Ar 1103 Form 2017

What is the AR 1103 Form

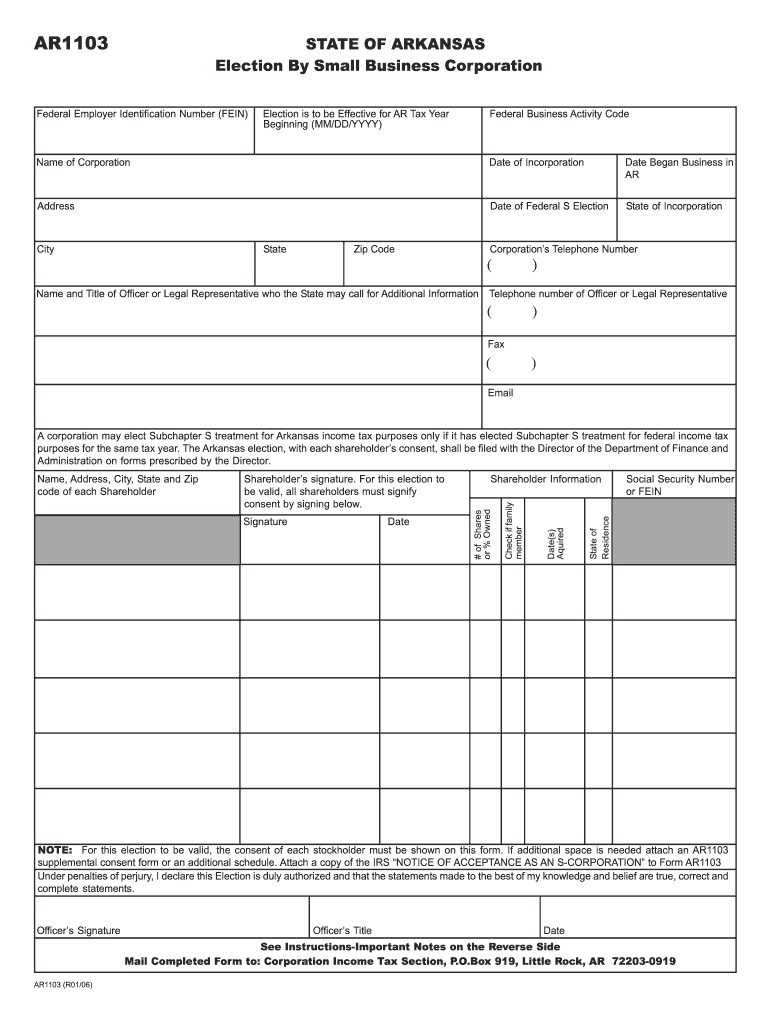

The AR 1103 form, officially known as the Arkansas Form 1103, is a document used by small business corporations in Arkansas to elect to be taxed as an S corporation. This form is crucial for businesses seeking to take advantage of S corporation status, which allows income to pass through to shareholders, avoiding double taxation at the corporate level. Understanding the purpose and implications of this form is essential for business owners who wish to optimize their tax obligations.

How to Use the AR 1103 Form

To use the AR 1103 form effectively, businesses must complete it accurately and submit it to the appropriate state tax authority. The form requires detailed information about the corporation, including its name, address, and federal employer identification number. Additionally, it must specify the effective date of the S corporation election. Proper completion ensures that the corporation is recognized as an S corporation for tax purposes, allowing it to benefit from the associated tax advantages.

Steps to Complete the AR 1103 Form

Completing the AR 1103 form involves several key steps:

- Gather necessary information, including the corporation's legal name, address, and federal employer identification number.

- Indicate the effective date for the S corporation election, which can be the beginning of the current tax year or a future date.

- Review the eligibility criteria to ensure the corporation qualifies for S corporation status.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the Arkansas Department of Finance and Administration.

Legal Use of the AR 1103 Form

The AR 1103 form is legally binding once it is completed and submitted to the appropriate authorities. It must comply with state laws governing S corporations, including eligibility requirements and filing deadlines. Failure to adhere to these regulations could result in the rejection of the S corporation election, leading to potential tax liabilities. Therefore, it is essential for businesses to understand the legal implications of submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the AR 1103 form are critical for businesses wishing to elect S corporation status. Typically, the form must be filed by the 15th day of the third month after the beginning of the tax year for which the election is to take effect. For example, if a corporation's tax year begins on January 1, the AR 1103 form must be submitted by March 15. Missing this deadline can result in the inability to elect S corporation status for that tax year.

Required Documents

When completing the AR 1103 form, certain documents may be required to support the application. These can include:

- Articles of incorporation or organization.

- Federal employer identification number (EIN) confirmation.

- Any prior tax filings or documentation relevant to the business structure.

Having these documents ready can help streamline the process and ensure compliance with state regulations.

Quick guide on how to complete ar 1103 form

Effortlessly Prepare Ar 1103 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to access the required forms and securely store them online. airSlate SignNow offers all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Ar 1103 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign Ar 1103 Form with Ease

- Find Ar 1103 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this task.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to secure your changes.

- Choose how you wish to submit your form—by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your preference. Edit and eSign Ar 1103 Form, ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar 1103 form

Create this form in 5 minutes!

How to create an eSignature for the ar 1103 form

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the AR 1103 form and why is it important?

The AR 1103 form is a critical document used for various legal and business transactions, particularly in Arkansas. It serves as a declaration or affirmation of information that may be required for compliance and record-keeping. Understanding its purpose can help streamline your administrative processes.

-

How can airSlate SignNow help me with the AR 1103 form?

AirSlate SignNow allows you to easily create, send, and eSign the AR 1103 form digitally. Our platform simplifies the signing process, ensuring that you can handle this essential document efficiently and securely. Plus, you can access the form from anywhere, making it more convenient for your workflow.

-

Is there a cost associated with using airSlate SignNow for the AR 1103 form?

AirSlate SignNow offers various pricing plans that cater to different business needs, including affordable options for managing the AR 1103 form. By investing in our service, you gain access to cost-effective solutions that can enhance your document management and eSigning capabilities. We also provide a free trial to help you evaluate the service.

-

What features does airSlate SignNow offer for the AR 1103 form?

Our platform includes features that are perfect for handling the AR 1103 form, such as customizable templates, secure document storage, and an intuitive interface for easy navigation. Additionally, you can track the status of your forms in real-time, ensuring that you stay up to date with the signing process.

-

Can I integrate airSlate SignNow with other applications for managing the AR 1103 form?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing you to enhance your workflow related to the AR 1103 form. This includes popular tools like Google Drive, Dropbox, and CRM systems. These integrations enable a more cohesive experience when managing your documents.

-

How secure is my information when using airSlate SignNow for the AR 1103 form?

AirSlate SignNow prioritizes the security of your documents, including the AR 1103 form. We utilize advanced encryption protocols to protect your data and ensure compliance with legal standards. This commitment to security helps you feel confident when sharing sensitive information.

-

Can multiple users collaborate on the AR 1103 form with airSlate SignNow?

Absolutely! AirSlate SignNow allows for collaborative work on the AR 1103 form, enabling multiple users to participate in the signing process simultaneously. This feature enhances teamwork and ensures that necessary signatures are collected without delays.

Get more for Ar 1103 Form

- Form to add father to birth certificate

- Vaccination certificate format

- Mother s worksheet for child s birth certificate louisiana new dhh louisiana form

- Marriage license in san benito county 2009 form

- Ohio medicaid prior authorization form

- Wellcare hipaa release of information form

- Pharmacy form

- Retro claim on wellcare of georgia form

Find out other Ar 1103 Form

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now