Form 592 B Resident and Nonresident Withholding , Form 592 B, Resident and Nonresident Withholding 2018

What is the Form 592 B Resident And Nonresident Withholding

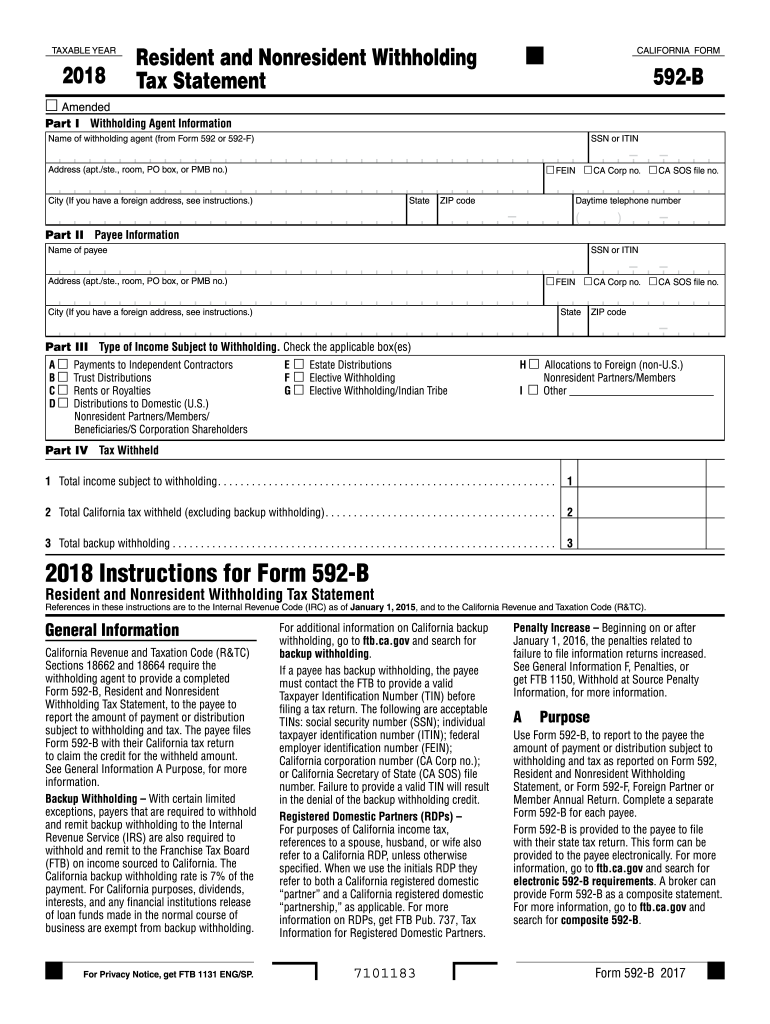

The Form 592 B Resident And Nonresident Withholding is a tax form used in the United States to report and withhold taxes for both resident and nonresident individuals. This form is essential for entities making payments to nonresidents for services performed in the state of California. It ensures compliance with state tax laws and helps facilitate the proper withholding of taxes from payments made to nonresidents. Understanding this form is crucial for businesses and individuals involved in transactions that require tax withholding.

Steps to Complete the Form 592 B Resident And Nonresident Withholding

Completing the Form 592 B involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the payee's details and the amount to be paid. Next, fill in the appropriate sections of the form, including the withholding amount based on the payment type. It is important to double-check all entries for accuracy. After completing the form, sign and date it as required. Finally, submit the form according to the specified filing methods, ensuring it is sent by the deadline to avoid penalties.

How to Obtain the Form 592 B Resident And Nonresident Withholding

The Form 592 B can be obtained through the California Franchise Tax Board's official website. It is available for download in a printable format, allowing users to fill it out manually or digitally. Additionally, tax preparation software may provide access to this form, streamlining the process for users who prefer electronic filing. Always ensure you are using the most current version of the form to comply with the latest tax regulations.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding the use of the Form 592 B, emphasizing the importance of accurate reporting and withholding. Businesses must adhere to these guidelines to avoid issues with tax compliance. The IRS outlines specific instructions for filling out the form, including details about the types of payments that require withholding and the applicable tax rates. Familiarizing oneself with these guidelines is essential for proper tax management.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 B are critical to ensure compliance with state tax laws. Typically, the form must be submitted by the 20th day of the month following the payment to the nonresident. It is advisable to keep track of important dates throughout the tax year to avoid late fees and penalties. Marking these deadlines on a calendar can help ensure timely submission and adherence to tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 592 B can result in significant penalties. These may include fines for late filing, underpayment of taxes, or failure to withhold the correct amount from payments made to nonresidents. It is crucial for businesses and individuals to understand these potential penalties and take proactive steps to ensure compliance, such as timely filing and accurate reporting.

Quick guide on how to complete 2018 form 592 b resident and nonresident withholding 2018 form 592 b resident and nonresident withholding

Your assistance manual on how to prepare your Form 592 B Resident And Nonresident Withholding , Form 592 B, Resident And Nonresident Withholding

If you’re unsure about how to generate and submit your Form 592 B Resident And Nonresident Withholding , Form 592 B, Resident And Nonresident Withholding, here are a few brief guidelines to make tax reporting simpler.

To start, you just need to set up your airSlate SignNow account to transform your document management online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to amend responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Form 592 B Resident And Nonresident Withholding , Form 592 B, Resident And Nonresident Withholding in a matter of minutes:

- Create your account and start processing PDFs almost immediately.

- Utilize our library to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form 592 B Resident And Nonresident Withholding , Form 592 B, Resident And Nonresident Withholding in our editor.

- Populate the essential fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, forward it to your recipient, and download it to your device.

Leverage this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can increase return discrepancies and delay refunds. Certainly, before e-filing your taxes, check the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 592 b resident and nonresident withholding 2018 form 592 b resident and nonresident withholding

FAQs

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 592 b resident and nonresident withholding 2018 form 592 b resident and nonresident withholding

How to make an eSignature for your 2018 Form 592 B Resident And Nonresident Withholding 2018 Form 592 B Resident And Nonresident Withholding in the online mode

How to make an electronic signature for your 2018 Form 592 B Resident And Nonresident Withholding 2018 Form 592 B Resident And Nonresident Withholding in Chrome

How to make an electronic signature for putting it on the 2018 Form 592 B Resident And Nonresident Withholding 2018 Form 592 B Resident And Nonresident Withholding in Gmail

How to generate an electronic signature for the 2018 Form 592 B Resident And Nonresident Withholding 2018 Form 592 B Resident And Nonresident Withholding from your smartphone

How to create an electronic signature for the 2018 Form 592 B Resident And Nonresident Withholding 2018 Form 592 B Resident And Nonresident Withholding on iOS devices

How to make an eSignature for the 2018 Form 592 B Resident And Nonresident Withholding 2018 Form 592 B Resident And Nonresident Withholding on Android devices

People also ask

-

What is Form 592 B Resident And Nonresident Withholding?

Form 592 B Resident And Nonresident Withholding is a tax form used in California for reporting the withholding of taxes on payments made to nonresidents. It is essential for businesses to comply with tax regulations regarding payments to individuals and entities outside of California. Understanding this form can help ensure proper filing and avoidance of penalties.

-

How can airSlate SignNow help with Form 592 B?

airSlate SignNow streamlines the process of preparing and signing Form 592 B Resident And Nonresident Withholding documents. With its eSignature capabilities, users can efficiently manage document workflows, ensuring that all necessary approvals are obtained quickly and securely. This helps facilitate timely submission of tax forms, reducing the risk of late fines.

-

What features does airSlate SignNow offer for handling Form 592 B?

airSlate SignNow provides a variety of features for handling Form 592 B Resident And Nonresident Withholding, such as customizable templates, automated workflows, and reminders for critical deadlines. Users can easily create, send, and sign documents electronically, making tax compliance simpler. The intuitive platform enhances productivity while ensuring accuracy in your filings.

-

Is airSlate SignNow cost-effective for managing Form 592 B?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 592 B Resident And Nonresident Withholding. With flexible pricing plans tailored to fit businesses of all sizes, users can optimize their document processes without breaking the bank. The efficiency gained from using our platform often leads to signNow cost savings over traditional paper-based processes.

-

Can airSlate SignNow integrate with other software for Form 592 B processing?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, which can enhance your workflow for Form 592 B Resident And Nonresident Withholding. These integrations can automate data population and minimize manual entry errors, further improving the accuracy and efficiency of your document management processes.

-

How secure is the data when using airSlate SignNow for Form 592 B?

Data security is a top priority for airSlate SignNow. When working with Form 592 B Resident And Nonresident Withholding, users can rest assured that sensitive information is protected through robust encryption protocols and secure storage practices. Our compliance with industry standards ensures that your tax documents remain confidential and secure.

-

What benefits does eSigning offer for Form 592 B?

eSigning with airSlate SignNow for Form 592 B Resident And Nonresident Withholding offers numerous benefits, including faster turnaround times, reduced paper waste, and enhanced tracking of document statuses. The convenience of signing digitally allows stakeholders to review and approve documents from anywhere, speeding up compliance while maintaining a professional workflow.

Get more for Form 592 B Resident And Nonresident Withholding , Form 592 B, Resident And Nonresident Withholding

- Credit bureau request form transunion canada

- Ph006 doctoramp39s orders adult parenteral nutrition daily order form

- Worker eligibility verification affidavit for all mhtc library modot mo form

- Bni meeting agenda pdf form

- Icmje disclosure form pdf fadi seif pdf atsjournals

- Investors contract template form

- Investors in a small business contract template form

- Irrigation contract template form

Find out other Form 592 B Resident And Nonresident Withholding , Form 592 B, Resident And Nonresident Withholding

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors