AR4 Click Here to Clear Form Info Click Here to Print Document ARKANSAS INDIVIDUALFIDUCIARY INCOME TAX INTEREST and DIVIDEND INC

Overview of the AR4 Form

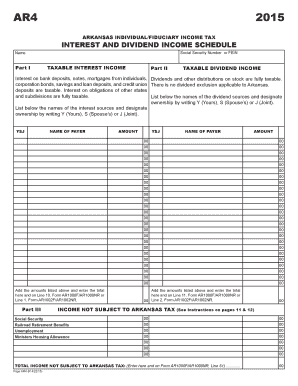

The AR4 form, officially known as the Arkansas Individual Fiduciary Income Tax Interest and Dividend Income Schedule, is essential for fiduciaries managing income on behalf of individuals. This form is specifically designed to report taxable interest and dividend income. It requires the Social Security Number or Federal Employer Identification Number (FEIN) of the fiduciary, along with pertinent personal information. Completing this form accurately is crucial for compliance with Arkansas state tax regulations.

Steps to Complete the AR4 Form

Filling out the AR4 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your Social Security Number or FEIN and details about taxable interest and dividends.

- Fill in Part I of the form, which focuses on reporting taxable interest income.

- Complete Part II, which requires reporting taxable dividend income.

- Review all entries for accuracy and completeness to avoid errors.

- Submit the form by mail or electronically, following the guidelines provided by the Arkansas Department of Finance and Administration.

Legal Use of the AR4 Form

The AR4 form serves a legal purpose in reporting income for fiduciaries. To be considered valid, it must be filled out correctly and submitted by the appropriate deadlines. The information provided on this form is used by the state to assess tax liabilities accurately. Compliance with state laws regarding eSignature and electronic submission is also important for ensuring that the form is legally binding.

State-Specific Rules for the AR4 Form

Arkansas has specific regulations governing the use of the AR4 form. These include:

- Fiduciaries must adhere to the state’s tax laws when reporting income.

- There are designated filing deadlines that must be met to avoid penalties.

- Specific instructions regarding the type of income that must be reported are outlined in the form's guidelines.

Examples of Using the AR4 Form

Common scenarios where the AR4 form is utilized include:

- Trustees managing a trust fund that generates interest and dividends.

- Executors of estates reporting income on behalf of deceased individuals.

- Individuals acting as fiduciaries for family members who are unable to manage their financial affairs.

Filing Deadlines for the AR4 Form

It is important to be aware of the filing deadlines associated with the AR4 form to avoid penalties. Typically, the form must be submitted by April 15 of the tax year following the income being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates ensures compliance with state tax regulations.

Quick guide on how to complete ar4 form

Complete ar4 form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an impeccable eco-friendly substitute to traditional printed and signed documents, enabling you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage ar4 form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign ar4 form effortlessly

- Find ar4 form and click Obtain Form to begin.

- Use the tools we provide to complete your document.

- Highlight relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Finished button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choice. Modify and eSign ar4 form while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ar4 form

Create this form in 5 minutes!

How to create an eSignature for the ar4 form

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask ar4 form

-

What is an AR4 form and why is it important?

The AR4 form is a crucial document for various businesses as it is used for specific regulatory compliance. Understanding its requirements can help streamline your processes and ensure you meet legal obligations. Utilizing the airSlate SignNow platform can simplify the sending and eSigning of the AR4 form efficiently.

-

How does airSlate SignNow support the completion of AR4 forms?

airSlate SignNow provides an intuitive interface that enables users to fill out, send, and eSign AR4 forms with ease. The easy-to-use tools help eliminate errors and reduce the time spent on paperwork. You can access your documents from anywhere, ensuring that the completion of AR4 forms is seamless.

-

What are the pricing options for using airSlate SignNow for AR4 forms?

airSlate SignNow offers flexible pricing plans tailored to various business needs, making it cost-effective for handling AR4 forms. You can choose between monthly or annual subscriptions, ensuring that you get the features that fit your budget. Additional discounts may be available for long-term commitments.

-

Can I integrate airSlate SignNow with other software to manage AR4 forms?

Absolutely! airSlate SignNow offers integration capabilities with various software tools, allowing you to manage AR4 forms alongside other applications your business uses. Integrations with CRM systems and cloud storage services enhance workflow efficiency and streamline document management processes.

-

What are the security features of airSlate SignNow when handling AR4 forms?

When it comes to the AR4 form and any sensitive documents, security is a top priority for airSlate SignNow. The platform utilizes encryption, secure access controls, and compliance with industry regulations to protect your information. You can confidently eSign and store AR4 forms knowing your data is safe.

-

How does airSlate SignNow ensure compliance for AR4 forms?

airSlate SignNow helps ensure compliance for AR4 forms by providing legally binding eSignatures and maintaining a secure audit trail. The platform keeps all your documents organized and accessible, which is essential for regulatory review. This ensures that your AR4 forms meet all necessary legal requirements.

-

Is there a mobile app available for managing AR4 forms with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage their AR4 forms on-the-go. This convenience means you can send, edit, and eSign documents using your mobile device anytime, anywhere. The app retains all the core functionalities to ensure a smooth user experience.

Get more for ar4 form

Find out other ar4 form

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template