Arizona Schedule APY Itemized Deductions for PartYear Residents Include with Your Return Azdor Form

What is the Arizona Schedule APY Itemized Deductions For PartYear Residents Include With Your Return Azdor

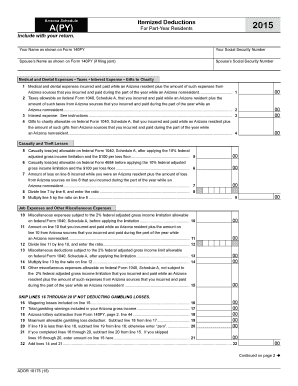

The Arizona Schedule APY is a tax form specifically designed for part-year residents of Arizona. This form allows individuals who have lived in the state for only part of the tax year to claim itemized deductions on their state income tax returns. It is essential for accurately reporting income and deductions that pertain only to the time spent as a resident in Arizona. By completing this form, taxpayers can ensure they are only taxed on income earned while residing in the state, making it a crucial component of the Arizona tax filing process.

Steps to complete the Arizona Schedule APY Itemized Deductions For PartYear Residents Include With Your Return Azdor

Completing the Arizona Schedule APY involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any records of itemized deductions.

- Determine the period of residency in Arizona and calculate the income earned during that time.

- Fill out the Arizona Schedule APY form, ensuring to include only deductions applicable to the residency period.

- Double-check all entries for accuracy, especially the calculations related to income and deductions.

- Attach the completed Schedule APY to your Arizona state tax return before submission.

Legal use of the Arizona Schedule APY Itemized Deductions For PartYear Residents Include With Your Return Azdor

The legal use of the Arizona Schedule APY is governed by state tax laws. This form must be filled out accurately to comply with Arizona tax regulations. Incorrect or fraudulent information can lead to penalties, including fines or audits. It is important to ensure that all deductions claimed are legitimate and supported by documentation. By adhering to these legal standards, taxpayers can avoid complications with the Arizona Department of Revenue.

Key elements of the Arizona Schedule APY Itemized Deductions For PartYear Residents Include With Your Return Azdor

Key elements of the Arizona Schedule APY include:

- Identification of the taxpayer, including name and Social Security number.

- Details of income earned during the residency period in Arizona.

- A comprehensive list of itemized deductions, such as mortgage interest, property taxes, and medical expenses.

- Calculation of the total deductions and the resultant taxable income.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Schedule APY typically align with the federal tax return deadlines. For most taxpayers, the deadline is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for part-year residents to be aware of these dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Schedule APY can be submitted through various methods:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate state tax office.

- In-person submission at designated Arizona Department of Revenue locations.

Quick guide on how to complete arizona schedule apy itemized deductions 2015 for partyear residents include with your return azdor

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The Easiest Way to Modify and Electrically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Schedule APY Itemized Deductions For PartYear Residents Include With Your Return Azdor

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule apy itemized deductions 2015 for partyear residents include with your return azdor

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an e-signature for a PDF document on Android

People also ask

-

What are Arizona Schedule APY Itemized Deductions For PartYear Residents?

Arizona Schedule APY Itemized Deductions For PartYear Residents are deductions that eligible individuals can include on their tax returns to reduce taxable income. This schedule helps ensure that taxpayers only pay taxes on income earned during their residency in Arizona. Understanding these deductions can signNowly impact your overall tax liability.

-

How do I include Arizona Schedule APY Itemized Deductions with my return?

To include Arizona Schedule APY Itemized Deductions For PartYear Residents with your return, prepare your itemized deductions accurately on the designated schedule. Ensure all necessary documentation is gathered to support each deduction. These forms must then be submitted along with your state tax return to ensure compliance with AZDOR regulations.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features like eSigning, document storage, and template creation to help you streamline your tax document management. You can easily send your Arizona Schedule APY Itemized Deductions For PartYear Residents for eSignature, making the process quick and efficient. This ensures all forms are signed and organized, enhancing your filing experience.

-

Is airSlate SignNow cost-effective for individuals filing taxes?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals, including those filing their taxes. With competitive pricing plans, you can manage your documents efficiently while ensuring compliance with tax laws. Leveraging our platform can save you both time and money, especially when handling Arizona Schedule APY Itemized Deductions For PartYear Residents.

-

How does airSlate SignNow integrate with accounting software?

airSlate SignNow integrates seamlessly with various accounting software to simplify your tax filing process. By connecting your accounting tools, you can automatically import information needed for Arizona Schedule APY Itemized Deductions For PartYear Residents. This saves time and reduces the risk of errors in your documentation.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers numerous benefits, such as enhanced security, easy collaboration, and time-saving workflows. You'll find it particularly helpful when managing Arizona Schedule APY Itemized Deductions For PartYear Residents, as all documents are securely stored and can be accessed anytime. This ensures you have what you need at your fingertips during tax season.

-

Can airSlate SignNow help me track my submitted tax documents?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your submitted tax documents in real-time. This includes tracking your Arizona Schedule APY Itemized Deductions For PartYear Residents to ensure they have been received and processed correctly. Staying updated can give you peace of mind during the filing process.

Get more for Arizona Schedule APY Itemized Deductions For PartYear Residents Include With Your Return Azdor

Find out other Arizona Schedule APY Itemized Deductions For PartYear Residents Include With Your Return Azdor

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF