Cdtfa 501 Dg 2018

What is the CDTFA 501 DG?

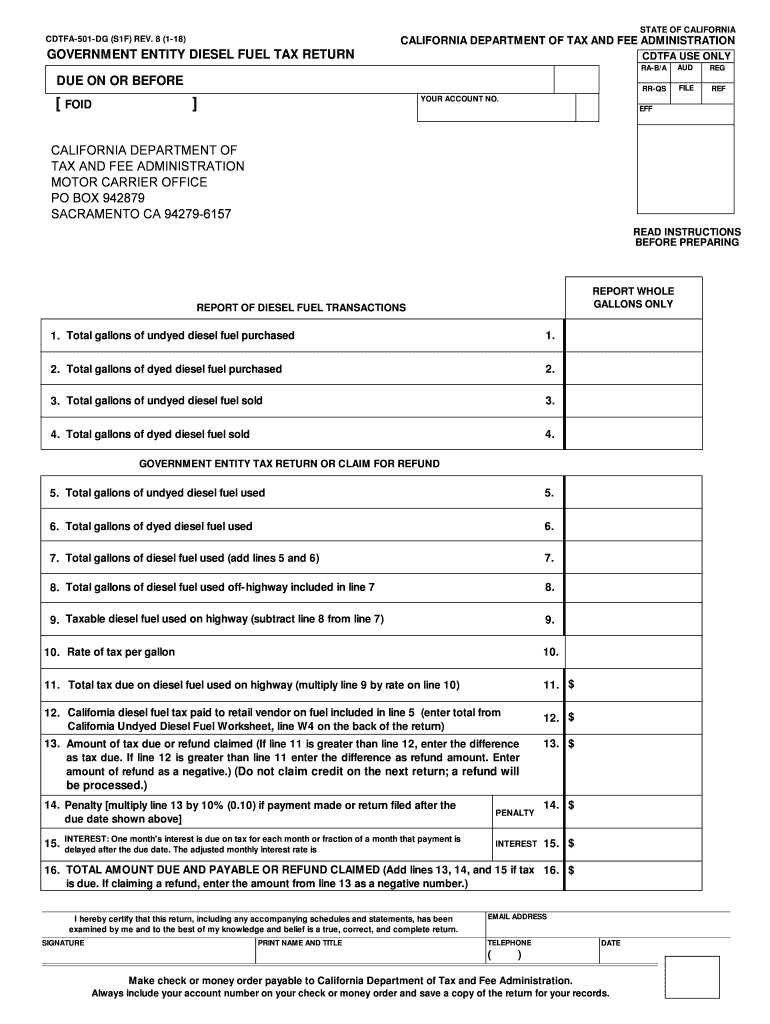

The CDTFA 501 DG is a specific form used for reporting diesel fuel tax returns in California. This form is essential for government entities that operate vehicles or equipment powered by diesel fuel. It helps ensure compliance with state tax regulations and provides a structured way to report fuel usage and tax obligations. Understanding this form is crucial for accurate tax reporting and maintaining compliance with state laws.

Steps to Complete the CDTFA 501 DG

Completing the CDTFA 501 DG involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding diesel fuel usage. This includes details about the quantity of fuel consumed, the type of vehicles or equipment used, and any applicable exemptions. Next, fill out the form with the gathered data, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, sign and submit the form through the preferred submission method, whether online or by mail.

Legal Use of the CDTFA 501 DG

The CDTFA 501 DG is legally binding when completed and submitted according to California state regulations. It is important to ensure that all information provided is truthful and accurate, as misrepresentation can lead to penalties. The form must be submitted by the designated deadlines to avoid any legal repercussions. Understanding the legal implications of this form is essential for government entities to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 501 DG are crucial for compliance. Typically, forms must be submitted quarterly, with specific due dates outlined by the California Department of Tax and Fee Administration. It is important to stay informed about these deadlines to avoid late fees or penalties. Marking these dates on a calendar can help ensure timely submission of the form.

Form Submission Methods

The CDTFA 501 DG can be submitted through various methods, including online submission, mail, or in-person delivery. Online submission is often the most efficient option, allowing for immediate processing. When submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing service. In-person submissions can be made at designated CDTFA offices, providing an opportunity to ask questions or clarify any uncertainties regarding the form.

Key Elements of the CDTFA 501 DG

Understanding the key elements of the CDTFA 501 DG is vital for accurate completion. The form typically includes sections for reporting fuel consumption, tax calculations, and any applicable exemptions. It also requires basic information about the entity filing the form, including name, address, and contact information. Familiarizing oneself with these elements can streamline the completion process and ensure that all necessary information is reported.

Quick guide on how to complete cdtfa 501 dg government entity diesel fuel tax return

Your assistance manual on how to prepare your Cdtfa 501 Dg

If you wish to learn how to formulate and submit your Cdtfa 501 Dg, here are some brief guidelines on simplifying tax declaration.

To begin, you just need to set up your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to edit, draft, and finalize your tax papers easily. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and return to modify answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the directions below to complete your Cdtfa 501 Dg in just minutes:

- Create your account and start working on PDFs within minutes.

- Use our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Cdtfa 501 Dg in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Review your document and amend any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper may lead to increased mistakes in returns and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 501 dg government entity diesel fuel tax return

FAQs

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 501 dg government entity diesel fuel tax return

How to make an electronic signature for your Cdtfa 501 Dg Government Entity Diesel Fuel Tax Return online

How to generate an electronic signature for your Cdtfa 501 Dg Government Entity Diesel Fuel Tax Return in Google Chrome

How to create an electronic signature for putting it on the Cdtfa 501 Dg Government Entity Diesel Fuel Tax Return in Gmail

How to make an eSignature for the Cdtfa 501 Dg Government Entity Diesel Fuel Tax Return right from your mobile device

How to create an electronic signature for the Cdtfa 501 Dg Government Entity Diesel Fuel Tax Return on iOS devices

How to create an eSignature for the Cdtfa 501 Dg Government Entity Diesel Fuel Tax Return on Android OS

People also ask

-

What is the cdtfa 501 form?

The cdtfa 501 form is a tax return used for reporting sales and use tax in California. It is essential for businesses to maintain compliance with state regulations. Knowing how to complete the cdtfa 501 can help avoid penalties and ensure accurate reporting.

-

How can airSlate SignNow assist with cdtfa 501 submissions?

airSlate SignNow offers a seamless way to electronically sign and manage your cdtfa 501 form. With our user-friendly platform, businesses can quickly prepare and submit documents digitally. This not only saves time but also increases the efficiency of the entire filing process.

-

Is airSlate SignNow a cost-effective solution for managing cdtfa 501 forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. We offer competitive pricing plans tailored for your needs while providing features that streamline the management of cdtfa 501 forms. This ensures you get great value without compromising on quality.

-

What features does airSlate SignNow offer for the cdtfa 501 process?

Our platform includes document templates, eSignature capabilities, and secure storage, all specifically designed to simplify the cdtfa 501 process. With customizable workflows, users can manage their forms efficiently, ensuring all necessary steps are completed in a timely manner.

-

Can airSlate SignNow integrate with other tools for handling cdtfa 501 forms?

Absolutely! airSlate SignNow integrates seamlessly with various tools and accounting software to assist in managing cdtfa 501 forms. This integration allows for easier data flow, ensuring your tax filings are accurate and up to date.

-

What are the benefits of using airSlate SignNow for businesses filing cdtfa 501?

Using airSlate SignNow for your cdtfa 501 filings offers numerous benefits, including enhanced efficiency, reduced paperwork, and faster processing times. Furthermore, our secure electronic signatures ensure that your documents are legally binding and compliant with state regulations.

-

How secure is airSlate SignNow when handling cdtfa 501 forms?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect all documents, including the cdtfa 501 forms. We ensure that your sensitive information is safe, allowing you to focus on your business without worrying about data bsignNowes.

Get more for Cdtfa 501 Dg

- Emdr pain protocol pdf form

- Convert javelin to pdf form

- Hawaiian airlines oxygen form

- Jasinc form

- Marathon petroleum vip matching program form

- Virginia service quick form virginia division for the aging vda virginia

- Time conflict approval form university of calgary ucalgary

- Janitorial service contract template form

Find out other Cdtfa 501 Dg

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney