Revenue Louisiana Gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue Louisiana Gov 2021

Understanding Form R 10614

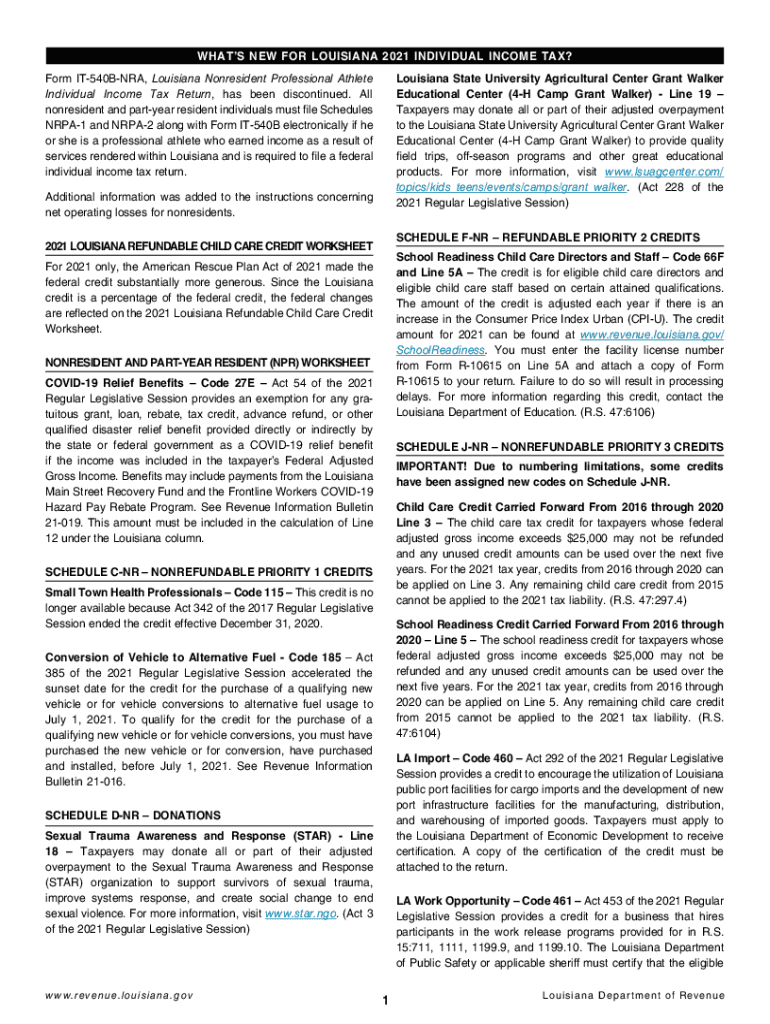

Form R 10614, also known as the Louisiana School Readiness Tax Credit form, is designed for individuals and families seeking to claim tax credits related to early childhood education expenses. This form allows eligible taxpayers to receive a credit for qualified expenses incurred for their children enrolled in approved early childhood education programs. The completion of this form is essential for maximizing available tax benefits and ensuring compliance with state tax regulations.

Eligibility Criteria for Form R 10614

To qualify for the School Readiness Tax Credit, taxpayers must meet specific eligibility requirements. These include:

- Having a dependent child under the age of five who is enrolled in an approved early childhood education program.

- Meeting the income limits set by the state, which may vary annually.

- Filing a Louisiana state income tax return for the applicable tax year.

It is important for taxpayers to review the latest guidelines from the Louisiana Department of Revenue to confirm their eligibility before completing Form R 10614.

Steps to Complete Form R 10614

Filling out Form R 10614 involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including proof of enrollment in an eligible program and receipts for qualified expenses.

- Complete all required sections of the form, ensuring that personal information and dependent details are accurate.

- Calculate the credit amount based on the expenses incurred, adhering to the guidelines provided by the Louisiana Department of Revenue.

- Review the completed form for any errors or omissions before submission.

Following these steps carefully can help streamline the filing process and enhance the likelihood of receiving the intended tax credit.

Form Submission Methods for R 10614

Taxpayers can submit Form R 10614 through various methods, depending on their preferences and circumstances:

- Online Submission: Many taxpayers opt to file their forms electronically through the Louisiana Department of Revenue’s online portal.

- Mail Submission: Alternatively, Form R 10614 can be printed and mailed to the appropriate address provided by the state.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at local tax offices, ensuring that they receive confirmation of submission.

It is advisable to check the latest submission guidelines to ensure compliance with current regulations.

Key Elements of Form R 10614

Form R 10614 includes several critical components that must be completed accurately:

- Taxpayer Information: This section requires personal details, including name, address, and Social Security number.

- Dependent Information: Taxpayers must provide information about their dependent child, including age and enrollment details.

- Expense Reporting: A detailed account of qualified expenses must be included, along with supporting documentation.

Completing these elements thoroughly is essential for a successful claim and to avoid delays in processing.

Penalties for Non-Compliance with Form R 10614

Failure to comply with the requirements associated with Form R 10614 can lead to penalties. These may include:

- Denial of the claimed tax credit, resulting in a higher tax liability.

- Potential fines or interest charges for late or inaccurate submissions.

- Increased scrutiny from the Louisiana Department of Revenue in future filings.

Taxpayers are encouraged to ensure all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete revenuelouisianagov taxforms it540tt 20212021 louisiana tax table revenuelouisianagov

Effortlessly Prepare Revenue louisiana gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue louisiana gov on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow offers you all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle Revenue louisiana gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue louisiana gov on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Revenue louisiana gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue louisiana gov

- Obtain Revenue louisiana gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue louisiana gov and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow uniquely provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, frustrating form hunts, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and electronically sign Revenue louisiana gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue louisiana gov to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuelouisianagov taxforms it540tt 20212021 louisiana tax table revenuelouisianagov

Create this form in 5 minutes!

How to create an eSignature for the revenuelouisianagov taxforms it540tt 20212021 louisiana tax table revenuelouisianagov

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an e-signature for a PDF file on Android OS

People also ask

-

What is form r 10614 and how does it work with airSlate SignNow?

Form r 10614 is a document used for specific regulatory compliance needs. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring that you meet all necessary requirements. Our platform simplifies the workflow, allowing for quicker processing times.

-

Is airSlate SignNow suitable for managing form r 10614?

Absolutely! airSlate SignNow is specifically designed to manage documents like form r 10614 efficiently. Its user-friendly interface allows businesses to handle this form seamlessly, ensuring compliance and reducing the risk of errors.

-

What features does airSlate SignNow offer for form r 10614?

With airSlate SignNow, you can utilize features such as customizable templates, secure eSigning, and automated workflows for form r 10614. These capabilities enhance document management efficiency and ensure that you can track the signing process in real time.

-

How much does it cost to use airSlate SignNow for form r 10614?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing form r 10614. By offering tiered pricing, businesses can select a plan that meets their needs and budget while maximizing the benefits of our eSigning features.

-

Can airSlate SignNow integrate with other applications for processing form r 10614?

Yes, airSlate SignNow offers robust integrations with various applications, enhancing your ability to process form r 10614. This connectivity allows you to sync data and streamline workflows with tools you already use, improving overall productivity.

-

What are the benefits of using airSlate SignNow for form r 10614?

Using airSlate SignNow for form r 10614 provides numerous benefits, including improved efficiency, reduced turnaround times, and increased security. Our platform ensures that your documents are handled safely, allowing for compliance with all regulations related to this specific form.

-

How secure is airSlate SignNow for handling form r 10614?

Security is a top priority for airSlate SignNow. When managing form r 10614, we use encryption and secure access protocols to protect your sensitive information. You can confidently send and eSign this form, knowing that your data is safeguarded.

Get more for Revenue louisiana gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue louisiana gov

- Notice of dishonored check civil keywords bad check bounced check mississippi form

- Check bad form 497313914

- Ms trust form

- Mississippi certificate trust form

- Mutual wills containing last will and testaments for man and woman living together not married with no children mississippi form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children mississippi form

- Mutual wills or last will and testaments for man and woman living together not married with minor children mississippi form

- Non marital cohabitation living together agreement mississippi form

Find out other Revenue louisiana gov TaxForms IT540TT LOUISIANA TAX TABLE Revenue louisiana gov

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter