Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms

What is the vehicle schedule for commercial auto insurance?

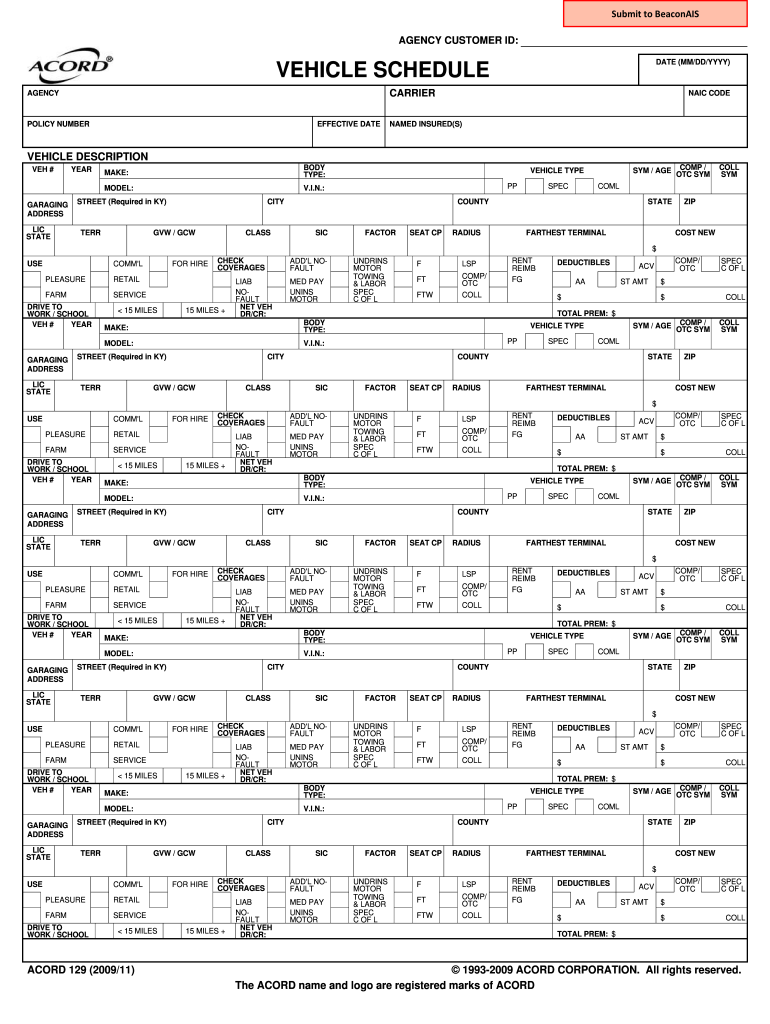

The vehicle schedule for commercial auto insurance is a detailed document that lists all vehicles covered under a business's insurance policy. This schedule typically includes essential information such as the make, model, year, and Vehicle Identification Number (VIN) of each vehicle. It is crucial for businesses to maintain an accurate vehicle schedule to ensure proper coverage and compliance with insurance requirements. The vehicle schedule also aids in determining premiums and assessing risk, as insurers evaluate the types of vehicles used in business operations.

Key elements of the vehicle schedule for commercial auto insurance

Understanding the key elements of a vehicle schedule is vital for businesses. Important components typically include:

- Vehicle Information: Details such as the make, model, year, and VIN.

- Usage: Descriptions of how each vehicle is used within the business.

- Ownership: Information on whether the vehicle is owned, leased, or rented.

- Driver Information: Details about the drivers authorized to operate each vehicle.

- Coverage Limits: Specific coverage amounts for liability, collision, and comprehensive insurance.

These elements help ensure that the commercial auto insurance policy adequately protects the business and its assets.

Steps to complete the vehicle schedule for commercial auto insurance

Completing the vehicle schedule involves several steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather Vehicle Information: Collect details for each vehicle, including make, model, year, and VIN.

- Determine Usage: Identify how each vehicle is utilized in the business, such as delivery, service, or personal use.

- List Drivers: Document all drivers authorized to operate the vehicles, including their driving history.

- Review Coverage Needs: Assess the coverage limits required for each vehicle based on its use and value.

- Submit the Schedule: Provide the completed vehicle schedule to your insurance provider for review and inclusion in your policy.

Following these steps helps ensure that your vehicle schedule is comprehensive and meets insurance requirements.

Legal use of the vehicle schedule for commercial auto insurance

The vehicle schedule is not just a formality; it serves a legal purpose in commercial auto insurance. It acts as a binding document that outlines the specifics of the coverage provided. In the event of an accident or claim, the vehicle schedule helps determine what is covered under the policy. It is essential to keep this document updated to reflect any changes in the fleet, such as adding or removing vehicles, to maintain compliance with insurance laws and regulations.

How to obtain the vehicle schedule for commercial auto insurance

Obtaining a vehicle schedule for commercial auto insurance typically involves contacting your insurance provider. Most insurers will provide a template or form that can be filled out with the necessary vehicle details. Additionally, businesses may also find vehicle schedule templates online that can be customized to fit their specific needs. It is important to ensure that the schedule complies with the insurer's requirements and accurately reflects the vehicles used in business operations.

Examples of using the vehicle schedule for commercial auto insurance

Practical examples of using the vehicle schedule can illustrate its importance. For instance, a delivery service may have a vehicle schedule that lists multiple vans, detailing their specific uses, such as local deliveries or long-distance transport. This information aids in assessing risk and determining appropriate coverage levels. Another example could be a construction company that uses specialized vehicles; the vehicle schedule would highlight these vehicles and their unique insurance needs, ensuring that they are adequately covered for potential liabilities.

Quick guide on how to complete vehicle schedule for commercial auto insurance business insurance services forms

Easily Prepare Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to obtain the correct forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents promptly without delays. Manage Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The Effortless Way to Edit and Electronically Sign Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms

- Locate Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or hide sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm starting grocery home delivery business. Do I need commercial auto insurance for my vehicle in Ontario?

I'm not sure about Ontario/Canada, but in the USA, the insurance company would terminate the insurance, or refuse to issue a policy to, anybody driving commercially with their vehicle. So my best response is to ask your insurance company. You would hate to suddenly lose your coverage because they determine that you are using your personal car for commercial use. I'm pretty sure that the same consideration could be a problem for Uber drivers, also. Check with your insurance company. By the way, when you establish a price on your delivery service, make sure that you take into account the depreciation cost, and replacement cost for your vehicle, and cost of insurance. Otherwise you may be investing time and money into a business that is bound to fail, eventually, because you've underestimated your expenses, and underpriced your service.

-

Is it normal for your auto insurance to cancel on you for not filling out and faxing a random mailed questionnaire?

NORMAL?:If the questionnaire were truly "random", it would not seem normal for an insurance company to cancel a policy for not filling it out.On the other hand, if the questionnaire or communication from the company were regarding information that was material to your application for insurance, substantiating information on an application or an upcoming renewal, lack of a response could trigger a cancellation. RANDOM?:Though it may have been described as a "random" questionnaire, insurance companies typically operate in very systemic and calculated way. Questionnaires are usually sent as a matter of routine, triggered by time frames or some combination of other factors. To follow it with a cancellation/non-renewal however suggests the latter.Regardless, every company and state are different in their requirements. It is generally in your best interest to communicate quickly and honestly with your insurance company when asked for information. ASK WHY?:If you have any questions about "Why" they need the information, ask them. WHY is a fair question to ask. It might be that they don't need the information in which case you can pass. In cases where they do, they should be able to give you a reasonable explanation.Contact your agent or representative and see what's up and if there is some information that they truly need regarding your policy.

-

What are some ways for international students to get cheap auto insurance in the US? Is there any technique to get cheap auto insurance rates while filling out the quotes?

It will vary by state. In theory start with Progressive and Geico but don't dismiss your regional or state specific company. How do you get the most value for the least money? Ask about all the discounts you can. Also, if possible take a six month policy. By doing this you, assuming no tickets or accidents, you should see a reduction every six months. Also, typically, taking the minimum coverage will keep your rates higher. If there is any chance of having insurance beyond six months, take at least $100,000 per person $300,000 per occurence in liability coverage.

-

In your opinion, which Indian insurance company should I opt for if I want to take commercial insurance (business insurance)? How important is commercial insurance? Is bajajallainz good?

Hi,Insurance is important. There is no better concept known to man-kind as on date that manages financial risks better then the ‘concept of insurance’ that we all know.The ultimate objective of any business is to build a strong balance sheet and whatever tools are available to protect the balance sheet, subject to cost benefit analysis, must be used. Insurance policy is one such very powerful tool that protects the balance sheet from many common ‘causes’ such as natural calamities and other process hazards.All insurance companies are good. They are all licensed and monitored by the regulator (IRDA) for their capability to pay claims. So no worries on this front.While all are capable of paying claims, there are certain companies whose systems and processes are more robust then the rest to serve the customer.Bajaj Allianz is certainly a very good company for commercial insurance and is well reputed for its quick claim settlement capabilities. So no need to blink, just go ahead.Trust this information is of help.

-

How do small business owners search for an insurance agent to buy commercial insurance in the US?

I’d start with the agent doing your auto & home, since most also do smaller businesses, since you already know him/her and have a relationship.You can google the kinds of insurance that you are looking for an agent for.You can go to sites like Yelp, Yellow Pages and other business listing sites, and search for commercial or business insurance agents.

-

How much business will insurance agents and brokers lose to new technologies like Google Compare for auto insurance?

The cold hard truth—a lot, but over a long period of time.Google has a few distinct advantages here...allow me to explain and let's keep this as simple as possible.1. Google has data. Lot's of data. 2. Google has leads, more leads than anyone else.3. Google has talent, more talent than anyone else.4. Google has cash. You know where this is going.If you're an agent or broker you've probably heard that, "X% of all consumers start their search online."X seems to change depending on who's pitching you what. But let's agree that it's somewhere around 50-70%, and let's also agree that this number is growing.Now consider that insurance related keyword terms consistently rank as the most expensive keywords on the web (based on Adwords avg. bid prices).Now consider the massive amount of online search queries for "insurance" and all the related search queries...Now consider how many times Google has shown preference for their own projects/companies in the search results...Yes they write the algorithm folks.Now consider that Google is one of the most active lobbyists in DC.Add all that up and tell me they won't own the insurance industry in 20 years. If you want to go deeper simply look at the global opportunity and consider the number of users coming online, increases in connection speeds, decreasing costs of mobile devices, changing consumer preferences....This is a HUGE opportunity and Google is uniquely positioned to go long and win big.Fortunately this doesn't mean the death of local agencies, and anything can happen between here and there (self-driving cars, apocalypse, war, etc).At the end of the day it's all about relationships, and relationships are about trust...Do millennials trust Google or that local insurance agent their dad recommended?

-

Which form for which ITR do I have to fill out for the income from the salary and income from insurance commission?

You may be filed form no. 1. Under the head salary you may fill the amount of salary and under the head income from other sources you Malay fill commission from LIC.

Create this form in 5 minutes!

How to create an eSignature for the vehicle schedule for commercial auto insurance business insurance services forms

How to make an electronic signature for the Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms in the online mode

How to create an eSignature for the Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms in Google Chrome

How to make an electronic signature for signing the Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms in Gmail

How to create an electronic signature for the Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms straight from your mobile device

How to make an eSignature for the Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms on iOS

How to make an electronic signature for the Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms on Android devices

People also ask

-

What is a Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms?

A Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms is a document that lists all vehicles covered under a commercial auto insurance policy. It provides essential details about each vehicle, including make, model, and usage. This schedule is crucial for accurate premium calculations and ensuring appropriate coverage.

-

How can airSlate SignNow help with Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms?

airSlate SignNow simplifies the creation, distribution, and signing of Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms. With our user-friendly interface, businesses can easily customize forms, obtain e-signatures, and store documents securely. This streamlines the insurance process, saving time and reducing paperwork.

-

Is airSlate SignNow cost-effective for managing Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms. Our pricing plans are designed to fit various business sizes, providing access to essential features without breaking the bank. You can maximize efficiency and minimize costs with our flexible options.

-

What features does airSlate SignNow offer for Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms?

airSlate SignNow includes features like customizable templates, bulk sending, and real-time tracking for Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms. Additionally, our platform supports various integrations to enhance workflow, making it easier to manage documents efficiently. These features ensure that your business processes are smooth and effective.

-

Can I integrate airSlate SignNow with other software to manage my Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and document management systems to help you manage your Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms. This integration allows for a more streamlined workflow, enabling you to access and send documents directly from your existing applications.

-

What are the benefits of using airSlate SignNow for Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms?

Using airSlate SignNow for Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms enhances efficiency and accuracy. Businesses benefit from reduced turnaround times, improved compliance, and enhanced security for sensitive information. Our platform ensures a smooth signing experience, which can lead to faster policy issuance.

-

Is airSlate SignNow secure for handling Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms?

Yes, airSlate SignNow prioritizes security and compliance when handling Vehicle Schedule for Commercial Auto Insurance Business Insurance Services Forms. We use industry-standard encryption and secure servers to protect your documents and data. Our platform is designed to ensure that your information remains confidential and secure.

Get more for Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms

Find out other Vehicle Schedule For Commercial Auto Insurance Business Insurance Services Forms

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word