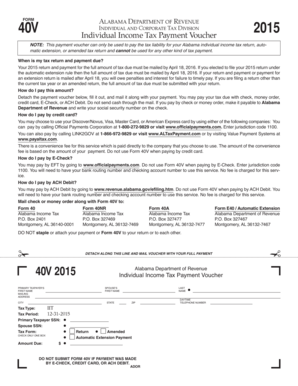

FORM AlAbAmA DepArtment of Revenue 40V InDIvIDuAl and CorporAte TAx DIvIsIon Individual Income Tax Payment Voucher NOTE This Pay

What is the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher?

The Alabama Department of Revenue 40V Individual Income Tax Payment Voucher is a specific form used by taxpayers in Alabama to facilitate the payment of their individual income tax liabilities. This voucher is designed exclusively for payments related to the Alabama Individual Income Tax Return. It ensures that payments are correctly attributed to the taxpayer's account, helping to avoid any confusion or misallocation of funds.

How to Use the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher

To use the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher, taxpayers must first complete their Alabama Individual Income Tax Return. Once the return is prepared, the voucher should be filled out with the necessary payment information. This includes the taxpayer's name, address, and the amount owed. After completing the voucher, it should be submitted along with the payment to the designated address provided by the Alabama Department of Revenue.

Steps to Complete the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher

Completing the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher involves several key steps:

- Obtain the voucher from the Alabama Department of Revenue website or your tax preparer.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount of tax you are paying.

- Review the information for accuracy to ensure proper processing.

- Sign and date the voucher.

- Submit the voucher along with your payment to the address specified by the Alabama Department of Revenue.

Legal Use of the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher

The Alabama Department of Revenue 40V Individual Income Tax Payment Voucher is legally recognized as a valid method for remitting tax payments. For the payment to be considered valid, it must be completed accurately and submitted in accordance with state regulations. Utilizing this voucher helps ensure compliance with Alabama tax laws and can protect taxpayers from potential penalties associated with late or incorrect payments.

Key Elements of the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher

Several key elements are essential when filling out the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher:

- Taxpayer Information: Accurate personal details must be provided.

- Payment Amount: The exact amount owed should be clearly indicated.

- Signature: The taxpayer must sign the voucher to validate the payment.

- Submission Instructions: Follow the specific mailing instructions to ensure proper processing.

Filing Deadlines for the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher

It is crucial for taxpayers to be aware of the filing deadlines associated with the Alabama Department of Revenue 40V Individual Income Tax Payment Voucher. Payments must typically be submitted by the tax return due date to avoid penalties and interest. Taxpayers should verify the specific deadlines for the current tax year, as these may vary annually.

Quick guide on how to complete form alabama department of revenue 40v individual and corporate tax division individual income tax payment voucher 2015 note

Complete [SKS] effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a fantastic eco-friendly option to traditional printed and signed documents, enabling you to find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign [SKS] seamlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FORM AlAbAmA DepArtment Of Revenue 40V InDIvIDuAl AnD CorporAte TAx DIvIsIon Individual Income Tax Payment Voucher NOTE This Pay

Create this form in 5 minutes!

How to create an eSignature for the form alabama department of revenue 40v individual and corporate tax division individual income tax payment voucher 2015 note

How to generate an e-signature for a PDF in the online mode

How to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF on Android OS

People also ask

-

What is the FORM AlAbAmA DepArtment Of Revenue 40V InDIvIDuAl AnD CorporAte TAx DIvIsIon Individual Income Tax Payment Voucher?

The FORM AlAbAmA DepArtment Of Revenue 40V InDIvIDuAl AnD CorporAte TAx DIvIsIon Individual Income Tax Payment Voucher is a document that allows individuals to pay their tax liability for Alabama Individual Income Tax Returns. This form should only be used for this specific purpose to ensure compliance with Alabama tax regulations.

-

How can I obtain the FORM AlAbAmA DepArtment Of Revenue 40V?

You can download the FORM AlAbAmA DepArtment Of Revenue 40V Individual Income Tax Payment Voucher directly from the Alabama Department of Revenue’s website or through authorized tax preparation services. Ensure you have the most recent version to avoid any issues with your tax payments.

-

Is there a fee associated with using the FORM AlAbAmA DepArtment Of Revenue 40V?

There is no fee for obtaining or submitting the FORM AlAbAmA DepArtment Of Revenue 40V Individual Income Tax Payment Voucher itself. However, ensure to check for any penalties or interest that might apply if payments are late to avoid additional charges.

-

What are the benefits of using the airSlate SignNow platform for submitting the payment voucher?

Using the airSlate SignNow platform allows for a streamlined and efficient means of submitting the FORM AlAbAmA DepArtment Of Revenue 40V. You can easily eSign the document, track its status, and ensure timely submission, minimizing the risk of errors or delays.

-

Can the FORM AlAbAmA DepArtment Of Revenue 40V be submitted online?

Currently, the FORM AlAbAmA DepArtment Of Revenue 40V must be printed and mailed to the Alabama Department of Revenue. However, airSlate SignNow simplifies the eSigning process before printing, enhancing efficiency.

-

Are there any integrations available for the FORM AlAbAmA DepArtment Of Revenue 40V with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various applications, allowing you to import data directly into the FORM AlAbAmA DepArtment Of Revenue 40V. This feature minimizes manual entry and enhances accuracy during the filling process.

-

What should I do if I made a mistake on the FORM AlAbAmA DepArtment Of Revenue 40V?

If you notice a mistake on your FORM AlAbAmA DepArtment Of Revenue 40V after submission, you should contact the Alabama Department of Revenue immediately. They can provide guidance on how to correct the error and any necessary steps to take.

Get more for FORM AlAbAmA DepArtment Of Revenue 40V InDIvIDuAl AnD CorporAte TAx DIvIsIon Individual Income Tax Payment Voucher NOTE This Pay

Find out other FORM AlAbAmA DepArtment Of Revenue 40V InDIvIDuAl AnD CorporAte TAx DIvIsIon Individual Income Tax Payment Voucher NOTE This Pay

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy