Fillable Online Understand the Geothermal Tax Credit Form

What is the Fillable Online Understand The Geothermal Tax Credit

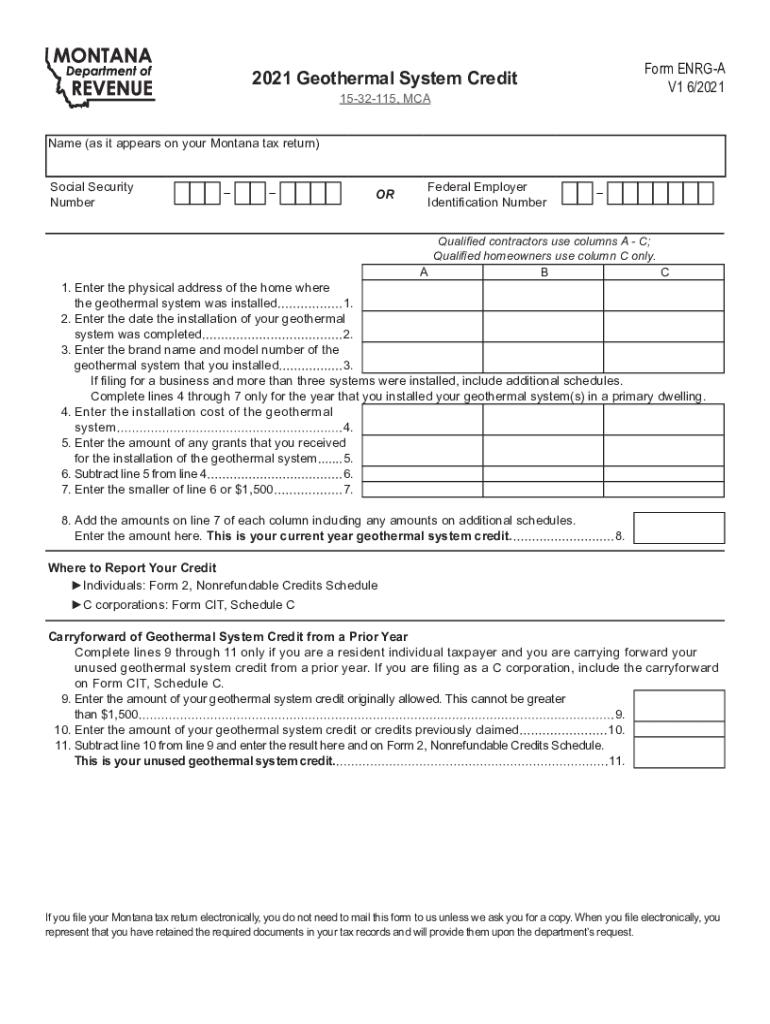

The Fillable Online Understand The Geothermal Tax Credit form is designed to help taxpayers in the United States claim tax credits for geothermal energy systems. This credit encourages the installation of geothermal heat pumps, which utilize the earth's stable underground temperature to heat and cool buildings efficiently. By completing this form, individuals and businesses can receive significant tax benefits, making renewable energy solutions more accessible and affordable.

How to use the Fillable Online Understand The Geothermal Tax Credit

Using the Fillable Online Understand The Geothermal Tax Credit form is straightforward. First, access the form through a reliable online platform that supports electronic signatures. Fill in the required fields, ensuring all information is accurate and complete. This includes personal details, the type of geothermal system installed, and any supporting documentation. Once completed, review the form for any errors before signing electronically. This process ensures that your submission is valid and legally binding.

Steps to complete the Fillable Online Understand The Geothermal Tax Credit

Completing the Fillable Online Understand The Geothermal Tax Credit involves several key steps:

- Gather necessary documentation, such as proof of installation and costs incurred.

- Access the fillable form through a secure online platform.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about the geothermal system, including installation date and costs.

- Attach any required supporting documents.

- Review the form for accuracy and completeness.

- Sign the form electronically to validate your submission.

Eligibility Criteria

To qualify for the geothermal tax credit, taxpayers must meet specific eligibility criteria. The geothermal system must be installed in a primary or secondary residence in the United States. Additionally, the system must meet the efficiency standards set by the IRS. Taxpayers should also ensure that they have not claimed the credit for the same installation in previous tax years. Understanding these criteria is essential for a successful application.

IRS Guidelines

The IRS provides detailed guidelines regarding the geothermal tax credit, outlining the requirements and limitations for taxpayers. According to IRS guidelines, the credit applies to the installation of geothermal heat pumps that meet certain efficiency ratings. Taxpayers must retain documentation proving the installation and costs to substantiate their claims. It is crucial to stay updated on any changes to IRS regulations that may affect eligibility or credit amounts.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Online Understand The Geothermal Tax Credit align with the general tax filing deadlines in the United States. Typically, taxpayers must submit their forms by April fifteenth of the year following the installation of the geothermal system. However, extensions may be available. It is important to keep track of these deadlines to ensure that you do not miss the opportunity to claim your credit.

Quick guide on how to complete fillable online understand the geothermal tax credit

Complete Fillable Online Understand The Geothermal Tax Credit effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any hold-ups. Handle Fillable Online Understand The Geothermal Tax Credit on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Fillable Online Understand The Geothermal Tax Credit with ease

- Obtain Fillable Online Understand The Geothermal Tax Credit and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes requiring you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Fillable Online Understand The Geothermal Tax Credit and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online understand the geothermal tax credit

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

The best way to make an e-signature for a PDF on Android

People also ask

-

What is the Geothermal Tax Credit and how can Fillable Online Understand The Geothermal Tax Credit help me?

The Geothermal Tax Credit allows homeowners to receive a tax rebate for the installation of geothermal heat pumps. Fillable Online Understand The Geothermal Tax Credit helps you understand the eligibility criteria, application process, and the documents required to maximize your tax benefits.

-

Are there any costs associated with using Fillable Online Understand The Geothermal Tax Credit?

Using Fillable Online Understand The Geothermal Tax Credit is cost-effective, with affordable pricing plans designed for businesses and individuals alike. Our solution simplifies the paperwork for the geothermal tax credit, ensuring you get the most value without any hidden fees.

-

What features does Fillable Online Understand The Geothermal Tax Credit offer?

Fillable Online Understand The Geothermal Tax Credit provides customizable templates, easy document sharing, and electronic signatures. These features streamline your experience and ensure that all necessary forms are correctly filled out to optimize your tax credit benefits.

-

How does Fillable Online Understand The Geothermal Tax Credit benefit my business?

By utilizing Fillable Online Understand The Geothermal Tax Credit, your business can save time and reduce costs associated with paperwork. The easy-to-use platform allows for efficient document management, enhancing productivity while ensuring compliance with tax requirements.

-

Can I integrate Fillable Online Understand The Geothermal Tax Credit with my existing software tools?

Yes, Fillable Online Understand The Geothermal Tax Credit offers seamless integration with various software tools to enhance your workflow. Whether you're using CRM systems or accounting software, you can easily connect and streamline the tax credit application process.

-

How can Fillable Online Understand The Geothermal Tax Credit help me with document management?

Fillable Online Understand The Geothermal Tax Credit allows you to organize and manage all your documents in one place. This ensures that critical documents related to your geothermal tax credit are easily accessible and properly filed, reducing the risk of errors or omissions.

-

Is Fillable Online Understand The Geothermal Tax Credit user-friendly for non-technical users?

Absolutely! Fillable Online Understand The Geothermal Tax Credit is designed with user-friendliness in mind, catering to all users regardless of their technical expertise. An intuitive interface guides you through each step, making it simple to navigate and complete the tax credit process.

Get more for Fillable Online Understand The Geothermal Tax Credit

- Guardian bond mississippi form

- Mississippi form

- Petition funds form

- Mississippi guardian 497314363 form

- Guardian ad litem 497314364 form

- Undivided interest property form

- Undivided interest property 497314366 form

- Motion to remove conservator and to set aside conservatorship or in the alternative to have another named as conservator form

Find out other Fillable Online Understand The Geothermal Tax Credit

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT