Ca 568 Instructions 2018-2026

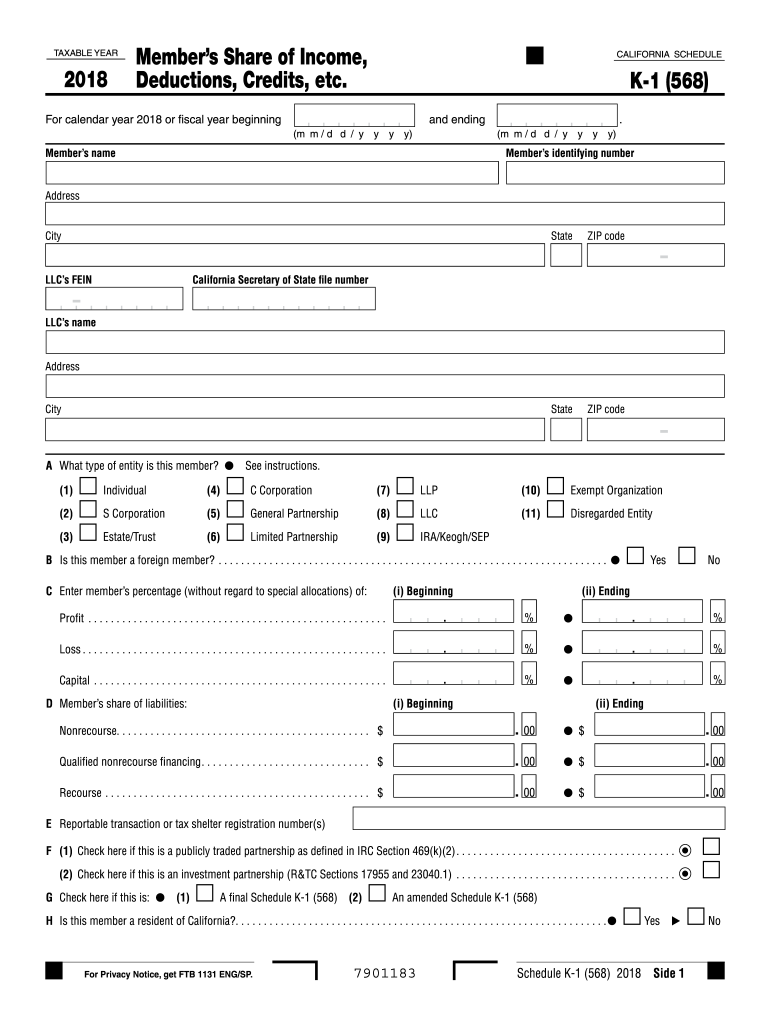

What are the CA 568 Instructions?

The CA 568 instructions provide guidance for California taxpayers who need to complete Form 568, which is used for reporting income, deductions, and credits for limited liability companies (LLCs) operating in California. This form is essential for LLCs to comply with state tax obligations. The instructions detail how to accurately fill out the form, ensuring that all necessary information is included to avoid delays or penalties.

Steps to Complete the CA 568 Instructions

Completing the CA 568 instructions involves several key steps:

- Gather necessary information about your LLC, including its name, address, and federal employer identification number (EIN).

- Review the specific income and expense categories applicable to your business operations.

- Follow the line-by-line instructions provided in the form to enter your financial data accurately.

- Calculate any applicable fees or taxes owed based on your reported income.

- Ensure all required signatures are included before submission.

Legal Use of the CA 568 Instructions

The CA 568 instructions are legally binding documents that guide taxpayers in fulfilling their obligations under California tax law. Adhering to these instructions ensures compliance with state regulations, reducing the risk of audits or penalties. It is important for taxpayers to use the most current version of the instructions to ensure accuracy and legality in their filings.

Filing Deadlines / Important Dates

Filing deadlines for the CA 568 form are crucial for timely compliance. Typically, the form must be filed by the 15th day of the fourth month after the close of your LLC's taxable year. For most LLCs operating on a calendar year, this means the deadline is April 15. It is advisable to check for any updates or changes to these dates annually, as they can vary based on state regulations.

Required Documents

When completing the CA 568 instructions, certain documents are necessary to support your filing. These may include:

- Financial statements detailing income and expenses.

- Records of any deductions or credits claimed.

- Previous year’s tax returns for reference.

- Any correspondence from the California Franchise Tax Board.

Form Submission Methods

The CA 568 form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through the California Franchise Tax Board’s website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if needed.

Quick guide on how to complete schedule k 1 form 568 2018 2019

Your assistance manual on how to prepare your Ca 568 Instructions

If you’re wondering how to create and submit your Ca 568 Instructions, here are some concise directions on how to simplify tax processing.

To start, you merely need to set up your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an intuitive and powerful document management solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and electronic signatures and revert to adjust responses when necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finish your Ca 568 Instructions in moments:

- Create your account and start editing PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Ca 568 Instructions in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkboxes).

- Employ the Signing Tool to add your legally-binding eSignature (if required).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes online with airSlate SignNow. Please remember that submitting on paper may lead to errors in returns and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 568 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 568 2018 2019

How to generate an electronic signature for your Schedule K 1 Form 568 2018 2019 in the online mode

How to make an electronic signature for the Schedule K 1 Form 568 2018 2019 in Google Chrome

How to generate an electronic signature for signing the Schedule K 1 Form 568 2018 2019 in Gmail

How to generate an electronic signature for the Schedule K 1 Form 568 2018 2019 straight from your mobile device

How to create an eSignature for the Schedule K 1 Form 568 2018 2019 on iOS

How to create an eSignature for the Schedule K 1 Form 568 2018 2019 on Android devices

People also ask

-

What are form 568 instructions, and why are they important?

Form 568 instructions provide detailed guidelines on how to properly complete the California LLC return of income. Understanding these instructions is crucial for compliance and ensuring accurate tax reporting, which can help prevent costly errors.

-

How does airSlate SignNow assist with filling out form 568?

AirSlate SignNow streamlines the process of filling out form 568 by providing an easy-to-use platform where you can digitally complete and sign documents. The software includes templates and features that make it simple to follow the form 568 instructions effectively.

-

Can airSlate SignNow help in managing multiple form 568 submissions?

Yes, airSlate SignNow offers features to manage multiple form 568 submissions efficiently. Users can create, store, and track their documents, ensuring that each submission adheres to the required form 568 instructions without hassle.

-

Is there a cost associated with using airSlate SignNow for form 568?

AirSlate SignNow offers cost-effective pricing plans suited for businesses of any size. Exploring the pricing options can help you find a solution that fits your budget while providing all the necessary features to follow form 568 instructions accurately.

-

What integrations does airSlate SignNow offer to streamline form 568 submissions?

AirSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and others to enhance your workflow. This connectivity allows you to access and send documents while adhering to form 568 instructions, thereby improving efficiency.

-

What benefits can I expect from using airSlate SignNow for form 568?

Using airSlate SignNow gives you the benefits of speed, convenience, and security when handling form 568 submissions. It simplifies the signing process and ensures that all necessary instructions are followed, making compliance easy and stress-free.

-

How can airSlate SignNow improve the accuracy of my form 568 submissions?

AirSlate SignNow enhances the accuracy of your form 568 submissions by providing step-by-step guidance through its user-friendly interface. Moreover, built-in checks ensure that you adhere to the form 568 instructions correctly, helping to minimize errors.

Get more for Ca 568 Instructions

- Application for verizon lifeline service pennsylvania form

- Mail 3ifinancialcom form

- Fragebogen bei der einstellung eines betriebs oder teilbetriebs form

- Irs 593 publication form

- Encroachment permit form

- International claims form royal mail

- Investment group contract template form

- Investor contract template form

Find out other Ca 568 Instructions

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form