Arizona Form 221 Taxhow

What is the Arizona Form 221?

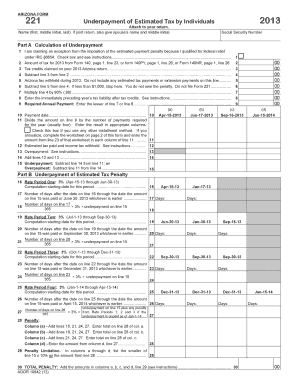

The Arizona Form 221 is a tax form used for specific tax-related purposes within the state of Arizona. It is essential for individuals and businesses to understand its function and requirements to ensure compliance with state tax laws. This form is typically utilized to report certain types of income or deductions, making it a crucial element in the tax filing process. Understanding the purpose of the Arizona Form 221 helps taxpayers accurately complete their tax returns and avoid potential issues with the Arizona Department of Revenue.

How to Obtain the Arizona Form 221

Obtaining the Arizona Form 221 is straightforward. Taxpayers can access the form through the Arizona Department of Revenue's official website, where it is available for download in PDF format. Additionally, physical copies may be available at local tax offices or public libraries. It's important to ensure that you are using the most current version of the form to comply with any updated tax regulations.

Steps to Complete the Arizona Form 221

Completing the Arizona Form 221 involves several key steps. First, gather all necessary documentation, including income statements and any relevant deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay special attention to sections that require signatures or additional documentation. After completing the form, review it thoroughly to avoid errors before submission. Finally, submit the form according to the instructions provided, whether online, by mail, or in person.

Legal Use of the Arizona Form 221

The Arizona Form 221 is legally binding when filled out and submitted according to state regulations. To ensure its legal standing, it is crucial to adhere to the guidelines set forth by the Arizona Department of Revenue. This includes providing accurate information, signing the form where required, and submitting it by the designated deadline. Utilizing a reliable electronic signature solution can further enhance the legal validity of the form, as it complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws.

Key Elements of the Arizona Form 221

Several key elements make up the Arizona Form 221. These include personal identification information, such as the taxpayer's name and Social Security number, as well as details regarding income sources and deductions. Additionally, the form may require specific calculations related to tax liability. Understanding these elements is essential for accurate completion and helps ensure that all required information is provided to the Arizona Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 221 are critical to avoid penalties and interest charges. Generally, the form must be submitted by the state’s tax filing deadline, which aligns with the federal tax filing date. Taxpayers should be aware of any extensions or specific dates that may apply to their situation, especially for those who may be self-employed or have unique filing requirements. Keeping track of these important dates ensures timely submission and compliance with state tax laws.

Form Submission Methods

Taxpayers have several options for submitting the Arizona Form 221. The form can be filed online through the Arizona Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided in the instructions or deliver it in person to a local tax office. Each submission method has its own advantages, and choosing the right one can simplify the filing process.

Quick guide on how to complete arizona form 221 taxhow

Effortlessly Prepare Arizona Form 221 Taxhow on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any holdups. Handle Arizona Form 221 Taxhow seamlessly across devices with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Modify and eSign Arizona Form 221 Taxhow with Ease

- Obtain Arizona Form 221 Taxhow and then select Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign feature, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Decide how you want to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Arizona Form 221 Taxhow and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 221 taxhow

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The best way to generate an e-signature for a PDF on Android

People also ask

-

What is AZ Form 221 and how can airSlate SignNow help?

AZ Form 221 is an essential document that many businesses need to manage efficiently. With airSlate SignNow, you can easily send, sign, and store AZ Form 221 digitally, ensuring quick access and enhanced productivity in your operations.

-

What features does airSlate SignNow offer for managing AZ Form 221?

airSlate SignNow provides a variety of features specifically designed for managing AZ Form 221, including customizable templates, automated workflows, real-time tracking, and secure cloud storage. These functionalities enhance organization and streamline the signing process, making it easier to handle essential documents.

-

Is there a cost associated with using airSlate SignNow for AZ Form 221?

Yes, airSlate SignNow offers flexible pricing plans tailored to suit various business needs. By choosing the right plan, you can efficiently manage AZ Form 221 and other documents while optimizing your budget.

-

Can I integrate airSlate SignNow with other tools for processing AZ Form 221?

Absolutely! airSlate SignNow integrates seamlessly with numerous platforms, such as CRM systems and cloud storage services. This allows you to streamline your workflow when processing AZ Form 221, enhancing collaboration and efficiency across different tools.

-

How secure is the process of signing AZ Form 221 with airSlate SignNow?

Security is a top priority at airSlate SignNow, which uses advanced encryption methods to protect your documents, including AZ Form 221. Our platform complies with industry-standard security protocols, ensuring that your sensitive information remains safe throughout the signing process.

-

Can multiple users collaborate on AZ Form 221 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on AZ Form 221 simultaneously. This feature promotes teamwork and speeds up the completion of documents by enabling easy sharing and editing among team members.

-

How can I track the status of my AZ Form 221 using airSlate SignNow?

airSlate SignNow provides real-time status tracking for your AZ Form 221, allowing you to monitor who has viewed, signed, or completed the document at any time. This transparency helps you stay organized and informed throughout the signing process.

Get more for Arizona Form 221 Taxhow

- Electrical contractor package mississippi form

- Sheetrock drywall contractor package mississippi form

- Flooring contractor package mississippi form

- Trim carpentry contractor package mississippi form

- Fencing contractor package mississippi form

- Hvac contractor package mississippi form

- Landscaping contractor package mississippi form

- Commercial contractor package mississippi form

Find out other Arizona Form 221 Taxhow

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template