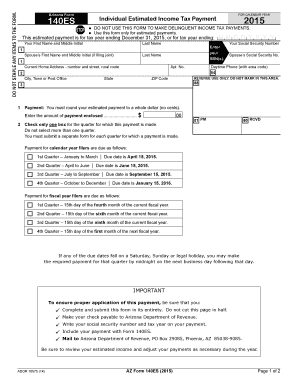

DO NOT USE THIS FORM to MAKE DELINQUENT INCOME TAX PAYMENTS

What is the DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS

The phrase "DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS" refers to a specific instruction indicating that the designated form should not be utilized for submitting overdue income tax payments. This guidance is crucial for taxpayers to avoid complications or misdirected payments. The form is typically intended for other purposes, and using it incorrectly could result in delays or penalties.

How to use the DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS

To ensure compliance with tax regulations, it is essential to follow the correct procedures when dealing with delinquent income tax payments. This form should not be filled out for that purpose. Instead, taxpayers should seek the appropriate form designated for making such payments. Understanding the proper channels for submitting overdue payments helps maintain good standing with tax authorities.

Steps to complete the DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS

Since this form is not intended for delinquent income tax payments, it is important to focus on the correct steps for handling tax obligations. Here are the general steps to follow:

- Identify the correct form for delinquent tax payments.

- Gather all necessary financial documents related to your income and tax obligations.

- Complete the correct form accurately, ensuring all required fields are filled.

- Submit the form through the designated method, whether online, by mail, or in-person, as specified by the IRS.

Legal use of the DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS

Legally, using the "DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS" ensures compliance with IRS regulations. Misusing this form can lead to complications, including potential penalties or delays in processing payments. It is vital for taxpayers to adhere to the guidelines set forth by the IRS to avoid legal repercussions.

IRS Guidelines

The IRS provides specific guidelines regarding the use of forms related to income tax payments. It is essential to consult the IRS website or official publications to understand which forms are appropriate for various tax situations, including delinquent payments. Following these guidelines helps ensure that taxpayers remain compliant and avoid unnecessary issues.

Penalties for Non-Compliance

Failing to follow the correct procedures for submitting delinquent income tax payments can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action by tax authorities. Understanding the risks associated with non-compliance emphasizes the importance of using the correct forms and adhering to IRS guidelines.

Quick guide on how to complete do not use this form to make delinquent income tax payments

Effortlessly prepare [SKS] on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of your documents or conceal sensitive data using tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS

Create this form in 5 minutes!

How to create an eSignature for the do not use this form to make delinquent income tax payments

How to make an e-signature for your PDF online

How to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What should I do if I need to make delinquent income tax payments?

If you need to make delinquent income tax payments, DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS. Instead, consult the IRS website for the correct procedures and options available for paying delinquent taxes.

-

How does airSlate SignNow ensure document security?

airSlate SignNow employs industry-leading security measures, including data encryption and secure access controls, to protect sensitive information. This is crucial, especially since you should DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS, as it may compromise your security.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers various integrations with popular software applications such as Salesforce, Google Drive, and more. This makes the document signing process seamless, ensuring you DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS without the proper tools.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Whether you are a small business or an enterprise, you will find a plan that suits you, which is essential as you DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS.

-

Is it easy to use airSlate SignNow for document signing?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing you to send and eSign documents effortlessly. Remember, while using our platform, DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS, as it's not intended for that purpose.

-

What types of documents can I send for eSignature?

You can send a wide variety of documents for eSignature, including contracts, agreements, and forms. However, keep in mind that you should DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS, as specific forms are required for tax payments.

-

How quickly can I get documents signed using airSlate SignNow?

With airSlate SignNow, you can get documents signed within minutes. Our efficient process ensures that your time is not wasted, but remember, if it pertains to taxes, DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS.

Get more for DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS

- Clear grays harbor county form

- Adem form 396

- Beneficiary certificate form

- Motion picture activity information california state parks ca

- Brazoria county dba permit form

- Adrian college physical gorm form

- Standard chartered bank uae remittance application form

- Kotei application final legend of the five rings form

Find out other DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later