CT 1040 Booklet20161212 Indd Form

What is the CT 1040 Booklet20161212 indd

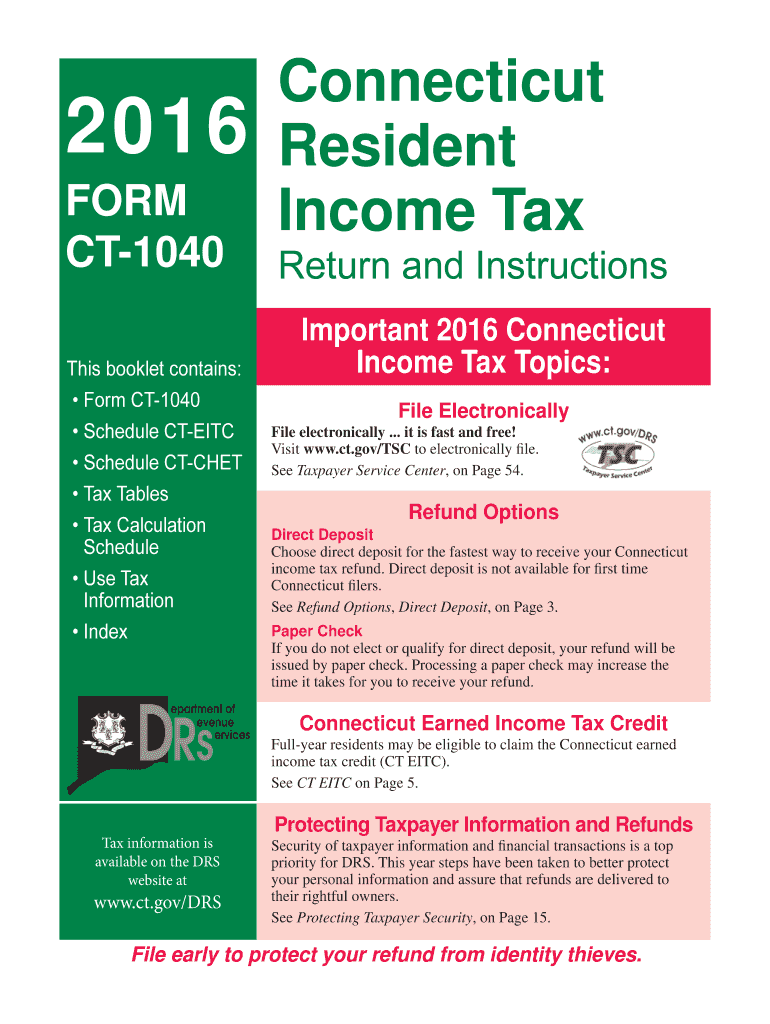

The CT 1040 Booklet20161212 indd is a tax form used by residents of Connecticut to file their individual income tax returns. This booklet includes detailed instructions and necessary schedules to ensure accurate reporting of income, deductions, and credits. It is essential for taxpayers to understand the contents of this booklet to comply with state tax regulations and to avoid potential penalties.

How to use the CT 1040 Booklet20161212 indd

Using the CT 1040 Booklet20161212 indd involves several steps. First, taxpayers should carefully read the instructions provided within the booklet. Next, they need to gather all necessary documentation, such as W-2 forms, 1099s, and receipts for deductions. Once all information is collected, individuals can begin filling out the form, ensuring that all entries are accurate and complete. After completing the form, it must be signed and submitted according to the provided guidelines.

Steps to complete the CT 1040 Booklet20161212 indd

Completing the CT 1040 Booklet20161212 indd requires a systematic approach:

- Review the form instructions thoroughly.

- Collect all relevant financial documents, including income statements and deduction records.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check calculations and entries for accuracy.

- Sign and date the form before submission.

Legal use of the CT 1040 Booklet20161212 indd

The CT 1040 Booklet20161212 indd serves as a legally binding document when filed with the Connecticut Department of Revenue Services. To ensure its legal validity, taxpayers must adhere to all instructions and provide accurate information. Falsifying information on this form can lead to penalties, including fines and legal repercussions. Therefore, it is crucial to maintain honesty and transparency when completing the form.

Filing Deadlines / Important Dates

Timely submission of the CT 1040 Booklet20161212 indd is critical to avoid penalties. The standard filing deadline for individual income tax returns in Connecticut is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions or changes announced by the Connecticut Department of Revenue Services.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the CT 1040 Booklet20161212 indd. The form can be filed online through the Connecticut Department of Revenue Services website, allowing for a quicker processing time. Alternatively, individuals can mail their completed forms to the designated address provided in the booklet. In-person submissions may also be possible at local tax offices, depending on current regulations and procedures.

Quick guide on how to complete ct 1040 booklet20161212indd

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Edit and eSign [SKS] to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 1040 Booklet20161212 indd

Create this form in 5 minutes!

How to create an eSignature for the ct 1040 booklet20161212indd

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the CT 1040 Booklet20161212 indd?

The CT 1040 Booklet20161212 indd is an official tax form used by residents of Connecticut to file their personal income taxes. This booklet provides detailed instructions on how to properly fill out the form and includes necessary schedules. It is essential for compliance with state tax regulations.

-

How can I obtain the CT 1040 Booklet20161212 indd?

You can easily download the CT 1040 Booklet20161212 indd from the Connecticut Department of Revenue Services website. It is available in PDF format, allowing you to view, print, and fill it out conveniently. Additionally, consider using e-signature solutions like airSlate SignNow to streamline your submission process.

-

Is there a cost associated with the CT 1040 Booklet20161212 indd?

The CT 1040 Booklet20161212 indd is provided for free by the Connecticut Department of Revenue Services. However, if you choose to use advanced e-signature features with airSlate SignNow, there may be subscription fees associated with the service, providing an easy and effective way to manage your tax documents.

-

What are the key features of using the CT 1040 Booklet20161212 indd with airSlate SignNow?

By using the CT 1040 Booklet20161212 indd alongside airSlate SignNow, you gain access to features like legally binding e-signatures, document tracking, and secure data storage. These features enhance the traditional filing process by making it more efficient and reliable. This integration is perfect for small businesses and individuals alike.

-

What benefits does airSlate SignNow provide for users of the CT 1040 Booklet20161212 indd?

Using airSlate SignNow with the CT 1040 Booklet20161212 indd allows you to save time and reduce paperwork. It facilitates real-time collaboration and enables multiple signers to access the document simultaneously. This means your tax documents can be completed promptly and securely.

-

Can I integrate airSlate SignNow with accounting software when using the CT 1040 Booklet20161212 indd?

Yes, airSlate SignNow allows seamless integration with various accounting and tax software. This ensures that your CT 1040 Booklet20161212 indd and other important documents can be managed efficiently without redundant data entry. Enjoy a streamlined workflow by integrating tools you already use.

-

What should I do if I have issues filling out the CT 1040 Booklet20161212 indd?

If you encounter difficulties while filling out the CT 1040 Booklet20161212 indd, you can refer to the detailed instructions included in the booklet or seek assistance from tax professionals. Additionally, airSlate SignNow’s support resources may provide insights on handling authentication and signing of the document properly.

Get more for CT 1040 Booklet20161212 indd

- 2013 oil rendition form kansas department of revenue ksrevenue

- Kentucky authorized representative medicaid service form

- Form planning child

- Change of address kentucky medicaid form

- Fire drill report form templatepdffillercom

- Effective 01012013 kentucky cabinet for health and family form

- Fire removal and other sales of merchandise ag ky form

- Nike lacrosse camps application us sports camps form

Find out other CT 1040 Booklet20161212 indd

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online