Motor Vehicle Appraisal for Tax 2016-2026

What is the Motor Vehicle Appraisal For Tax

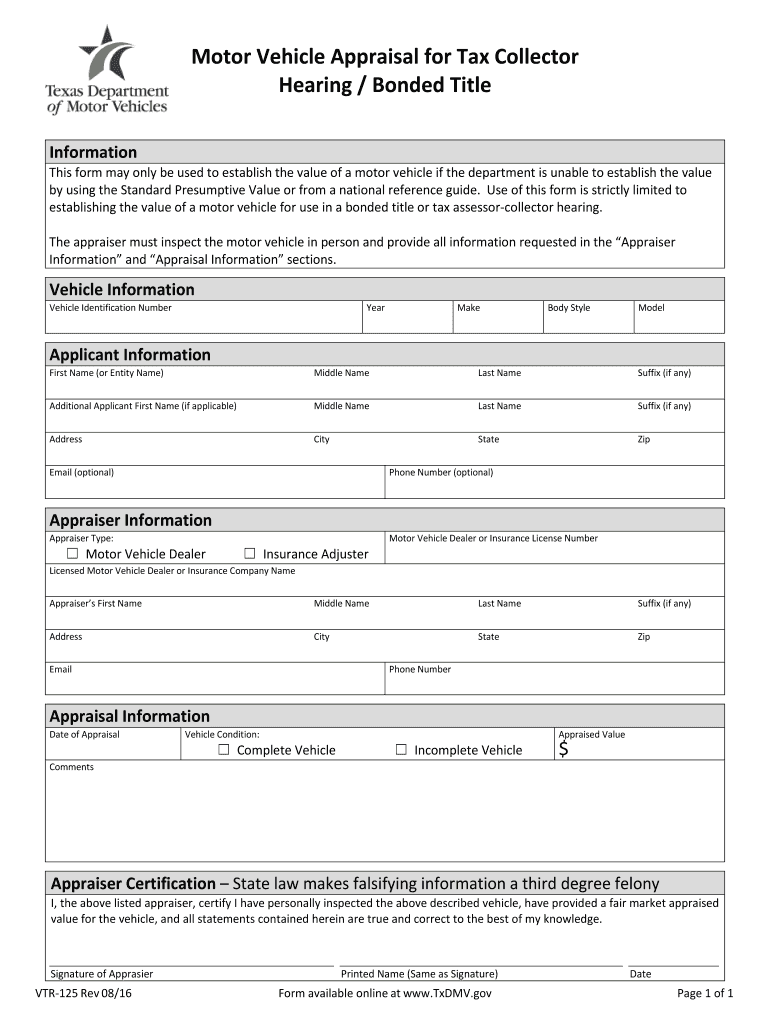

The Motor Vehicle Appraisal for Tax is a crucial document used to determine the value of a vehicle for tax purposes. This appraisal is particularly important when a vehicle is being registered or transferred, as it helps establish the fair market value necessary for calculating taxes owed. In many states, including Texas, this appraisal is required for vehicles that are not titled or when applying for a bonded title. The appraisal ensures that the tax assessment reflects the vehicle's current condition and market value, which can vary significantly based on factors such as age, mileage, and overall condition.

Steps to complete the Motor Vehicle Appraisal For Tax

Completing the Motor Vehicle Appraisal for Tax involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary information about the vehicle, including the Vehicle Identification Number (VIN), make, model, year, and any modifications. Next, assess the vehicle's condition by examining its exterior, interior, and mechanical aspects. You may consider using a professional appraisal service or refer to resources like the Kelley Blue Book for guidance on determining the vehicle's market value. Once you have established the value, fill out the appraisal form completely, ensuring all fields are accurate. Finally, submit the completed form to the appropriate state agency, such as the Department of Motor Vehicles (DMV), along with any required fees.

Legal use of the Motor Vehicle Appraisal For Tax

The legal use of the Motor Vehicle Appraisal for Tax is essential for ensuring compliance with state laws regarding vehicle registration and taxation. This appraisal serves as an official record that can be used to support the value declared during vehicle transactions. It is particularly important for vehicles with a bonded title, as it validates the vehicle's worth and helps prevent fraudulent claims. The appraisal must be conducted in accordance with state regulations, and the completed form should be submitted to the relevant authorities to avoid penalties or complications during the registration process.

Required Documents

When completing the Motor Vehicle Appraisal for Tax, several documents may be required to support your application. These typically include:

- Proof of ownership, such as a bill of sale or previous title.

- Identification, such as a driver's license or state ID.

- Any previous appraisals or valuations, if applicable.

- Documentation of any modifications or repairs made to the vehicle.

Gathering these documents in advance can streamline the appraisal process and ensure all necessary information is available for submission.

State-specific rules for the Motor Vehicle Appraisal For Tax

Each state has its own specific rules and regulations regarding the Motor Vehicle Appraisal for Tax. In Texas, for example, the appraisal must be completed by a licensed appraiser or a qualified individual familiar with the vehicle's market value. Additionally, certain vehicles may be exempt from appraisal requirements based on their age or type. It is essential to consult your state's Department of Motor Vehicles or equivalent authority to understand the exact requirements and ensure compliance. This may include specific forms, submission methods, and deadlines that must be adhered to for a successful appraisal.

How to obtain the Motor Vehicle Appraisal For Tax

Obtaining the Motor Vehicle Appraisal for Tax can be done through several avenues. You can start by visiting your local DMV office, where staff can provide the necessary forms and guidance on completing the appraisal. Alternatively, many states offer online resources where you can download the appraisal form and instructions. If you prefer a professional assessment, consider hiring a licensed appraiser who can evaluate your vehicle and complete the necessary documentation. Ensure that any appraiser you choose is familiar with your state's requirements to avoid any issues during submission.

Quick guide on how to complete motor vehicle appraisal for tax collector hearingbonded title form vtr 125 dmv texas

Simplify your existence by completing the Motor Vehicle Appraisal For Tax form with airSlate SignNow

Whether you need to register a new vehicle, obtain a driver’s license, transfer ownership, or carry out any other activity related to motor vehicles, dealing with such RMV paperwork as Motor Vehicle Appraisal For Tax is a necessary challenge.

There are several methods to access them: via mail, at the RMV service center, or by obtaining them online through your local RMV website and printing them. Each of these options is time-consuming. If you seek a faster way to complete and endorse them with a legally-binding signature, airSlate SignNow is your optimal choice.

How to quickly fill out Motor Vehicle Appraisal For Tax

- Click Show details to view a brief overview of the document you are interested in.

- Select Get document to begin and open the document.

- Follow the green label indicating the mandatory fields if applicable to you.

- Utilize the top toolbar and employ our advanced functionality set to modify, annotate, and enhance your document.

- Insert text, your initials, shapes and images, and other components.

- Click Sign in in the same toolbar to create a legally-binding signature.

- Examine the document text to ensure there are no errors or inconsistencies.

- Press Done to complete the document.

Utilizing our service to complete your Motor Vehicle Appraisal For Tax and other related documents will save you considerable time and stress. Streamline your RMV document completion tasks right from the start!

Create this form in 5 minutes or less

Find and fill out the correct motor vehicle appraisal for tax collector hearingbonded title form vtr 125 dmv texas

Create this form in 5 minutes!

How to create an eSignature for the motor vehicle appraisal for tax collector hearingbonded title form vtr 125 dmv texas

How to create an electronic signature for your Motor Vehicle Appraisal For Tax Collector Hearingbonded Title Form Vtr 125 Dmv Texas in the online mode

How to make an eSignature for the Motor Vehicle Appraisal For Tax Collector Hearingbonded Title Form Vtr 125 Dmv Texas in Google Chrome

How to create an electronic signature for putting it on the Motor Vehicle Appraisal For Tax Collector Hearingbonded Title Form Vtr 125 Dmv Texas in Gmail

How to create an eSignature for the Motor Vehicle Appraisal For Tax Collector Hearingbonded Title Form Vtr 125 Dmv Texas straight from your smart phone

How to generate an eSignature for the Motor Vehicle Appraisal For Tax Collector Hearingbonded Title Form Vtr 125 Dmv Texas on iOS

How to generate an electronic signature for the Motor Vehicle Appraisal For Tax Collector Hearingbonded Title Form Vtr 125 Dmv Texas on Android

People also ask

-

What is the vtr 125 google com and how does airSlate SignNow relate to it?

The vtr 125 google com typically refers to a digital solution for document management. AirSlate SignNow is a powerful tool that allows users to eSign and manage their documents efficiently, aligning perfectly with the functionality often sought after via vtr 125 google com.

-

How much does airSlate SignNow cost compared to vtr 125 google com?

AirSlate SignNow offers a competitive pricing structure designed to suit businesses of all sizes. When comparing it to other solutions like vtr 125 google com, you'll find that SignNow provides cost-effective options without compromising on quality or features.

-

What are the key features of airSlate SignNow?

AirSlate SignNow boasts features such as secure eSigning, document templates, and real-time collaboration. These functionalities make it a smart choice for organizations looking for a solution related to vtr 125 google com, enhancing their workflow seamlessly.

-

What are the benefits of using airSlate SignNow over alternatives like vtr 125 google com?

Using airSlate SignNow provides benefits such as enhanced security, user-friendly interfaces, and integration with various applications. This makes it a superior option compared to alternatives like vtr 125 google com, meeting diverse business needs more effectively.

-

Can I integrate airSlate SignNow with my existing tools instead of using vtr 125 google com?

Yes, airSlate SignNow offers seamless integrations with popular business applications such as CRM systems and project management tools. This flexibility allows businesses to enhance their operations without solely relying on vtr 125 google com.

-

Is airSlate SignNow suitable for small businesses compared to solutions like vtr 125 google com?

Absolutely! AirSlate SignNow is designed with small businesses in mind, providing an easy-to-use platform that enhances productivity. Compared to vtr 125 google com, it offers a more tailored solution to fit the needs and budgets of smaller enterprises.

-

How secure is airSlate SignNow compared to other platforms like vtr 125 google com?

Security is a top priority for airSlate SignNow, which uses advanced encryption and compliance standards to protect user data. When considering security features, it stands out compared to platforms like vtr 125 google com, ensuring that your documents remain safe.

Get more for Motor Vehicle Appraisal For Tax

- Direct deposit form johnson amp wales university jwu

- Moment of inertia gizmo answer key pdf form

- Fritter finder form

- Forms for residence permits to live with someone in sweden

- American heritage life insurance company claim forms

- California form 100x instructions

- Alaska sales tax information office of the state assessor

- Us nonresident alien income tax returnform 1040nr

Find out other Motor Vehicle Appraisal For Tax

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile