Supplemental Schedule CT 1040WH, Connecticut Income CT Gov Form

What is the Supplemental Schedule CT 1040WH, Connecticut Income CT gov

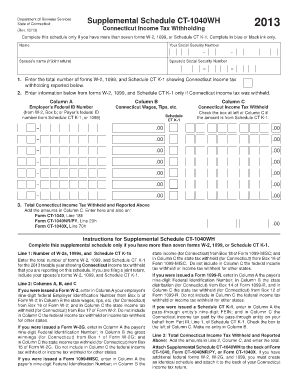

The Supplemental Schedule CT 1040WH is a tax form used by residents of Connecticut to report their income and calculate their withholding tax. This form is specifically designed for individuals who need to provide additional information related to their income tax obligations. It is essential for ensuring that taxpayers accurately report their income and comply with state tax regulations. The form is part of the Connecticut income tax filing process and is submitted alongside the main tax return, CT 1040.

Steps to complete the Supplemental Schedule CT 1040WH, Connecticut Income CT gov

Completing the Supplemental Schedule CT 1040WH involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and interest.

- Calculate total income and any adjustments that apply.

- Review the form for accuracy before submission.

It is important to ensure that all information is complete and accurate to avoid delays or penalties.

How to use the Supplemental Schedule CT 1040WH, Connecticut Income CT gov

The Supplemental Schedule CT 1040WH is used in conjunction with the Connecticut income tax return. To use the form effectively:

- Complete the schedule accurately, ensuring all income sources are reported.

- Attach the completed schedule to your CT 1040 tax return.

- Submit the entire package by the filing deadline to avoid penalties.

This form helps the Connecticut Department of Revenue Services assess your tax liability based on your reported income.

Legal use of the Supplemental Schedule CT 1040WH, Connecticut Income CT gov

The Supplemental Schedule CT 1040WH is legally binding when completed and submitted according to state regulations. It must be signed and dated by the taxpayer to validate the information provided. Compliance with Connecticut tax laws is crucial, as failure to submit accurate information can result in penalties or audits. The form must adhere to the guidelines set forth by the Connecticut Department of Revenue Services to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Supplemental Schedule CT 1040WH typically align with the Connecticut income tax return deadlines. Taxpayers should be aware of the following important dates:

- April 15: Standard deadline for filing the CT 1040 and associated schedules.

- October 15: Extended deadline for those who file for an extension.

It is essential to submit the form by these dates to avoid late fees and interest charges.

Required Documents

To complete the Supplemental Schedule CT 1040WH, several documents are necessary:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as rental income or interest statements.

Having these documents ready will streamline the process and ensure accurate reporting of income.

Quick guide on how to complete supplemental schedule ct 1040wh connecticut income ctgov

Complete Supplemental Schedule CT 1040WH, Connecticut Income CT gov effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct template and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without holdups. Manage Supplemental Schedule CT 1040WH, Connecticut Income CT gov on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign Supplemental Schedule CT 1040WH, Connecticut Income CT gov without hassle

- Find Supplemental Schedule CT 1040WH, Connecticut Income CT gov and select Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or disorganized documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Supplemental Schedule CT 1040WH, Connecticut Income CT gov and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the supplemental schedule ct 1040wh connecticut income ctgov

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Supplemental Schedule CT 1040WH, Connecticut Income CT gov.?

The Supplemental Schedule CT 1040WH is a tax form used by residents of Connecticut to report withholding amounts on their income. This form aids in the calculation of tax liabilities and is crucial for compliance with state tax regulations. Understanding this schedule ensures accurate filing and helps avoid penalties.

-

How do I file the Supplemental Schedule CT 1040WH, Connecticut Income CT gov.?

To file the Supplemental Schedule CT 1040WH, Connecticut Income CT gov., you need to complete the form accurately showing your withheld amounts. You can submit it electronically or by mail along with your main tax return. Using tools like airSlate SignNow can simplify this process by allowing you to eSign and send documents easily.

-

What are the benefits of using airSlate SignNow for the Supplemental Schedule CT 1040WH, Connecticut Income CT gov.?

Using airSlate SignNow provides a hassle-free way to eSign the Supplemental Schedule CT 1040WH, Connecticut Income CT gov. It streamlines your document management, ensuring that your forms are completed, signed, and sent quickly. This efficiency saves time and enhances accuracy in your filings.

-

Is there a cost associated with filing the Supplemental Schedule CT 1040WH, Connecticut Income CT gov.?

There may be fees associated with filing taxes, including the Supplemental Schedule CT 1040WH, which can vary based on your tax preparer or software. However, airSlate SignNow offers a cost-effective solution that reduces your overall expenses related to document management and eSigning.

-

What features does airSlate SignNow offer for handling tax documents like the Supplemental Schedule CT 1040WH, Connecticut Income CT gov.?

airSlate SignNow features include customizable templates, cloud storage, and real-time tracking of document statuses. These features ensure that your Supplemental Schedule CT 1040WH, Connecticut Income CT gov. is easily accessible and securely stored. Such tools help enhance coordination during the filing process.

-

Can I integrate airSlate SignNow with other software for filing the Supplemental Schedule CT 1040WH, Connecticut Income CT gov.?

Yes, airSlate SignNow supports integrations with various accounting and financial software, making it easier to file the Supplemental Schedule CT 1040WH, Connecticut Income CT gov. This seamless connectivity enhances productivity because you can pull information from your existing systems directly into your tax forms.

-

How does eSigning the Supplemental Schedule CT 1040WH, Connecticut Income CT gov. work?

eSigning the Supplemental Schedule CT 1040WH, Connecticut Income CT gov. using airSlate SignNow is straightforward. You simply upload your document, add the required signer fields, and invite the necessary parties to eSign. This process is legally binding and signNowly accelerates document turnaround times.

Get more for Supplemental Schedule CT 1040WH, Connecticut Income CT gov

- Quitclaim deed from individual to husband and wife north carolina form

- Nc general deed form

- Quitclaim deed from corporation to husband and wife north carolina form

- General warranty deed from corporation to husband and wife north carolina form

- Quitclaim deed from corporation to individual north carolina form

- General warranty deed from corporation to individual north carolina form

- Quitclaim deed from corporation to llc north carolina form

- Quitclaim deed from corporation to corporation north carolina form

Find out other Supplemental Schedule CT 1040WH, Connecticut Income CT gov

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document