ARIZONA FORM 321 Credit for Contributions to Charities that Provide Assistance to the Working Poor for the Calendar Year , or Sc

Understanding the ARIZONA FORM 321 Credit

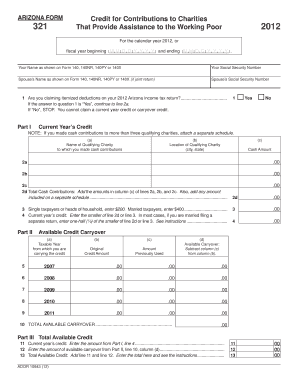

The ARIZONA FORM 321 Credit for Contributions to Charities that Provide Assistance to the Working Poor is a tax credit designed to incentivize charitable donations. This form allows taxpayers to claim a credit for contributions made to qualifying charities that assist low-income individuals and families. The credit is applicable for the calendar year or the fiscal year specified, starting from the beginning date to the ending date indicated on the form. It is essential for taxpayers to be aware of the eligibility criteria and the specific charities that qualify for this credit to maximize their tax benefits.

Steps to Complete the ARIZONA FORM 321

Completing the ARIZONA FORM 321 requires careful attention to detail to ensure accuracy. Here are the steps involved:

- Gather necessary documentation, including proof of contributions made to eligible charities.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the calendar or fiscal year for which you are claiming the credit.

- List the contributions made, including the name of the charity, the amount donated, and the date of the contribution.

- Calculate the total credit amount based on the contributions listed.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the ARIZONA FORM 321

To qualify for the ARIZONA FORM 321 Credit, certain eligibility criteria must be met:

- Contributions must be made to qualifying charities that provide assistance to the working poor.

- The taxpayer must be an Arizona resident for the year the contributions are made.

- Donations must be cash or property, and documentation must be provided to support the claims.

- There may be limits on the amount that can be claimed based on the taxpayer's income and filing status.

Filing Deadlines for the ARIZONA FORM 321

Timely filing of the ARIZONA FORM 321 is crucial to ensure that you receive the credit. The filing deadlines typically align with the state tax return deadlines. For most taxpayers, this means:

- The form must be submitted by April 15 of the year following the tax year.

- If you are filing for a fiscal year, ensure that you adhere to the deadline corresponding to your fiscal year end.

Legal Use of the ARIZONA FORM 321

Using the ARIZONA FORM 321 legally involves adhering to state tax laws and regulations. It is important to ensure that:

- The form is filled out accurately and truthfully, reflecting all contributions made.

- All required documentation is attached to substantiate the claims made on the form.

- Compliance with state tax laws is maintained to avoid penalties or audits.

Obtaining the ARIZONA FORM 321

The ARIZONA FORM 321 can be obtained through various means:

- Visit the Arizona Department of Revenue website to download the form directly.

- Request a physical copy from local tax offices or libraries that provide tax forms.

- Consult with a tax professional who can provide the form and assist with completion.

Quick guide on how to complete arizona form 321 credit for contributions to charities that provide assistance to the working poor 2012 for the calendar year

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize key sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ARIZONA FORM 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor For The Calendar Year , Or Sc

Create this form in 5 minutes!

How to create an eSignature for the arizona form 321 credit for contributions to charities that provide assistance to the working poor 2012 for the calendar year

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an e-signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the ARIZONA FORM 321 Credit For Contributions To Charities?

The ARIZONA FORM 321 Credit For Contributions To Charities allows taxpayers to receive a credit for contributions made to qualified charities that provide assistance to the working poor. This credit can help reduce your overall tax liability when filing your Arizona state taxes for the calendar year, or fiscal year beginning MM/DD/YYYY and ending MM/DD/YYYY.

-

How can I claim the ARIZONA FORM 321 Credit?

To claim the ARIZONA FORM 321 Credit, you'll need to complete the appropriate tax forms during your Arizona state tax return. Ensure that you meet all eligibility requirements and have documentation for your contributions to eligible charities. Using platforms like airSlate SignNow can help streamline your document management and ensure all necessary forms are correctly filled out.

-

What types of contributions qualify for the ARIZONA FORM 321 Credit?

Contributions to qualified charities that provide assistance to low-income individuals and families can qualify for the ARIZONA FORM 321 Credit. It's vital to verify that the organization is recognized by the state and meets the specific criteria outlined in the applicable tax guidelines. Always keep receipts and documentation of your contributions for your records.

-

Are there limits to the ARIZONA FORM 321 Credit I can claim?

Yes, there are limits to how much credit you can claim under the ARIZONA FORM 321 Credit based on your contribution amounts and your tax liability. Be sure to review the current limits set by the Arizona Department of Revenue to maximize your benefits while ensuring compliance. Consulting a tax professional can provide clarity on your specific situation.

-

How does the ARIZONA FORM 321 Credit benefit taxpayers?

The ARIZONA FORM 321 Credit provides taxpayers with an opportunity to decrease their state tax obligation while supporting charitable causes that assist the working poor. This dual benefit encourages philanthropy and directly impacts community welfare. By utilizing e-signature solutions like airSlate SignNow, you can easily manage your charitable documentation and claims.

-

Can I use airSlate SignNow to assist with ARIZONA FORM 321 documentation?

Absolutely, airSlate SignNow can streamline your document management process while preparing the ARIZONA FORM 321 documentation. With features like e-signature and secure document sharing, you can seamlessly gather necessary paperwork and submit your claims on time. Leverage our platform for efficient handling of your tax-related documents.

-

How can I find eligible charities for the ARIZONA FORM 321 Credit?

To find eligible charities for the ARIZONA FORM 321 Credit, you can check the Arizona Department of Revenue’s website or consult their updated lists of qualified organizations. It's crucial to ensure that the charity you choose meets the state’s requirements to make your contributions count toward the credit. Keeping this information at hand can help you maximize your tax benefits.

Get more for ARIZONA FORM 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor For The Calendar Year , Or Sc

- Tdrf damage reporting form

- Mce form 9 8 alternative instructional methods reporting form trec state tx

- Texas tax exemption certificate form

- Emergency motion to stay form

- Express scripts forms

- Dbe loan grant participation summary twdb 0373 dbe twdb state tx form

- Dove country classic scholarships form

- Gladewater scholarship form

Find out other ARIZONA FORM 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor For The Calendar Year , Or Sc

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter