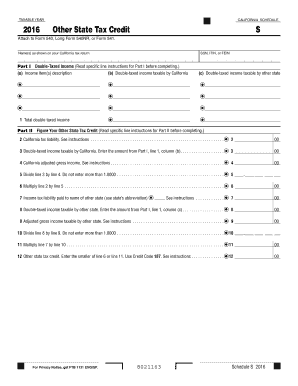

Schedule S Other State Tax Credit Schedule S Other State Tax Credit Form

What is the Schedule S Other State Tax Credit

The Schedule S Other State Tax Credit is a specific tax form used by residents of certain states in the United States to claim a credit for taxes paid to other states. This form allows taxpayers to avoid double taxation on income earned in states outside their primary residence. By filing this form, individuals can receive a credit that reduces their state tax liability, ensuring that they are not penalized for earning income in multiple jurisdictions.

How to use the Schedule S Other State Tax Credit

To effectively use the Schedule S Other State Tax Credit, taxpayers must first determine their eligibility based on the income earned in other states. Once eligibility is confirmed, individuals should gather all relevant documentation, including proof of taxes paid to other states. The completed Schedule S form should then be submitted along with the primary state tax return. It is essential to follow the specific instructions provided by the state tax authority to ensure proper credit is applied.

Steps to complete the Schedule S Other State Tax Credit

Completing the Schedule S Other State Tax Credit involves several key steps:

- Gather all necessary documents, including W-2s and 1099s from other states.

- Calculate the total taxes paid to other states for the taxable year.

- Fill out the Schedule S form accurately, detailing the income earned and taxes paid to each state.

- Attach the completed Schedule S to your state tax return.

- Review the form for accuracy before submission to avoid delays or issues.

Eligibility Criteria

To qualify for the Schedule S Other State Tax Credit, taxpayers must meet specific criteria, including:

- Residency in a state that allows the credit.

- Payment of income taxes to another state on income earned there.

- Filing a state tax return in the primary state of residence.

It is important for taxpayers to check their state’s regulations, as eligibility can vary significantly between states.

Required Documents

When filing the Schedule S Other State Tax Credit, taxpayers should prepare the following documents:

- W-2 forms or 1099 forms showing income earned in other states.

- Tax returns or payment receipts from the other states where taxes were paid.

- Any additional documentation required by the state tax authority to substantiate the credit claim.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule S Other State Tax Credit. Typically, state tax returns, including the Schedule S, are due on April fifteenth. However, some states may have different deadlines or allow for extensions. It is advisable to check with the specific state tax authority for the most accurate and up-to-date information regarding deadlines.

Quick guide on how to complete 2016 schedule s other state tax credit 2016 schedule s other state tax credit

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers a perfect environmentally-friendly option to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule S Other State Tax Credit Schedule S Other State Tax Credit

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedule s other state tax credit 2016 schedule s other state tax credit

The way to create an e-signature for your PDF online

The way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule S Other State Tax Credit?

The Schedule S Other State Tax Credit is a tax form that allows taxpayers to claim a credit for taxes paid to other states. By using this credit, you can potentially reduce your overall tax liability in your home state. It is essential for individuals who are filing taxes while living or working in multiple states.

-

How can airSlate SignNow assist with Schedule S Other State Tax Credit documentation?

airSlate SignNow provides an efficient platform for preparing, signing, and managing your Schedule S Other State Tax Credit documents. The user-friendly interface ensures you can easily fill out and eSign necessary forms required for your tax credit claims. Streamlining your documentation process helps you save time and reduce errors.

-

Are there any costs associated with using airSlate SignNow for Schedule S Other State Tax Credit forms?

airSlate SignNow offers several pricing plans to meet different business needs, including options for managing Schedule S Other State Tax Credit forms. The cost varies based on features selected, but it remains a cost-effective solution compared to traditional document management. With competitive pricing, you can enjoy comprehensive features while saving on operational costs.

-

What features does airSlate SignNow provide for managing Schedule S Other State Tax Credit documents?

airSlate SignNow includes features like eSignature, document templates, and real-time collaboration, specifically designed for managing Schedule S Other State Tax Credit documentation. These features help ensure accuracy and save time during the tax filing process. Furthermore, the platform is equipped with secure data storage for your sensitive tax information.

-

Is it easy to integrate airSlate SignNow with other tax software for Schedule S Other State Tax Credit?

Yes, airSlate SignNow offers seamless integrations with various tax software, which enhances your ability to manage Schedule S Other State Tax Credit documents efficiently. By integrating with your existing tools, you can streamline workflows and ensure all necessary forms are easily accessible. This integration makes tax season considerably smoother.

-

Can multiple users collaborate on Schedule S Other State Tax Credit documents with airSlate SignNow?

Absolutely! With airSlate SignNow, multiple users can collaborate in real-time on Schedule S Other State Tax Credit documents. This collaborative feature is beneficial for professionals such as accountants or tax advisors who need to work together to finalize submissions. Enhanced teamwork results in more accurate and timely filings.

-

What are the benefits of using airSlate SignNow for Schedule S Other State Tax Credit?

Using airSlate SignNow for your Schedule S Other State Tax Credit offers numerous benefits, including speed, convenience, and efficiency. The platform simplifies the document management process, allowing you to focus on more important aspects of your tax situation. Additionally, the eSignature feature eliminates the need for physical paperwork.

Get more for Schedule S Other State Tax Credit Schedule S Other State Tax Credit

Find out other Schedule S Other State Tax Credit Schedule S Other State Tax Credit

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free