Attach to AR1000FAR1000NR Form

What is the Attach To AR1000FAR1000NR

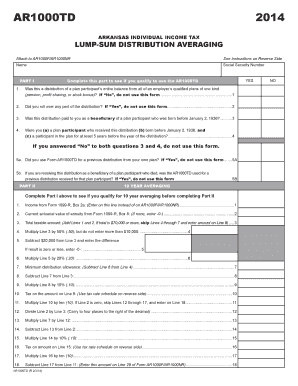

The Attach To AR1000FAR1000NR form is a crucial document used in the context of U.S. tax reporting. It serves as an attachment to the AR1000 and AR1000N forms, which are associated with income tax filings in certain states. This form is primarily utilized by individuals and businesses to report specific tax-related information, ensuring compliance with state tax regulations. Understanding its purpose and requirements is essential for accurate tax reporting.

How to use the Attach To AR1000FAR1000NR

Using the Attach To AR1000FAR1000NR form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information relevant to your tax situation. Next, accurately fill out the form, ensuring that all sections are completed as required. Once the form is filled out, it should be attached to the primary AR1000 or AR1000N form before submission. It is important to review the completed forms for accuracy to avoid any potential issues with tax authorities.

Steps to complete the Attach To AR1000FAR1000NR

Completing the Attach To AR1000FAR1000NR form requires careful attention to detail. Follow these steps:

- Gather your financial records, including income statements and expense receipts.

- Obtain the latest version of the Attach To AR1000FAR1000NR form from the appropriate tax authority.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide the necessary details as requested on the form, ensuring accuracy in reporting income and deductions.

- Review the completed form for any errors or omissions.

- Attach the form to your AR1000 or AR1000N before submission.

Legal use of the Attach To AR1000FAR1000NR

The Attach To AR1000FAR1000NR form must be used in accordance with state tax laws to ensure its legal validity. It is essential that the information provided is accurate and complete, as any discrepancies may lead to penalties or legal issues. Additionally, the form must be submitted by the designated deadlines to maintain compliance with tax regulations. Understanding the legal implications of this form is vital for both individuals and businesses to avoid complications during tax audits.

Filing Deadlines / Important Dates

Filing deadlines for the Attach To AR1000FAR1000NR form vary based on state regulations. Typically, these forms must be submitted by the annual tax filing deadline, which is usually April 15 for individual taxpayers. However, specific states may have different deadlines or extensions available. It is crucial to stay informed about these dates to ensure timely submission and avoid penalties associated with late filings.

Required Documents

To complete the Attach To AR1000FAR1000NR form accurately, several documents may be required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any relevant documentation supporting credits or deductions claimed.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with tax regulations.

Quick guide on how to complete attach to ar1000far1000nr

Accomplish [SKS] effortlessly on any gadget

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the attach to ar1000far1000nr

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

What is the best way to Attach To AR1000FAR1000NR?

To efficiently Attach To AR1000FAR1000NR, simply follow the step-by-step instructions provided in the user manual. Ensure that all necessary components are properly aligned and connected. If you encounter any issues, our customer support team is available to assist you.

-

What are the key features of the AR1000FAR1000NR?

The AR1000FAR1000NR features state-of-the-art technology designed for optimal performance. It supports seamless integration with various software applications, enhancing its versatility. Furthermore, you can easily Attach To AR1000FAR1000NR for efficient document management.

-

Is there a subscription cost to Attach To AR1000FAR1000NR?

Yes, there is a subscription fee associated when you choose to Attach To AR1000FAR1000NR. However, the pricing is competitive and offers great value for the features included. We also provide different subscription tiers to accommodate various business needs.

-

Can I integrate AR1000FAR1000NR with other tools?

Definitely! The AR1000FAR1000NR is designed to work with a range of third-party applications. By utilizing our API, users can effortlessly Attach To AR1000FAR1000NR and enhance their workflow by integrating it with tools they currently use.

-

What are the benefits of using AR1000FAR1000NR?

Using the AR1000FAR1000NR provides numerous benefits including improved efficiency and streamlined document management. By enabling you to Attach To AR1000FAR1000NR, it simplifies processes, reduces paperwork, and saves time for your business operations.

-

How secure is the attachment process for AR1000FAR1000NR?

The attachment process for AR1000FAR1000NR is highly secure, employing encryption and other safety protocols. Our commitment to security ensures that your documents remain safe when you Attach To AR1000FAR1000NR. We prioritize data protection and compliance with industry standards.

-

Can I use airSlate SignNow with AR1000FAR1000NR?

Absolutely! airSlate SignNow is compatible with AR1000FAR1000NR, allowing you to attach electronic signatures seamlessly. This integration simplifies your workflows and lets you effectively Attach To AR1000FAR1000NR without any hassle.

Get more for Attach To AR1000FAR1000NR

- Standard form sjb 1000

- Lucie notice form

- St tammany department of environmental services form

- Certificate of ordination filing stearns county mn form

- Physicians certificate of medical examination for mental illness co titus tx form

- Faa anti drug and alcohol misuse prevention plan tooele county co tooele ut form

- Non custodial parent affidavit of direct payment for travis county traviscountytx form

- Travis subpoena form

Find out other Attach To AR1000FAR1000NR

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement