Is airSlate SignNow compatible with accounting software for filing the 2023 Michigan Form 4884?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, making it easy to prepare and file the 2023 Michigan Form 4884. This integration streamlines the process by automating data entry and ensuring your figures are accurate. As a result, you can save time and reduce the risk of errors.

-

What features does airSlate SignNow offer for the 2023 Michigan Form 4884?

Key features for handling the 2023 Michigan Form 4884 on airSlate SignNow include e-signature capabilities, secure cloud storage, and document sharing options. These features enhance collaboration and ensure that your filings are completed quickly and securely. Additionally, you can track the status of your documents in real-time.

-

What are the pricing plans for using airSlate SignNow for the 2023 Michigan Form 4884?

airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. You can choose from various subscription options to find the plan that best fits your needs for managing the 2023 Michigan Form 4884. Each plan provides comprehensive features to ensure you get the best value for your investment.

-

How secure is airSlate SignNow when handling the 2023 Michigan Form 4884?

Security is a top priority at airSlate SignNow. We implement robust encryption and compliance measures to protect your sensitive data, including the 2023 Michigan Form 4884. Our platform complies with industry standards, ensuring that your documents are safe from unauthorized access.

-

Can I access airSlate SignNow on mobile devices while working on the 2023 Michigan Form 4884?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to work on the 2023 Michigan Form 4884 from anywhere. This flexibility enables you to sign documents, make updates, and manage your paperwork on the go, ensuring a smooth workflow.

Get more for Unknown Article Translation Michigan Form 4884

Find out other Unknown Article Translation Michigan Form 4884

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter