Arizona Form 321 Credit for Contributions to Charities that Provide Assistance to the Working Poor

What is the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor

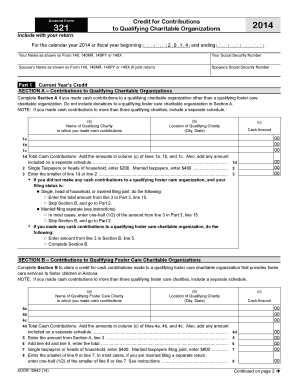

The Arizona Form 321 is a tax credit form designed for individuals who contribute to qualifying charities that provide assistance to the working poor. This form allows taxpayers to receive a dollar-for-dollar tax credit against their Arizona state income tax liability. The credit is aimed at encouraging charitable donations to organizations that support low-income individuals and families, thereby promoting community welfare and social responsibility.

Steps to complete the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor

Completing the Arizona Form 321 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your personal details and the amount contributed to eligible charities. Next, identify the qualified charities as listed by the Arizona Department of Revenue. Fill out the form by entering your contributions in the designated sections. It is essential to review the completed form for any errors before submitting it. Finally, retain copies of the form and any supporting documents for your records.

Eligibility Criteria

To qualify for the Arizona Form 321 credit, taxpayers must meet specific eligibility criteria. Individuals must have made contributions to qualifying charities that provide assistance to the working poor. The contributions must be cash donations or the equivalent value of property. Additionally, the taxpayer must file an Arizona state income tax return to claim the credit. It is important to verify that the charities are recognized by the Arizona Department of Revenue as eligible organizations to ensure that contributions qualify for the credit.

Legal use of the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor

The legal use of the Arizona Form 321 is governed by state tax laws that outline the conditions under which the credit can be claimed. To be legally binding, the form must be completed accurately and submitted in accordance with Arizona state regulations. Taxpayers should ensure that all contributions are documented and that the charities meet the eligibility requirements set forth by the Arizona Department of Revenue. Compliance with these regulations not only validates the credit but also helps avoid potential legal issues related to tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 321 coincide with the general tax filing deadlines for state income tax returns. Typically, taxpayers must submit their forms by April 15 of each year, unless an extension is granted. It is crucial to be aware of any changes in deadlines, especially during tax season, to ensure that the form is filed on time and that all eligible credits are claimed. Late submissions may result in the inability to claim the credit for that tax year.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 321 can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file the form online through the Arizona Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed directly to the appropriate tax office or submitted in person at designated locations. Each method has specific guidelines and requirements, so it is advisable to review the instructions carefully to ensure proper submission.

Quick guide on how to complete arizona form 321 credit for contributions to charities that provide assistance to the working poor

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor

Create this form in 5 minutes!

How to create an eSignature for the arizona form 321 credit for contributions to charities that provide assistance to the working poor

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor?

The Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor is a tax credit program that allows taxpayers to receive a credit for contributions made to qualified charities. This initiative helps improve the lives of working poor individuals and families in Arizona by providing financial assistance to those in need.

-

How can airSlate SignNow help with the Arizona Form 321 Credit process?

airSlate SignNow provides businesses with a seamless way to eSign and send documents related to the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor. Our easy-to-use platform ensures that all necessary documents are completed quickly and accurately, streamlining the contribution process.

-

What are the benefits of using airSlate SignNow for my charitable contributions?

Using airSlate SignNow for your charitable contributions related to the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor offers several advantages. It simplifies document management, enhances compliance, and ensures that your contributions are processed efficiently, ultimately maximizing your tax benefits.

-

Are there any costs associated with using airSlate SignNow for Arizona Form 321 Credit?

airSlate SignNow offers a variety of pricing plans that cater to different needs, ensuring that all users can harness the benefits of electronic signing for the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor. Our cost-effective solutions help save time and resources while ensuring seamless document handling.

-

What features of airSlate SignNow are particularly useful for charitable contributions?

airSlate SignNow includes a range of features that enhance the experience for managing contributions related to the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor. These features include easy document sharing, customizable templates, and real-time tracking of document status, making the contribution process transparent and efficient.

-

Can airSlate SignNow integrate with other platforms for managing charitable contributions?

Yes, airSlate SignNow integrates seamlessly with various platforms and applications that can assist in managing charitable contributions, including accounting software and CRM systems. This integration supports users in handling the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor more comprehensively across their business operations.

-

How secure is the airSlate SignNow platform for handling sensitive contribution documents?

The airSlate SignNow platform prioritizes security, ensuring that all documents related to the Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor are protected with top-tier encryption and compliance measures. Users can feel confident that their sensitive information remains confidential and secure throughout the signing process.

Get more for Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor

Find out other Arizona Form 321 Credit For Contributions To Charities That Provide Assistance To The Working Poor

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form