2210 K Form Fill Online, Printable, Fillable, Blank

What is the 2210 K Form?

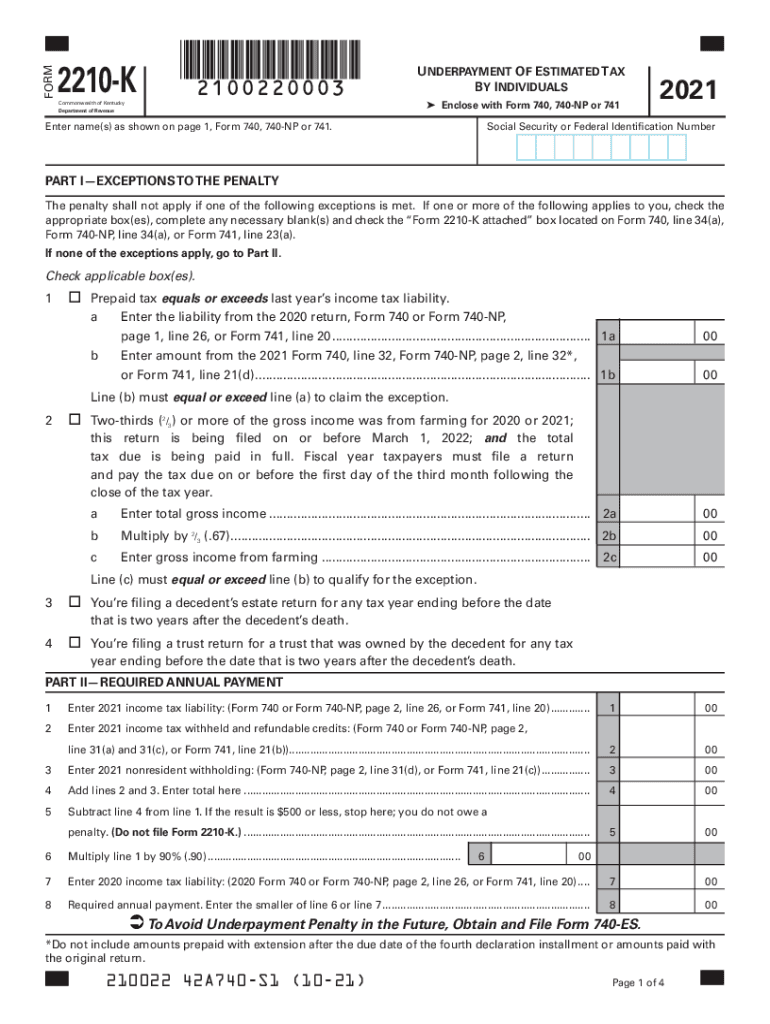

The 2210 K form, also known as the Kentucky 2210K tax form, is a document used by taxpayers in Kentucky to calculate any underpayment of estimated tax. This form is particularly important for individuals and businesses that may not have withheld enough tax throughout the year, leading to potential penalties. The 2210 K form allows taxpayers to determine if they owe a penalty for underpayment and how much that penalty might be. Understanding this form is crucial for ensuring compliance with state tax regulations.

Steps to Complete the 2210 K Form

Completing the 2210 K form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information, including income sources and previous tax payments. Follow these steps:

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Calculate your total income and any adjustments to income that may apply.

- Determine your total tax liability for the year.

- Compare your total tax liability to the amount you have already paid through withholding and estimated payments.

- If there is a discrepancy, use the form to calculate any potential penalty for underpayment.

- Review the completed form for accuracy before submission.

Legal Use of the 2210 K Form

The 2210 K form is legally recognized as a valid method for reporting underpayment of estimated taxes in Kentucky. To ensure its legal standing, it must be completed accurately and submitted by the appropriate deadlines. Compliance with state tax laws is essential to avoid penalties. The form must be signed and dated by the taxpayer, affirming that the information provided is true and correct to the best of their knowledge.

Filing Deadlines and Important Dates

Filing the 2210 K form must be done within specific deadlines to avoid penalties. Generally, the form should be submitted by the same deadline as your annual tax return. For most taxpayers, this is April 15 of the following year. However, if you file for an extension, ensure that the 2210 K form is submitted along with your extended return. Keeping track of these dates is crucial for compliance and to avoid unnecessary penalties.

Examples of Using the 2210 K Form

There are various scenarios in which a taxpayer might need to use the 2210 K form. For instance:

- A self-employed individual who did not make sufficient estimated tax payments throughout the year may need to file this form.

- A retiree who has income from pensions or investments and did not withhold enough tax might also be required to submit the form.

- Individuals who have had a significant change in income during the year may find that they owe additional taxes and need to calculate any penalties for underpayment using the 2210 K form.

Key Elements of the 2210 K Form

Understanding the key elements of the 2210 K form is essential for accurate completion. The form includes sections for personal information, income calculations, tax liability, and any penalties for underpayment. Additionally, it provides instructions on how to calculate estimated tax payments and determine if a penalty applies. Familiarity with these elements can help taxpayers navigate the form more efficiently and ensure compliance with state tax laws.

Quick guide on how to complete 2210 k form fill online printable fillable blank

Effortlessly Prepare 2210 K Form Fill Online, Printable, Fillable, Blank on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage 2210 K Form Fill Online, Printable, Fillable, Blank on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Edit and Electronically Sign 2210 K Form Fill Online, Printable, Fillable, Blank with Ease

- Locate 2210 K Form Fill Online, Printable, Fillable, Blank and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or black out confidential information with the tools specially designed by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign 2210 K Form Fill Online, Printable, Fillable, Blank and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2210 k tax form and why is it important?

The 2210 k tax form is crucial for taxpayers who wish to avoid penalties for underpayment of estimated taxes. By understanding the calculations involved in the 2210 k tax, you can better manage your tax obligations and avoid surprises at tax time. Utilizing tools like airSlate SignNow can simplify the process of filing your 2210 k tax form.

-

How can airSlate SignNow help with the 2210 k tax process?

airSlate SignNow streamlines the signing and submission of forms, including the 2210 k tax. Our platform allows you to easily eSign documents and manage your tax paperwork effortlessly. This means you can focus more on your finances and less on the logistics of sending documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking. These features are particularly useful for navigating complex forms like the 2210 k tax. With our solution, you can ensure all your documents are organized and accessible in one place.

-

Is airSlate SignNow cost-effective for individuals needing to file a 2210 k tax?

Yes, airSlate SignNow provides a cost-effective solution for individuals and businesses alike, especially when dealing with forms like the 2210 k tax. Our pricing models cater to various needs, making it affordable for everyone to streamline their document processes. Investing in our service can save you time and reduce the potential costs of tax filing errors.

-

Can I use airSlate SignNow for collaborative tax filing involving the 2210 k tax?

Absolutely! airSlate SignNow allows for seamless collaboration on tax documents, including the 2210 k tax. You can invite team members or tax professionals to review and eSign your documents in real-time, ensuring everyone is on the same page during the filing process.

-

What integrations does airSlate SignNow offer that benefit users filing a 2210 k tax?

airSlate SignNow integrates with various applications, including CRM and accounting software, to enhance your tax filing experience. These integrations are particularly beneficial for managing data necessary for the 2210 k tax. This way, you can sync your documents and keep all relevant information in one location.

-

Is it easy to store and retrieve documents related to the 2210 k tax with airSlate SignNow?

Yes, airSlate SignNow offers a user-friendly interface for storing and retrieving all your tax documents, including the 2210 k tax. You can easily organize your files and access them whenever needed, which simplifies the often hectic tax filing period. Our efficient storage solution helps you manage your tax-related paperwork without hassle.

Get more for 2210 K Form Fill Online, Printable, Fillable, Blank

- Order of recusal mississippi 497314175 form

- Mississippi serve form

- Notice of hearing mississippi form

- Amended counterclaim mississippi form

- Answer and counterclaim mississippi form

- Judgment notice form

- Opposition summary judgment form

- Plaintiffs response to defendants motion for partial summary judgment mississippi form

Find out other 2210 K Form Fill Online, Printable, Fillable, Blank

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast