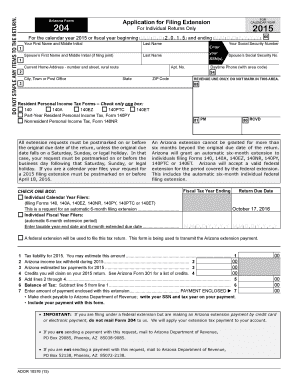

Arizona Form 204 for CALENDAR YEAR Application for Filing Extension for Individual Returns Only for the Calendar Year or Fiscal

What is the Arizona Form 204 FOR CALENDAR YEAR Application For Filing Extension For Individual Returns Only For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 5 And Ending M M D D Y Y Y Y

The Arizona Form 204 is a specific application designed for individuals seeking an extension to file their tax returns for the calendar year or fiscal year that begins in 2015. This form allows taxpayers to request additional time to complete their tax filings without incurring immediate penalties. It is essential for individuals who may need extra time due to various circumstances, such as personal challenges or the complexity of their financial situations.

Steps to complete the Arizona Form 204 FOR CALENDAR YEAR Application For Filing Extension For Individual Returns Only For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 5 And Ending M M D D Y Y Y Y

Completing the Arizona Form 204 involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including your Social Security number and details regarding your income. Next, fill out the form carefully, ensuring that you enter the correct dates for the beginning and ending of the tax year. It is crucial to double-check all entries to avoid mistakes that could delay the processing of your extension request. Once completed, sign the form to validate it before submission.

How to obtain the Arizona Form 204 FOR CALENDAR YEAR Application For Filing Extension For Individual Returns Only For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 5 And Ending M M D D Y Y Y Y

The Arizona Form 204 can be obtained through several channels. It is available on the official Arizona Department of Revenue website, where taxpayers can download a printable version. Additionally, individuals can request a physical copy by contacting the Department of Revenue directly. For those who prefer digital methods, accessing the form through authorized tax preparation software is also an option, providing a convenient way to fill it out electronically.

Legal use of the Arizona Form 204 FOR CALENDAR YEAR Application For Filing Extension For Individual Returns Only For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 5 And Ending M M D D Y Y Y Y

The legal use of the Arizona Form 204 hinges on its compliance with state tax regulations. When properly filled out and submitted, the form serves as an official request for an extension, protecting the taxpayer from penalties associated with late filing. To ensure its legal standing, it is important to follow all guidelines set forth by the Arizona Department of Revenue, including submission deadlines and required signatures. Understanding these legal parameters helps taxpayers navigate their obligations effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 204 are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the application for an extension must be submitted by the original due date of the tax return. For the 2015 tax year, this means that the form should be filed by April 15, 2016. It is advisable to stay informed about any changes to deadlines or specific requirements by regularly checking with the Arizona Department of Revenue.

Penalties for Non-Compliance

Failing to file the Arizona Form 204 by the deadline can result in significant penalties. Taxpayers may incur late fees or interest on any unpaid taxes, which can accumulate quickly. Additionally, not filing for an extension when needed may lead to more severe consequences, including the potential for audits or other legal actions by the state. Understanding these penalties emphasizes the importance of timely and accurate submissions.

Quick guide on how to complete arizona form 204 for calendar year application for filing extension 2015 for individual returns only for the calendar year 2015

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly favored by organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your files rapidly without holdups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Edit and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of your documents or redact confidential information with tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tiresome form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Form 204 FOR CALENDAR YEAR Application For Filing Extension For Individual Returns Only For The Calendar Year Or Fiscal

Create this form in 5 minutes!

How to create an eSignature for the arizona form 204 for calendar year application for filing extension 2015 for individual returns only for the calendar year 2015

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is Arizona Form 204 for calendar year applications?

Arizona Form 204 for calendar year applications is designed for individuals seeking an extension to file their tax returns for the calendar year or fiscal year beginning on MM/DD/YYYY and ending on MM/DD/YYYY. Utilizing this form helps ensure compliance with state regulations while providing extra time to complete your tax submissions.

-

How can airSlate SignNow assist with the Arizona Form 204 submission process?

AirSlate SignNow simplifies the process of submitting the Arizona Form 204 for calendar year applications by allowing users to electronically sign and send documents securely. This streamlines the workflow, ensuring timely submissions without the hassle of physical paperwork.

-

What are the costs associated with using airSlate SignNow for Arizona Form 204?

AirSlate SignNow offers a variety of pricing plans that cater to different needs, making it a cost-effective solution for submitting your Arizona Form 204 for calendar year applications. You can choose between monthly or annual subscriptions based on your usage requirements, ensuring you only pay for what you need.

-

What features does airSlate SignNow provide for managing my Arizona Form 204?

AirSlate SignNow includes features such as document templates, electronic signatures, and secure cloud storage, all of which streamline the management of your Arizona Form 204 for calendar year applications. These features enhance efficiency and ensure all documents are easily accessible when needed.

-

Is airSlate SignNow compliant with Arizona state regulations for Form 204?

Yes, airSlate SignNow is compliant with Arizona state regulations regarding the Arizona Form 204 for calendar year applications. The eSigning process adheres to legal standards, ensuring that your submissions are valid and recognized by state authorities.

-

Can I access support for issues related to Arizona Form 204 with airSlate SignNow?

Absolutely! AirSlate SignNow provides dedicated customer support to assist users with any issues related to the Arizona Form 204 for calendar year applications. Our team is available to help troubleshoot problems, answer questions, and guide you through the signing process.

-

What integrations does airSlate SignNow offer that can help with Arizona Form 204?

AirSlate SignNow seamlessly integrates with various applications, including cloud storage and productivity tools, enhancing the workflow for managing your Arizona Form 204 for calendar year applications. These integrations simplify document management and increase overall efficiency in your filing process.

Get more for Arizona Form 204 FOR CALENDAR YEAR Application For Filing Extension For Individual Returns Only For The Calendar Year Or Fiscal

Find out other Arizona Form 204 FOR CALENDAR YEAR Application For Filing Extension For Individual Returns Only For The Calendar Year Or Fiscal

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP