Occupational Tax Formscurrent YearCity of LexingtonOccupational Tax Formscurrent YearCity of Lexington2021 Form W 4 Internal Rev

Understanding the Refund Occupational Form

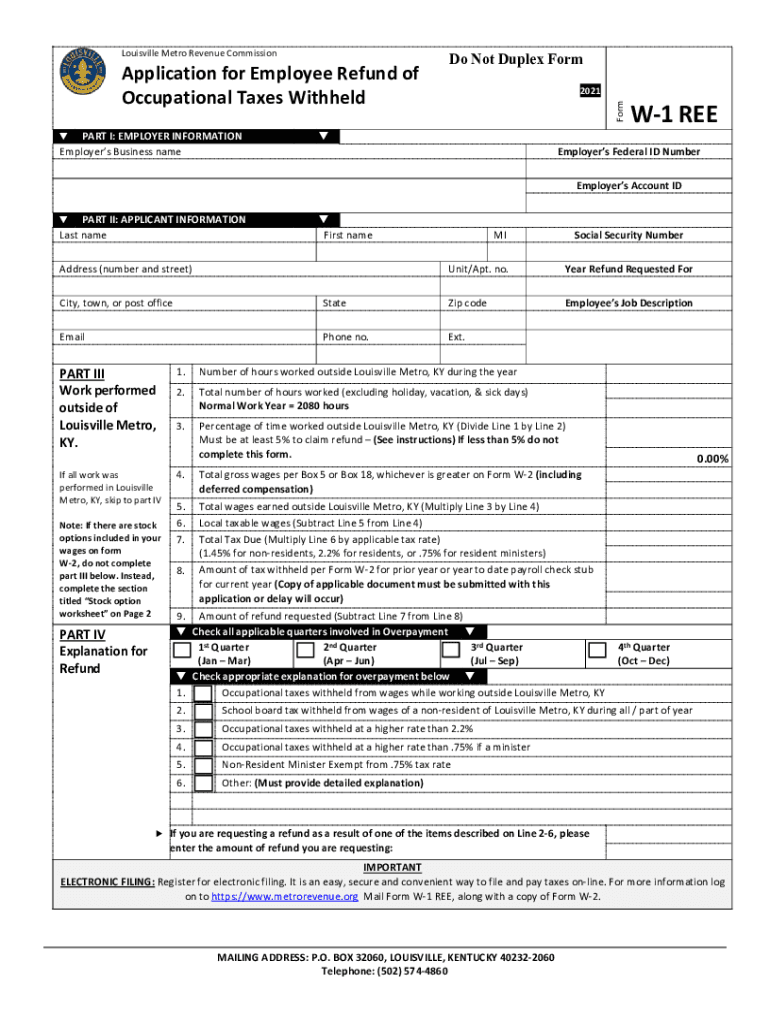

The refund occupational form is a crucial document for individuals seeking to reclaim overpaid occupational taxes in Louisville. This form is specifically designed for residents and workers who have had occupational taxes withheld from their earnings. Understanding its purpose and requirements is essential for a smooth refund process.

Occupational taxes are typically levied on individuals working within a specific city or jurisdiction. If you believe you have overpaid these taxes, filing the refund occupational form allows you to formally request a refund from the city. This form serves as the official request for a review of your tax payments and the potential return of excess funds.

Steps to Complete the Refund Occupational Form

Completing the refund occupational form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including your W-2 forms and any records of tax payments made. This information will be crucial in supporting your refund claim.

Next, accurately fill out the refund occupational form, providing all required personal information, including your name, address, and Social Security number. Be sure to include details about your employment and the specific taxes withheld. Double-check your entries to avoid errors that could delay processing.

Once the form is complete, submit it according to the instructions provided. This may involve mailing the form to the appropriate city department or submitting it electronically through a designated platform.

Legal Use of the Refund Occupational Form

The refund occupational form is governed by local tax laws and regulations. It is essential to understand that this form must be used in accordance with the legal framework established by the city of Louisville. Filing this form does not guarantee a refund; rather, it initiates a review process by the tax authorities.

To ensure compliance, familiarize yourself with any specific legal requirements related to the form. This may include deadlines for submission and documentation needed to support your claim. Adhering to these guidelines is vital for a successful refund application.

Required Documents for Submission

When filing the refund occupational form, certain documents are typically required to substantiate your claim. These may include:

- W-2 forms from your employer showing withheld occupational taxes

- Pay stubs or records of payments made

- Identification documents, such as a driver’s license or Social Security card

Having these documents ready will streamline the process and help ensure that your claim is processed efficiently. Incomplete submissions can lead to delays or denials, so it is important to include all required materials.

Filing Deadlines and Important Dates

Filing deadlines for the refund occupational form can vary, so it is crucial to stay informed about the specific dates applicable to your situation. Typically, claims must be filed within a certain period following the tax year in question.

Check local regulations for the exact deadlines, as missing them could result in forfeiting your right to a refund. Keeping a calendar of important dates related to tax filings can help you stay organized and compliant.

Who Issues the Refund Occupational Form

The refund occupational form is issued by the city of Louisville’s tax authority. This department is responsible for managing occupational tax collections and processing refund requests. It is advisable to contact the tax office directly if you have any questions about the form or the refund process.

Understanding the role of the issuing authority can help you navigate any potential issues that arise during the filing process. They can provide guidance on how to correctly fill out the form and what to expect after submission.

Quick guide on how to complete occupational tax formscurrent yearcity of lexingtonoccupational tax formscurrent yearcity of lexington2021 form w 4 internal

Accomplish Occupational Tax Formscurrent YearCity Of LexingtonOccupational Tax Formscurrent YearCity Of Lexington2021 Form W 4 Internal Rev effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Occupational Tax Formscurrent YearCity Of LexingtonOccupational Tax Formscurrent YearCity Of Lexington2021 Form W 4 Internal Rev on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and electronically sign Occupational Tax Formscurrent YearCity Of LexingtonOccupational Tax Formscurrent YearCity Of Lexington2021 Form W 4 Internal Rev without hassle

- Locate Occupational Tax Formscurrent YearCity Of LexingtonOccupational Tax Formscurrent YearCity Of Lexington2021 Form W 4 Internal Rev and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would prefer to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and electronically sign Occupational Tax Formscurrent YearCity Of LexingtonOccupational Tax Formscurrent YearCity Of Lexington2021 Form W 4 Internal Rev and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a refund occupational form?

A refund occupational form is a document used to request the reimbursement of expenses related to occupational services. It is typically employed by employees needing to reclaim costs incurred for work-related purposes. Understanding how to fill out this form accurately can expedite the refund process.

-

How can airSlate SignNow help with the refund occupational form?

airSlate SignNow simplifies the process of creating and signing a refund occupational form by providing an intuitive platform for eSigning and document management. With our software, users can easily prepare, send, and receive signed forms without the hassles of printing and mailing. This efficiency can enhance the overall refund process experience.

-

Is there a cost associated with using airSlate SignNow for the refund occupational form?

Yes, there are pricing plans available for airSlate SignNow, which cater to various business needs. Our packages are designed to be cost-effective, providing a range of features for managing documents, including the refund occupational form. Pricing details can be found on our website to help you choose the best plan for your requirements.

-

What features does airSlate SignNow offer for creating a refund occupational form?

airSlate SignNow offers several features to streamline the creation of a refund occupational form, including customizable templates, drag-and-drop functionality, and collaborative editing. Additionally, users can track the status of their forms in real-time, ensuring a smooth refund process. These features signNowly reduce the time it takes to manage important documents.

-

Can I integrate airSlate SignNow with other software for the refund occupational form?

Absolutely! airSlate SignNow supports integrations with various software platforms, enabling seamless workflows for managing the refund occupational form. Whether you use accounting software or HR management tools, our integrations help centralize the process, making it easier for teams to handle reimbursements efficiently.

-

What are the benefits of using airSlate SignNow for my refund occupational form?

Using airSlate SignNow for your refund occupational form can signNowly expedite processing times and enhance accuracy in submissions. Automating the signing and archiving process minimizes errors and keeps all parties informed. Furthermore, digital storage ensures compliance and easy access to records whenever you need them.

-

How secure is airSlate SignNow when handling sensitive documents like refund occupational forms?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards to protect sensitive information in refund occupational forms. Our platform includes features like secure cloud storage and identity verification to safeguard against unauthorized access. Users can trust that their data is well-protected while using our services.

Get more for Occupational Tax Formscurrent YearCity Of LexingtonOccupational Tax Formscurrent YearCity Of Lexington2021 Form W 4 Internal Rev

- Memorandum motion form

- Memorandum brief in opposition to motion to transfer cause to chancery court mississippi form

- Motion special form

- Agreed order on appointment of special master mississippi form

- Motion special 497314126 form

- Motion to enforce settlement mississippi form

- Agreed order of dismissal mississippi form

- Breach contract defendant 497314129 form

Find out other Occupational Tax Formscurrent YearCity Of LexingtonOccupational Tax Formscurrent YearCity Of Lexington2021 Form W 4 Internal Rev

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors