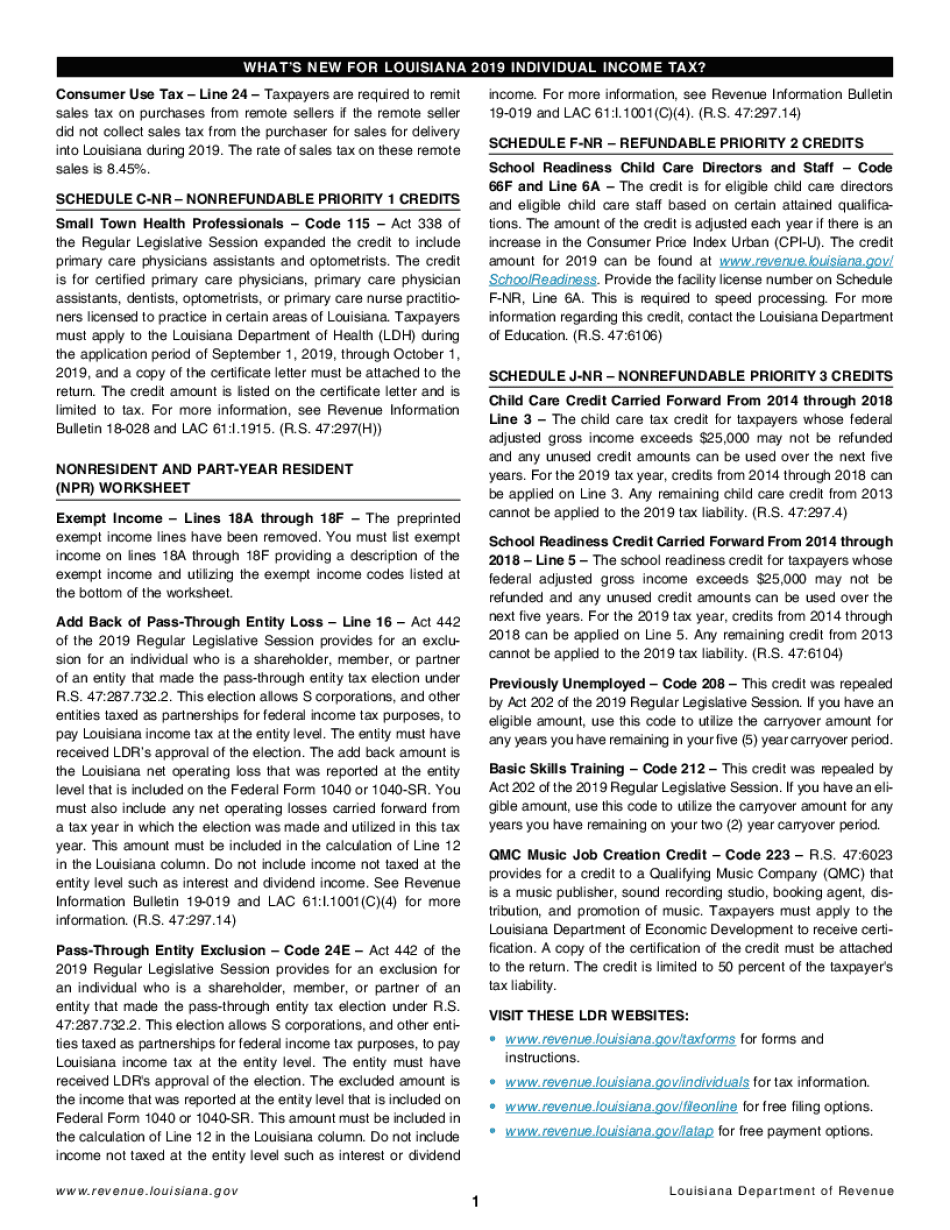

WHATS NEW for LOUISIANA INDIVIDUAL INCOME TAX 2019

Key elements of the 2020 LDR

The 2020 Louisiana Department of Revenue (LDR) form is essential for individuals filing their state income tax returns. This form includes important sections such as personal information, income details, and deductions. Understanding these components is crucial for accurate filing. The form requires taxpayers to provide their Social Security number, filing status, and any dependents. Additionally, it outlines various income sources, including wages, interest, and dividends, which must be reported to determine the total taxable income.

Steps to complete the 2020 LDR

Completing the 2020 LDR involves several key steps to ensure compliance and accuracy. Begin by gathering all necessary documents, such as W-2s and 1099s, which detail your income for the year. Next, fill out the personal information section, ensuring all names and Social Security numbers are correct. Proceed to report your income sources, followed by deductions and credits applicable to your situation. Finally, review the entire form for accuracy before submitting it to the Louisiana Department of Revenue.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for avoiding penalties. The deadline for submitting the 2020 LDR typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Louisiana Department of Revenue's official announcements for any changes or extensions related to specific tax years.

Required Documents

To accurately complete the 2020 LDR, several documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits claimed, like the school readiness tax credit

Having these documents ready will streamline the filing process and help ensure that all income and deductions are accurately reported.

Form Submission Methods

The 2020 LDR can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Louisiana Department of Revenue's website

- Mailing a paper form to the appropriate address

- In-person submission at designated tax offices

Choosing the right submission method depends on personal preference and convenience, but electronic filing is often the fastest and most efficient option.

Penalties for Non-Compliance

Failing to file the 2020 LDR on time or underreporting income can lead to significant penalties. The Louisiana Department of Revenue may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on unpaid taxes, increasing the total amount due. It is essential to file accurately and on time to avoid these financial repercussions.

Quick guide on how to complete whats new for louisiana 2019 individual income tax

Complete WHATS NEW FOR LOUISIANA INDIVIDUAL INCOME TAX with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage WHATS NEW FOR LOUISIANA INDIVIDUAL INCOME TAX on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign WHATS NEW FOR LOUISIANA INDIVIDUAL INCOME TAX effortlessly

- Obtain WHATS NEW FOR LOUISIANA INDIVIDUAL INCOME TAX and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign WHATS NEW FOR LOUISIANA INDIVIDUAL INCOME TAX and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct whats new for louisiana 2019 individual income tax

Create this form in 5 minutes!

How to create an eSignature for the whats new for louisiana 2019 individual income tax

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how is it related to 2020 ldr?

airSlate SignNow is an electronic signature platform that enables businesses to send, sign, and manage documents efficiently. In the context of 2020 ldr, it provides a cost-effective solution for facilitating electronic agreements, ensuring swift transactions and enhanced workflow.

-

How much does airSlate SignNow cost for businesses looking to implement 2020 ldr?

Pricing for airSlate SignNow varies based on the plan you choose, making it accessible for businesses of all sizes. For those looking to leverage the 2020 ldr capabilities, it offers plans that provide essential features at competitive rates, ensuring maximum value for your investment.

-

What features does airSlate SignNow offer that cater to 2020 ldr needs?

airSlate SignNow includes a variety of features that align well with 2020 ldr, such as customizable workflows, automated reminders, and real-time tracking of document status. These functionalities streamline the signing process and enhance overall efficiency.

-

How can airSlate SignNow benefit my business with 2020 ldr?

The implementation of airSlate SignNow for 2020 ldr can signNowly reduce turnaround times for document signing, improve customer satisfaction, and lower operational costs. By automating the signing process, your business can focus more on core activities rather than paperwork.

-

Does airSlate SignNow integrate with other tools for 2020 ldr?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, making it easier to implement 2020 ldr in your existing workflow. You can easily connect it with CRM systems, cloud storage services, and more, enhancing productivity.

-

Is there a mobile app for airSlate SignNow related to 2020 ldr?

Absolutely! airSlate SignNow has a mobile app that allows you to manage your documents and eSign on-the-go. This is particularly useful for businesses utilizing 2020 ldr, as it provides flexibility and convenience in document management.

-

What security measures does airSlate SignNow implement for 2020 ldr?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your documents. This ensures that your sensitive information remains secure, especially important when dealing with 2020 ldr transactions and agreements.

Get more for WHATS NEW FOR LOUISIANA INDIVIDUAL INCOME TAX

- Legal last will and testament form for widow or widower with minor children vermont

- Legal last will form for a widow or widower with no children vermont

- Legal last will and testament form for a widow or widower with adult and minor children vermont

- Legal last will and testament form for divorced and remarried person with mine yours and ours children vermont

- Legal last will and testament form with all property to trust called a pour over will vermont

- Written revocation of will vermont form

- Last will and testament for other persons vermont form

- Notice to beneficiaries of being named in will vermont form

Find out other WHATS NEW FOR LOUISIANA INDIVIDUAL INCOME TAX

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer