Schedule D 1 Form 1041

What is the Schedule D-1 Form 1041

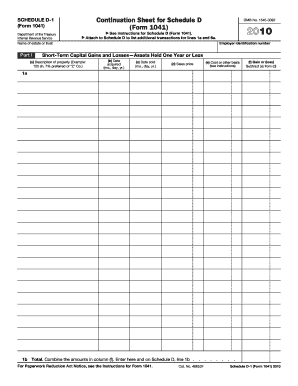

The Schedule D-1 Form 1041 is a tax form used by estates and trusts in the United States to report capital gains and losses. It is an essential part of the IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form allows fiduciaries to report income, deductions, and credits, ensuring that the tax obligations of the estate or trust are met. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule D-1 Form 1041

Using the Schedule D-1 Form 1041 involves several steps. First, gather all necessary documentation related to the estate or trust's capital assets. This includes records of sales, purchases, and any adjustments to the basis of the assets. Next, complete the form by detailing the capital gains and losses incurred during the tax year. It is important to ensure that all calculations are accurate to avoid penalties. Finally, attach the completed Schedule D-1 to the Form 1041 and submit it to the IRS by the designated deadline.

Steps to complete the Schedule D-1 Form 1041

Completing the Schedule D-1 Form 1041 involves a methodical approach:

- Gather all relevant financial documents, including records of asset transactions.

- Calculate the total capital gains and losses for the tax year.

- Fill out the form, ensuring each section is completed accurately.

- Double-check all calculations and information for accuracy.

- Attach the Schedule D-1 to the Form 1041.

- Submit the forms to the IRS by the specified deadline.

Legal use of the Schedule D-1 Form 1041

The Schedule D-1 Form 1041 is legally recognized as a valid document for reporting capital gains and losses for estates and trusts. To ensure its legal standing, it must be filled out accurately and submitted in accordance with IRS guidelines. Compliance with tax laws is critical, as failure to report correctly can lead to penalties or legal issues. Utilizing a reliable eSignature solution can enhance the security and legitimacy of the document when filing electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D-1 Form 1041 align with the due dates for Form 1041. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year for the estate or trust. For estates with a calendar year ending December 31, the deadline would be April 15 of the following year. It is important to stay informed about any changes to deadlines to avoid late filing penalties.

Required Documents

To complete the Schedule D-1 Form 1041, certain documents are necessary:

- Transaction records for capital assets, including purchase and sale invoices.

- Documentation of any adjustments to the basis of the assets.

- Previous tax returns, if applicable, for reference on prior capital gains and losses.

- Any supporting schedules or forms that relate to the estate or trust's income.

Quick guide on how to complete schedule d 1 form 1041

Prepare [SKS] effortlessly on any device

Digital document handling has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document printing. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule D 1 Form 1041

Create this form in 5 minutes!

How to create an eSignature for the schedule d 1 form 1041

The way to make an e-signature for a PDF file in the online mode

The way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the Schedule D 1 Form 1041, and why is it important?

The Schedule D 1 Form 1041 is used to report capital gains and losses from the sale of securities or other assets by estates and trusts. Understanding this form is crucial for ensuring compliance with tax regulations and accurately reporting income on an estate's tax return.

-

How can airSlate SignNow assist with the Schedule D 1 Form 1041?

airSlate SignNow streamlines the process of eSigning and sending the Schedule D 1 Form 1041 by enabling users to securely share documents and obtain electronic signatures. This ensures that your forms are completed efficiently and remain legally binding, saving time and effort.

-

Is there a cost associated with using airSlate SignNow for the Schedule D 1 Form 1041?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate various business needs. While there is a nominal fee for premium features, the cost-effective solution is worth the investment for those frequently dealing with documents like the Schedule D 1 Form 1041.

-

What features does airSlate SignNow offer for document management, specifically for the Schedule D 1 Form 1041?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking of document status. These functionalities enhance the management of the Schedule D 1 Form 1041, ensuring that you can quickly access and complete necessary documentation.

-

Can I integrate airSlate SignNow with other software to manage the Schedule D 1 Form 1041?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including CRM and productivity tools. This allows you to manage and automate workflows related to the Schedule D 1 Form 1041 efficiently, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for the Schedule D 1 Form 1041?

The use of airSlate SignNow for the Schedule D 1 Form 1041 simplifies the signing process, reduces paper consumption, and accelerates document turnaround time. Additionally, it provides a secure environment for sensitive information, ensuring peace of mind during tax-related processes.

-

Is eSigning the Schedule D 1 Form 1041 legally binding?

Yes, eSigning the Schedule D 1 Form 1041 with airSlate SignNow is legally binding and compliant with eSign laws. This ensures that your electronically signed documents hold the same legal weight as traditional handwritten signatures.

Get more for Schedule D 1 Form 1041

Find out other Schedule D 1 Form 1041

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer