Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations Include with Your Return

What is the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return

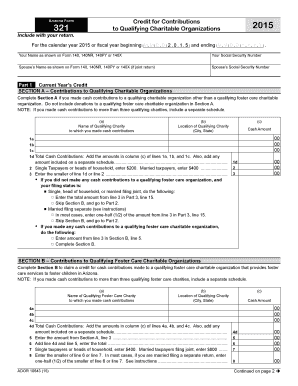

The Arizona Form 321 is a tax credit form designed for individuals who make contributions to qualifying charitable organizations. This form allows taxpayers to claim a credit against their state income tax liability for donations made to eligible charities. The credit is intended to encourage charitable giving and support local organizations that provide essential services to the community. Taxpayers must ensure that the organizations they contribute to are recognized by the state as qualifying charitable organizations to be eligible for this credit.

Steps to complete the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return

Completing the Arizona Form 321 involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and records of contributions made to qualifying charities. Next, fill out the form with personal information, including your name, address, and Social Security number. Indicate the total amount of contributions made during the tax year and ensure that you provide details about the charitable organizations. Finally, review the form for completeness and accuracy before submitting it with your state tax return.

Eligibility Criteria

To qualify for the Arizona Form 321 credit, taxpayers must meet specific criteria. The contributions must be made to organizations that are classified as qualifying charitable organizations by the state of Arizona. Additionally, there are limits on the amount that can be claimed based on filing status. For example, single filers can claim a maximum credit, while married couples filing jointly may have a higher threshold. It is essential to verify that your contributions meet the eligibility requirements to successfully claim the credit.

Required Documents

When filing the Arizona Form 321, certain documents are required to substantiate your claims. These include receipts or bank statements that prove the contributions made to qualifying charitable organizations. Additionally, you may need to provide documentation showing the organization's status as a qualifying charity. Keeping accurate records is crucial, as these documents may be requested by the Arizona Department of Revenue during an audit or review of your tax return.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 321 can be submitted through various methods. Taxpayers have the option to file their forms online through the Arizona Department of Revenue's e-filing system, which offers a convenient way to submit electronically. Alternatively, individuals can print the completed form and mail it to the appropriate address provided by the state. In-person submissions may also be possible at designated tax offices, although this method is less common. It is important to choose a submission method that aligns with your preferences and ensures timely processing.

IRS Guidelines

While the Arizona Form 321 is a state-specific credit, it is essential to be aware of IRS guidelines regarding charitable contributions. The Internal Revenue Service provides rules on what constitutes a qualified charitable contribution and the documentation required for federal tax purposes. Taxpayers should ensure that their contributions meet both state and federal requirements to maximize their tax benefits. Familiarizing yourself with IRS guidelines can help prevent issues when filing your tax return.

Quick guide on how to complete arizona form 321 credit for contributions to qualifying charitable organizations 2015 include with your return

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a great environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, adjust, and electronically sign your documents quickly without any holdups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Create your eSignature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misfiled documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return

Create this form in 5 minutes!

How to create an eSignature for the arizona form 321 credit for contributions to qualifying charitable organizations 2015 include with your return

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations?

The Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations allows taxpayers to receive a tax credit for contributions made to qualifying charities. This credit can reduce your state tax liability, making it a valuable incentive for charitable giving. Be sure to include this form with your return to maximize your benefits.

-

How can airSlate SignNow assist with filing the Arizona Form 321?

airSlate SignNow simplifies the document signing and submission process, allowing users to efficiently complete the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return. With features like templates and eSignature capabilities, you can easily prepare and sign your forms online, ensuring timely submissions.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers several features for tax document management, including secure eSigning, customizable templates, and cloud storage for easy access. These features help streamline the process of filling out documents like the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return, making your tax preparation easier.

-

Is airSlate SignNow cost-effective for individuals submitting Arizona Form 321?

Yes, airSlate SignNow provides a cost-effective solution for individuals needing to submit their Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations. With flexible pricing plans, you can choose a solution that fits your budget, while still benefiting from robust features and support.

-

What are the benefits of using airSlate SignNow for charitable contributions?

Using airSlate SignNow for your charitable contributions enables quick and efficient document processing. By facilitating the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return, you can ensure all required documents are completed accurately and submitted on time, maximizing your tax refund.

-

Can airSlate SignNow integrate with accounting software for easier tax preparation?

Yes, airSlate SignNow can integrate with various accounting software platforms to streamline your tax preparation process. These integrations can help automatically populate the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations, reducing manual data entry and improving accuracy.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security, employing top-tier encryption and secure servers to protect your sensitive tax documents. When submitting the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return, you can feel confident that your data is safe and secure.

Get more for Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return

- Municipal form no 103

- Form 3 certificate of legal practitioner and waiver by purchaser

- City of santa rosa encroachment permit application form

- Turner prequalification form

- Dd 93 form

- Nsw companion animals register permanent identification p1a form

- Mn valuation exclusion on homestead property cr dvhe100 form

- It 2104 2 1999 form

Find out other Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations Include With Your Return

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online