Forms and PublicationsLouisvilleKY GovOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson

Understanding the Louisville OL 3 Form

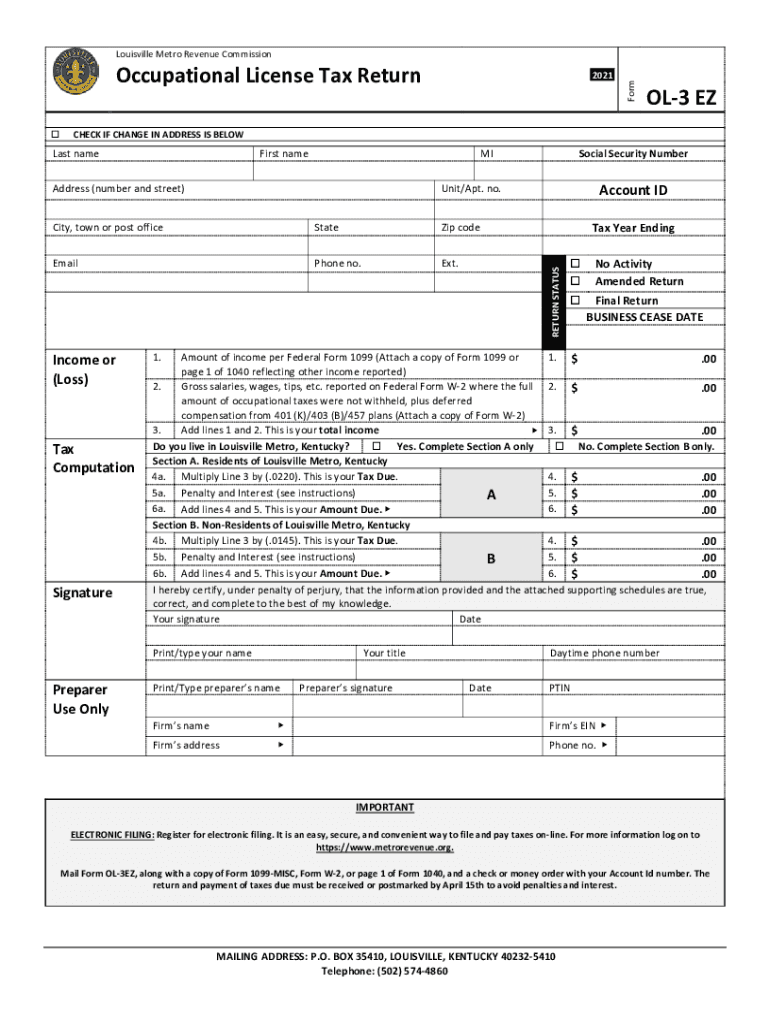

The Louisville OL 3 form, also known as the OL3 occupational tax return, is a crucial document for individuals and businesses operating within Louisville, Kentucky. This form is designed to report and remit occupational license taxes, which are levied on income earned within the city. Understanding its purpose and requirements is essential for compliance and to avoid potential penalties.

The OL 3 form requires detailed information about the taxpayer, including their name, address, and Social Security number or Federal Employer Identification Number (FEIN). Additionally, it necessitates reporting gross receipts and calculating the corresponding tax owed based on the applicable rates set by the city.

Steps to Complete the Louisville OL 3 Form

Completing the Louisville OL 3 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and any relevant business records. This information will help in accurately reporting gross receipts.

Next, fill out the form carefully, ensuring that all sections are completed. Pay special attention to the calculation of the occupational tax, which is typically a percentage of gross receipts. After completing the form, review it for any errors or omissions before submission.

Finally, submit the completed OL 3 form by the designated deadline to avoid penalties. This can often be done electronically, which simplifies the process and ensures timely filing.

Legal Use of the Louisville OL 3 Form

The Louisville OL 3 form is legally binding and must be completed in accordance with local tax laws. To ensure its validity, it is essential to comply with all requirements set forth by the city of Louisville. This includes accurate reporting of income and timely submission of the form.

Failure to adhere to these legal stipulations can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of the OL 3 form is vital for both individuals and businesses operating in Louisville.

Filing Deadlines for the OL 3 Form

Timely filing of the Louisville OL 3 form is critical to avoid penalties. The filing deadline is typically set for April 15 each year, coinciding with the federal tax deadline. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is advisable to check for any updates or changes to the filing schedule, as local regulations may vary. Staying informed about these deadlines helps ensure compliance and avoids unnecessary financial consequences.

Required Documents for the OL 3 Form

When preparing to complete the Louisville OL 3 form, it is important to have all necessary documents on hand. Required documents typically include:

- Income statements or pay stubs

- Business financial records

- Previous year’s OL 3 form, if applicable

- Identification documents, such as a Social Security number or FEIN

Having these documents readily available will streamline the process of completing the form and help ensure accuracy in reporting.

Penalties for Non-Compliance with the OL 3 Form

Non-compliance with the Louisville OL 3 form can lead to significant penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action for continued non-compliance. The city of Louisville takes occupational tax obligations seriously, and failure to file or pay can result in escalating consequences.

To avoid these penalties, it is essential to file the OL 3 form accurately and on time. If there are uncertainties or questions regarding the form, seeking assistance from a tax professional can provide clarity and help ensure compliance.

Quick guide on how to complete forms and publicationslouisvillekygovoccupational license taxesjefferson parish sheriff laoccupational license taxesjefferson

Prepare Forms And PublicationsLouisvilleKY govOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents quickly without any hold-ups. Manage Forms And PublicationsLouisvilleKY govOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Forms And PublicationsLouisvilleKY govOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson without hassle

- Find Forms And PublicationsLouisvilleKY govOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Forms And PublicationsLouisvilleKY govOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson to ensure effective communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the louisville ol 3 form?

The louisville ol 3 form is a crucial document used for various legal and administrative purposes in Louisville, Kentucky. It can be filled out and signed electronically, making the process faster and more efficient. By using the airSlate SignNow platform, users can easily manage their louisville ol 3 form and ensure compliance with local regulations.

-

How can airSlate SignNow help with the louisville ol 3 form?

airSlate SignNow simplifies the process of completing the louisville ol 3 form by providing an intuitive interface for eSigning and document management. Users can upload the form, fill it out, and send it for signatures within minutes. This streamlines the workflow, reducing the time taken for document processing.

-

What are the pricing options for using airSlate SignNow for the louisville ol 3 form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage the louisville ol 3 form efficiently. Pricing is designed to ensure maximum value while accommodating various features, including document editing and advanced eSignature options. You can choose from monthly or annual subscriptions based on your needs.

-

Can I sign the louisville ol 3 form on my mobile device?

Yes, airSlate SignNow allows users to sign the louisville ol 3 form on mobile devices. The platform is fully responsive and optimized for mobile usage, enabling you to fill out and sign documents from anywhere at any time. This flexibility enhances accessibility and convenience for busy professionals.

-

Are there integrations available with airSlate SignNow for the louisville ol 3 form?

airSlate SignNow integrates seamlessly with various applications, making it easy to include the louisville ol 3 form in your existing workflows. You can connect with platforms like Google Drive, Salesforce, and more to automate processes and enhance productivity. These integrations streamline document management and eSigning for your team.

-

What are the benefits of using airSlate SignNow for the louisville ol 3 form?

Using airSlate SignNow for the louisville ol 3 form provides numerous benefits, including time savings, reduced paperwork, and efficient document handling. The eSignature feature ensures that you never have to print, sign, and scan documents again, enhancing productivity. Additionally, it improves compliance and reduces errors in document processing.

-

Is it secure to use airSlate SignNow for the louisville ol 3 form?

Absolutely, airSlate SignNow prioritizes security for all documents, including the louisville ol 3 form. The platform uses advanced encryption methods and complies with industry standards to protect sensitive information. You can have peace of mind knowing that your electronic signatures and documents are safe and secure.

Get more for Forms And PublicationsLouisvilleKY govOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson

- Plaintiffs answer to counter claim mississippi form

- Order dismissing case for want of prosecution mississippi form

- Complaint mississippi 497314116 form

- Motion change venue 497314118 form

- Opposition motion form

- Defendant admission form

- 2nd grade end of year assessment form

- Arkansas better chance program manual form

Find out other Forms And PublicationsLouisvilleKY govOccupational License TaxesJefferson Parish Sheriff, LAOccupational License TaxesJefferson

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free