AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE to CLEAR FORM INTEREST and DIVIDEND INCOME SCHEDULE Social Security Number Name Pa

Understanding the AR4 Arkansas Individual Income Tax Form

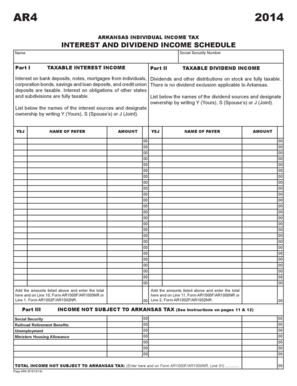

The AR4 Arkansas Individual Income Tax form is essential for reporting interest and dividend income for residents of Arkansas. This form collects information about your taxable interest income, which includes interest earned from bank deposits, notes, and mortgages, as well as any taxable dividend income. Properly completing this form ensures compliance with state tax regulations and helps in accurately calculating your tax liabilities.

Steps to Complete the AR4 Arkansas Individual Income Tax Form

To fill out the AR4 form, follow these steps:

- Begin by entering your Social Security Number and name at the top of the form.

- In Part I, report your taxable interest income. This includes all interest earned from various sources, such as bank accounts and loans.

- In Part II, list your taxable dividend income. Include dividends received from stocks and mutual funds.

- Ensure all amounts are accurate and double-check your calculations to avoid errors.

- Sign and date the form to validate your submission.

Legal Use of the AR4 Arkansas Individual Income Tax Form

The AR4 form is legally binding when completed correctly. It must be signed by the taxpayer to certify that the information provided is true and accurate to the best of their knowledge. Misrepresentation or omission of information can lead to penalties or legal repercussions. Utilizing a secure platform for digital signatures can enhance the legitimacy of your submission.

State-Specific Rules for the AR4 Arkansas Individual Income Tax Form

Arkansas has specific regulations governing the reporting of interest and dividend income. Taxpayers must adhere to these rules to ensure compliance. For instance, certain types of interest income may be exempt from state taxation, while others may require detailed reporting. Familiarity with these state-specific rules can aid in accurate tax reporting and help avoid potential issues with the Arkansas Department of Finance and Administration.

Required Documents for the AR4 Arkansas Individual Income Tax Form

When preparing to complete the AR4 form, gather the following documents:

- Forms 1099-INT and 1099-DIV, which report interest and dividend income, respectively.

- Bank statements showing interest earned during the tax year.

- Investment statements detailing dividend payments received.

- Any other relevant financial documents that support your reported income.

Filing Methods for the AR4 Arkansas Individual Income Tax Form

The AR4 form can be submitted through various methods:

- Online filing through the Arkansas Department of Finance and Administration website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Quick guide on how to complete ar4 2014 arkansas individual income tax click here to clear form interest and dividend income schedule social security number

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the necessary form and store it securely online. airSlate SignNow provides you with all the resources required to create, alter, and electronically sign your documents swiftly and without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Alter and Electronically Sign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize key sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management requirements with just a few clicks from your chosen device. Alter and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar4 2014 arkansas individual income tax click here to clear form interest and dividend income schedule social security number

The best way to make an e-signature for your PDF document in the online mode

The best way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the AR4 Arkansas Individual Income Tax form?

The AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM INTEREST AND DIVIDEND INCOME SCHEDULE is a crucial document for reporting taxable interest and dividend income in Arkansas. This helps taxpayers accurately disclose their earnings from bank deposits, notes, and mortgages as part of their individual tax return.

-

How do I report interest income on the AR4 form?

To report interest income on the AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM, you need to fill out Part I, which specifically addresses TAXABLE INTEREST INCOME. Ensure that your Social Security Number and name are correctly included to avoid any processing delays.

-

What information is required for the dividend income section?

For Part II of the AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM, you will need to provide details on your TAXABLE DIVIDEND INCOME. Be sure to list all dividends received to ensure your tax filings are accurate and compliant with Arkansas laws.

-

Are there any integration options with accounting software?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions to streamline your tax filing process. This means you can manage your AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM INTEREST AND DIVIDEND INCOME SCHEDULE without the hassle of manual entries.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for handling tax documents like the AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM offers several benefits, including an intuitive interface, enhanced security, and cost-effective solutions for eSigning and document submission. This makes it easier for individuals to manage their INTEREST AND DIVIDEND INCOME SCHEDULE.

-

Is there a cost associated with using airSlate SignNow?

airSlate SignNow offers competitive pricing plans, ensuring that you get maximum value when managing forms like the AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM. With affordable options, individuals can easily handle their interest and dividend income reporting without incurring hefty fees.

-

How can I ensure my form is submitted correctly?

To ensure that your AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM is submitted accurately, review all entries for completeness, especially your Social Security Number and financial details in Part I and Part II. Utilizing features such as document tracking can also help confirm your submission status.

Get more for AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM INTEREST AND DIVIDEND INCOME SCHEDULE Social Security Number Name Pa

- Foc50 form

- Texas security id form

- Probation referral form oakland county

- High mileage appeal form orangeburg county orangeburgcounty

- Listing agreement standard form new orleans undersigned client 2005

- Printable lease form

- Nebraska real estate disclosure form fillable

- Ritchie jennings memorial scholarship application form

Find out other AR4 ARKANSAS INDIVIDUAL INCOME TAX CLICK HERE TO CLEAR FORM INTEREST AND DIVIDEND INCOME SCHEDULE Social Security Number Name Pa

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document