Form 104 Colorado

What is the Form 104 Colorado

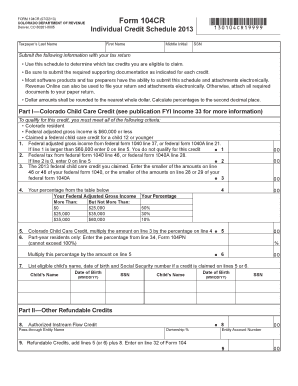

The Form 104 Colorado is a state tax form used by residents to report their income and calculate their state tax liability. This form is essential for individuals and businesses operating in Colorado, as it ensures compliance with state tax laws. The form collects information on various income sources, deductions, and credits applicable to Colorado taxpayers. Understanding the purpose and requirements of Form 104 is crucial for accurate tax filing and avoiding potential penalties.

How to obtain the Form 104 Colorado

To obtain the Form 104 Colorado, taxpayers can visit the official Colorado Department of Revenue website, where the form is available for download. It is also possible to request a physical copy through mail if preferred. Additionally, many tax preparation software programs include the Form 104 Colorado, allowing users to fill it out digitally. Ensuring that you have the correct version of the form is important, as tax laws and requirements may change annually.

Steps to complete the Form 104 Colorado

Completing the Form 104 Colorado involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any relevant receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy to avoid discrepancies.

- Claim any deductions and credits you qualify for, which can help reduce your taxable income.

- Calculate your total tax liability and any payments already made through withholding or estimated payments.

- Sign and date the form before submitting it to the appropriate state tax authority.

Legal use of the Form 104 Colorado

The Form 104 Colorado is legally binding when completed and submitted according to state regulations. It must be signed by the taxpayer, and electronic signatures are accepted if using an authorized eSignature platform. Compliance with the Colorado Department of Revenue's guidelines is essential to ensure that the form is considered valid. Taxpayers should retain copies of their filed forms and supporting documents for their records, as these may be required in case of an audit.

Key elements of the Form 104 Colorado

Key elements of the Form 104 Colorado include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from wages, self-employment, and other sources.

- Deductions: Standard and itemized deductions that may apply.

- Tax Credits: Any credits that reduce the overall tax liability.

- Signature: Required for the form to be legally binding.

Form Submission Methods

Taxpayers can submit the Form 104 Colorado through various methods:

- Online: Filing electronically via approved e-filing services.

- Mail: Sending a completed paper form to the Colorado Department of Revenue.

- In-Person: Delivering the form directly to a local tax office if preferred.

Quick guide on how to complete colorado printable tax forms 104

Complete colorado printable tax forms 104 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Handle colorado printable tax forms 104 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign what is form 104 colorado effortlessly

- Find colorado printable tax forms 104 and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark relevant sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Alter and electronically sign what is form 104 colorado and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to colorado printable tax forms 104

Create this form in 5 minutes!

How to create an eSignature for the what is form 104 colorado

The way to create an e-signature for your PDF document online

The way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an e-signature for a PDF file on Android OS

People also ask what is form 104 colorado

-

What is form 104 colorado and why is it important?

Form 104 Colorado is a state tax return form used by residents to report their annual income and calculate their tax liability. Understanding what is form 104 Colorado is crucial for ensuring compliance with state tax laws and avoiding penalties. Correctly filing this form can also lead to potential tax refunds for eligible individuals.

-

How can airSlate SignNow help with filing what is form 104 colorado?

AirSlate SignNow simplifies the process of filling out and eSigning what is form 104 Colorado by providing a user-friendly platform. It allows users to quickly generate, edit, and securely sign the document online. This streamlines the filing process, saving time and ensuring accuracy.

-

What are the pricing options for using airSlate SignNow for what is form 104 colorado?

AirSlate SignNow offers flexible pricing plans to cater to different needs when dealing with what is form 104 Colorado. Users can choose from monthly or annual subscriptions, with various features included at each level. This cost-effective solution ensures that businesses can manage their document needs within their budget.

-

Is airSlate SignNow compliant with Colorado state regulations for what is form 104 colorado?

Yes, airSlate SignNow complies with Colorado state regulations, making it a reliable choice for handling what is form 104 Colorado. The platform ensures that all electronic signatures and document uploads meet the legal requirements set forth by state authorities. This compliance helps protect users from potential legal issues.

-

What features does airSlate SignNow offer for managing what is form 104 colorado?

AirSlate SignNow offers various features to enhance the management of what is form 104 Colorado, such as easy document creation, collaboration tools, and customizable templates. Users can also track the status of their documents and receive notifications when forms are signed. These features help streamline the tax filing process efficiently.

-

Can airSlate SignNow integrate with tax preparation software for what is form 104 colorado?

Yes, airSlate SignNow integrates with various tax preparation software to assist users with what is form 104 Colorado. This integration allows for seamless data transfer and management, making it easier to prepare and file tax documents. Users benefit from increased efficiency and reduced errors in the filing process.

-

What benefits does airSlate SignNow provide for businesses dealing with what is form 104 colorado?

By using airSlate SignNow for what is form 104 Colorado, businesses can reduce paperwork and streamline document sharing, which saves time and resources. The platform improves workflow efficiency, facilitates quick approvals, and enables secure transactions. These benefits ultimately enhance the overall handling of tax processes.

Get more for colorado printable tax forms 104

- Fg1313a california fish and game commission state of california fgc ca form

- International certificate of good health form 77 043

- 190 form

- H apps formflow forms chp809frp printing california chp ca

- Job description form

- Federal custody and control form electronic

- Dros form

- Ct tr1 annual treasurers report for the attorney general of california annual treasurers report for the attorney general of form

Find out other what is form 104 colorado

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free