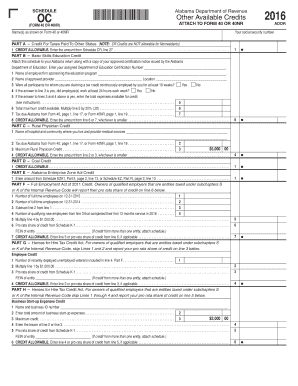

PART a Credit for Taxes Paid to Other States NOTE CR Credits Are NOT Allowable for Nonresidents Revenue Alabama Form

Understanding the PART A Credit For Taxes Paid To Other States

The PART A Credit For Taxes Paid To Other States is a tax credit designed for residents of Alabama who have paid taxes to another state. This credit helps to alleviate the burden of double taxation, allowing taxpayers to receive a credit for taxes paid elsewhere. However, it is important to note that CR credits are not allowable for nonresidents. This means that only Alabama residents who have incurred tax obligations in another state can claim this credit, ensuring that the credit is applied fairly and in accordance with state tax laws.

Steps to Complete the PART A Credit For Taxes Paid To Other States

Completing the PART A Credit requires careful attention to detail. Here are the steps involved:

- Gather all necessary documentation, including proof of taxes paid to other states.

- Fill out the appropriate forms, ensuring that all information is accurate and complete.

- Calculate the amount of credit based on the taxes paid to the other state.

- Submit the completed form along with any required documentation to the Alabama Department of Revenue.

Eligibility Criteria for the PART A Credit

To qualify for the PART A Credit For Taxes Paid To Other States, taxpayers must meet specific eligibility criteria. These include:

- Being a resident of Alabama during the tax year.

- Having paid income taxes to another state.

- Filing a tax return in Alabama for the same tax year.

Required Documents for Claiming the PART A Credit

When claiming the PART A Credit, it is essential to provide the necessary documentation to support your claim. Required documents typically include:

- Proof of taxes paid to the other state, such as tax returns or payment receipts.

- A copy of your Alabama tax return for the same year.

- Any additional forms required by the Alabama Department of Revenue.

Legal Use of the PART A Credit

The legal use of the PART A Credit is governed by Alabama tax laws. Taxpayers must ensure they meet all legal requirements to avoid penalties. The credit is intended to prevent double taxation, but misuse or incorrect claims can lead to audits or penalties. Therefore, it is crucial to understand the legal framework surrounding the credit and to maintain accurate records of all tax payments made to other states.

Filing Deadlines for the PART A Credit

Filing deadlines for the PART A Credit align with Alabama's tax return deadlines. Taxpayers should be aware of these key dates:

- Typically, Alabama tax returns are due on April 15 of each year.

- Extensions may be available, but any taxes owed must still be paid by the original due date to avoid penalties.

Quick guide on how to complete part a credit for taxes paid to other states note cr credits are not allowable for nonresidents revenue alabama

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign [SKS] with minimal effort

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PART A Credit For Taxes Paid To Other States NOTE CR Credits Are NOT Allowable For Nonresidents Revenue Alabama

Create this form in 5 minutes!

How to create an eSignature for the part a credit for taxes paid to other states note cr credits are not allowable for nonresidents revenue alabama

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is PART A Credit For Taxes Paid To Other States NOTE CR Credits Are NOT Allowable For Nonresidents Revenue Alabama?

PART A Credit For Taxes Paid To Other States NOTE CR Credits Are NOT Allowable For Nonresidents Revenue Alabama refers to a specific tax credit available for residents who have paid taxes in other states. This credit allows Alabama residents to alleviate double taxation. However, it's essential to note that nonresidents cannot claim these credits, making it crucial to understand your residency status.

-

How can airSlate SignNow help with the documentation for PART A Credit For Taxes Paid To Other States?

airSlate SignNow provides an intuitive platform to eSign and prepare documents required for claiming the PART A Credit For Taxes Paid To Other States NOTE CR Credits ARE NOT Allowable For Nonresidents Revenue Alabama. With templates and streamlined workflows, users can efficiently manage their tax documentation processes, ensuring compliance and accuracy.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax credits?

Yes, airSlate SignNow offers a cost-effective solution that is ideal for small businesses managing tax credits like the PART A Credit For Taxes Paid To Other States NOTE CR Credits ARE NOT Allowable For Nonresidents Revenue Alabama. By reducing the time spent on paperwork and facilitating easy collaboration, it allows businesses to save money and resources.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow includes features such as customizable templates, secure cloud storage, and mobile signing, making it a comprehensive solution for managing tax documents. These features are particularly beneficial when handling claims like the PART A Credit For Taxes Paid To Other States NOTE CR Credits ARE NOT Allowable For Nonresidents Revenue Alabama, ensuring all necessary documents are easily accessible and organized.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance protocols to protect your sensitive tax documents. This is particularly important when dealing with matters like the PART A Credit For Taxes Paid To Other States NOTE CR Credits ARE NOT Allowable For Nonresidents Revenue Alabama, as accurate and secure handling of such information is critical.

-

Can airSlate SignNow integrate with existing accounting software for tax credit management?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, enhancing your ability to handle tax credits such as the PART A Credit For Taxes Paid To Other States NOTE CR Credits ARE NOT Allowable For Nonresidents Revenue Alabama. This integration streamlines data flow and makes it easier to manage your financial documentation.

-

What benefits does airSlate SignNow provide for managing tax filing?

One of the primary benefits of using airSlate SignNow for tax filing is the convenience of eSigning and document sharing, which speeds up the filing process for credits like the PART A Credit For Taxes Paid To Other States NOTE CR Credits ARE NOT Allowable For Nonresidents Revenue Alabama. Additionally, the platform's user-friendly interface enhances collaboration among teams during the tax filing period.

Get more for PART A Credit For Taxes Paid To Other States NOTE CR Credits Are NOT Allowable For Nonresidents Revenue Alabama

Find out other PART A Credit For Taxes Paid To Other States NOTE CR Credits Are NOT Allowable For Nonresidents Revenue Alabama

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile