140 Tax Booklet Optional Tables2014 Wo Page Numbers Form

What is the 140 Tax Booklet Optional Tables2014 Wo Page Numbers

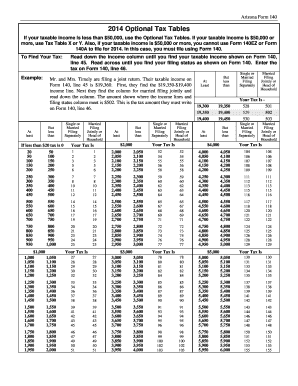

The 140 Tax Booklet Optional Tables2014 Wo Page Numbers is a specific tax form used by individuals and businesses in the United States for reporting various tax-related information. This form includes optional tables that assist taxpayers in calculating their tax liabilities and determining eligible deductions. It is essential for ensuring accurate tax filings and compliance with Internal Revenue Service (IRS) regulations. The absence of page numbers in this version may require users to refer to specific sections based on their needs, making familiarity with the content critical for effective use.

How to use the 140 Tax Booklet Optional Tables2014 Wo Page Numbers

Using the 140 Tax Booklet Optional Tables2014 Wo Page Numbers involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, review the optional tables provided in the booklet to identify which sections apply to your situation. Carefully fill out the required fields, ensuring that all calculations are accurate. It is advisable to double-check your entries before submission to avoid errors that could lead to delays or penalties.

Steps to complete the 140 Tax Booklet Optional Tables2014 Wo Page Numbers

Completing the 140 Tax Booklet Optional Tables2014 Wo Page Numbers requires a systematic approach:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Review the instructions provided in the booklet to understand the requirements for each section.

- Fill out your personal information accurately at the beginning of the form.

- Utilize the optional tables to calculate any deductions or credits for which you may be eligible.

- Review your entries for accuracy and completeness before finalizing the form.

- Submit the completed form by the appropriate deadline, either electronically or by mail.

Legal use of the 140 Tax Booklet Optional Tables2014 Wo Page Numbers

The legal use of the 140 Tax Booklet Optional Tables2014 Wo Page Numbers hinges on compliance with IRS guidelines. When completed correctly, this form serves as a legally binding document that reflects your tax obligations. It is crucial to ensure that all information is truthful and accurate, as discrepancies can lead to audits or penalties. Utilizing a reliable eSignature platform can enhance the legality of your submission, providing a digital certificate that verifies your identity and intent.

IRS Guidelines

The IRS provides specific guidelines for the use of the 140 Tax Booklet Optional Tables2014 Wo Page Numbers. These guidelines outline the eligibility criteria, necessary documentation, and deadlines for submission. It is essential to familiarize yourself with these regulations to ensure compliance. The IRS also updates its guidelines periodically, so staying informed about any changes is crucial for accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 140 Tax Booklet Optional Tables2014 Wo Page Numbers are critical to avoid penalties. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates regarding filing dates and to mark important deadlines on your calendar to ensure timely submission.

Quick guide on how to complete 140 tax booklet optional tables2014 wo page numbers

Prepare [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for printed and signed documents, as you can access the correct format and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 140 Tax Booklet Optional Tables2014 Wo Page Numbers

Create this form in 5 minutes!

How to create an eSignature for the 140 tax booklet optional tables2014 wo page numbers

The best way to generate an e-signature for a PDF document online

The best way to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to create an e-signature from your smart phone

How to create an e-signature for a PDF document on iOS

The way to create an e-signature for a PDF file on Android OS

People also ask

-

What is the 140 Tax Booklet Optional Tables2014 Wo Page Numbers?

The 140 Tax Booklet Optional Tables2014 Wo Page Numbers is a specific set of resources that assist users in navigating tax reporting. It provides optional tables that can simplify the reporting process for 2014 taxes without page numbers, making it easier to reference sections. Using these tables can help you save time and ensure accuracy in your tax filings.

-

How does airSlate SignNow facilitate the use of the 140 Tax Booklet Optional Tables2014 Wo Page Numbers?

airSlate SignNow enhances the experience of using the 140 Tax Booklet Optional Tables2014 Wo Page Numbers by allowing users to eSign and send documents effortlessly. Our platform ensures that you can easily attach and reference these tables in your digital documents. This integration simplifies your tax preparation and ensures that all necessary information is readily available.

-

Is there a cost involved in accessing the 140 Tax Booklet Optional Tables2014 Wo Page Numbers?

The 140 Tax Booklet Optional Tables2014 Wo Page Numbers can typically be accessed through various tax software or documentation services, which may entail a fee. However, airSlate SignNow offers cost-effective solutions that allow you to manage your tax documents and eSign them without the high costs often associated with tax preparation. Explore our pricing plans for more details.

-

What features does airSlate SignNow provide that assist with the 140 Tax Booklet Optional Tables2014 Wo Page Numbers?

airSlate SignNow offers a suite of features that enhance the utility of the 140 Tax Booklet Optional Tables2014 Wo Page Numbers. Our tools include easy document signing, collaboration options, and storage that ensures your tax-related documents are always accessible. Additionally, features like templates allow you to streamline your document creation process.

-

Can I integrate airSlate SignNow with other tax preparation systems to use the 140 Tax Booklet Optional Tables2014 Wo Page Numbers?

Yes, airSlate SignNow supports integrations with popular tax preparation software, enabling you to use the 140 Tax Booklet Optional Tables2014 Wo Page Numbers seamlessly. This integration allows you to manage your eSignatures and documents directly alongside your tax work. Our commitment to compatibility ensures you can combine the tools you need for efficient tax filing.

-

What are the benefits of using airSlate SignNow for tax-related documents, including the 140 Tax Booklet Optional Tables2014 Wo Page Numbers?

Using airSlate SignNow for tax-related documents such as the 140 Tax Booklet Optional Tables2014 Wo Page Numbers brings numerous benefits, including enhanced efficiency and security. You can manage document workflows with ease and ensure that your information is protected through advanced security features. This makes airSlate SignNow an ideal partner for your tax preparation needs.

-

How user-friendly is airSlate SignNow for managing the 140 Tax Booklet Optional Tables2014 Wo Page Numbers?

airSlate SignNow is designed with user experience in mind, making it very user-friendly for managing the 140 Tax Booklet Optional Tables2014 Wo Page Numbers. The interface is intuitive, allowing users of all levels to navigate and utilize the platform effectively. You can easily upload and share documents, ensuring tax tasks are completed without unnecessary complications.

Get more for 140 Tax Booklet Optional Tables2014 Wo Page Numbers

- Form c 220 tabc 2011

- Dars form 2013

- Ex parte temporary restraining order texas attorney general oag state tx form

- Certification letter for victim of family violence for waiver of electric oag state tx form

- Temporary restraining order against candelaria ranch llc and oag state tx form

- Paternity acknowledgment form texas

- Completed grievance form

- Fee affidavit form texas department of criminal justice tdcj state tx

Find out other 140 Tax Booklet Optional Tables2014 Wo Page Numbers

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors