Form 12203

What is the Form 12203

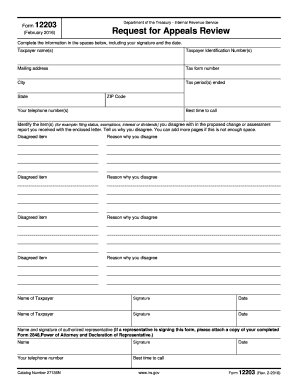

The Form 12203 is a document utilized by taxpayers in the United States to request a refund of overpaid taxes or to appeal a tax assessment. This form is particularly relevant for individuals who believe they have been incorrectly charged or wish to contest a decision made by the Internal Revenue Service (IRS). Its primary purpose is to facilitate communication between taxpayers and the IRS regarding tax disputes or refund requests.

How to use the Form 12203

Using the Form 12203 involves several steps to ensure that your request is properly submitted and considered by the IRS. Begin by accurately filling out the form with your personal information, including your name, address, and Social Security number. Clearly state the reason for your request, providing any necessary details or documentation that supports your claim. Once completed, review the form for accuracy before submitting it to the appropriate IRS address. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the Form 12203

Completing the Form 12203 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 12203 from the IRS website or other reliable sources.

- Fill in your personal information, ensuring that all details are accurate and up to date.

- Provide a clear explanation of your request, including any relevant tax years and amounts.

- Attach any supporting documents that substantiate your claim, such as previous tax returns or correspondence from the IRS.

- Review the entire form for completeness and accuracy before signing and dating it.

- Submit the form via mail to the designated IRS address or electronically if applicable.

Legal use of the Form 12203

The legal use of the Form 12203 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated timeframes set by the IRS. When used correctly, it serves as a formal request for reconsideration of tax matters, and its submission can invoke taxpayer rights under U.S. tax law. It is essential to comply with all legal requirements to ensure that your request is processed without delay.

Form Submission Methods

The Form 12203 can be submitted to the IRS through various methods. Taxpayers can choose to mail the completed form to the appropriate IRS address, ensuring that it is sent via a method that provides tracking. Alternatively, if electronic submission is permitted, taxpayers may submit the form online through the IRS e-filing system. It is important to verify the submission method based on the specific instructions provided for the form to ensure compliance and timely processing.

Required Documents

When submitting the Form 12203, certain documents may be required to support your request. These can include:

- Copies of previous tax returns related to the claim.

- Any correspondence received from the IRS regarding the issue.

- Documentation that substantiates your claim, such as payment records or notices of assessment.

Including these documents can strengthen your case and facilitate a smoother review process by the IRS.

Quick guide on how to complete form 12203

Complete Form 12203 seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the needed template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Form 12203 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 12203 without any hassle

- Locate Form 12203 and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to distribute your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and eSign Form 12203 and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12203

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What is form 12203 and how is it used?

Form 12203 is a document used for various purposes in legal and financial contexts. In the airSlate SignNow platform, it can be efficiently prepared, sent, and eSigned, ensuring your documents are legally binding. Utilizing form 12203 within our eSignature solution simplifies the paperwork process.

-

How does airSlate SignNow enhance the functionality of form 12203?

airSlate SignNow enhances the functionality of form 12203 by offering features like templates, cloud storage, and secure eSigning. This ensures that users can easily manage their documents from anywhere, providing a streamlined experience. With our intuitive interface, handling form 12203 becomes fast and efficient.

-

Is there a cost associated with using form 12203 on airSlate SignNow?

Yes, there is a pricing structure associated with using form 12203 on airSlate SignNow, which varies based on the plan you choose. Our subscription plans are designed to be cost-effective and cater to businesses of all sizes. Depending on your needs, you will have access to features that make handling form 12203 easier.

-

Can form 12203 be integrated with other applications?

Absolutely! airSlate SignNow allows for seamless integration with various applications, enhancing how you utilize form 12203. This means you can connect it with CRM systems or document storage solutions, streamlining your workflow and maximizing productivity.

-

What are the benefits of eSigning form 12203 with airSlate SignNow?

eSigning form 12203 with airSlate SignNow provides numerous benefits including speed, security, and accessibility. It eliminates the need for printing and scanning, allowing for immediate execution of documents. Additionally, every eSignature is time-stamped and legally binding, ensuring the document’s integrity.

-

How secure is my data when using form 12203 on airSlate SignNow?

Your data is secure when using form 12203 on airSlate SignNow due to our robust encryption protocols and compliance with industry standards. We prioritize the confidentiality and security of your documents, so you can focus on completing transactions without worry. Regular security audits further enhance our commitment to data protection.

-

What types of businesses benefit from using form 12203?

A wide range of businesses benefit from using form 12203, particularly those in finance, legal, and real estate sectors. airSlate SignNow provides tools to simplify document handling for any business, making it easier to send and eSign form 12203 rapidly. This versatility makes it an ideal solution for small to large enterprises alike.

Get more for Form 12203

Find out other Form 12203

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT