Schedule CT 1040AW, Part Year Resident Income Allocation CT Gov Ct Form

What is the Schedule CT 1040AW, Part Year Resident Income Allocation

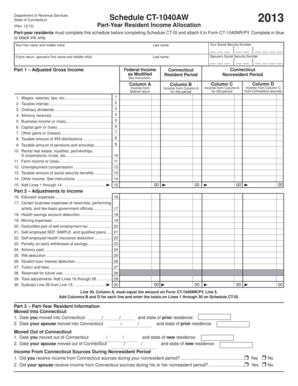

The Schedule CT 1040AW is a form used by part-year residents of Connecticut to allocate their income between the time they were residents and the time they were not. This form is essential for accurately reporting income earned during the year while considering the specific tax obligations for the state. It helps ensure that individuals only pay taxes on the income they earned while residing in Connecticut, thus preventing overpayment and ensuring compliance with state tax laws.

How to use the Schedule CT 1040AW, Part Year Resident Income Allocation

To use the Schedule CT 1040AW effectively, individuals must first determine their residency status for the tax year. This involves identifying the dates of residency and non-residency. Once residency status is established, taxpayers should gather all relevant income documentation, including W-2s and 1099s. The form requires users to input their total income, followed by the allocation of that income based on the time spent as a resident. Completing the form accurately is crucial for proper tax filing.

Steps to complete the Schedule CT 1040AW, Part Year Resident Income Allocation

Completing the Schedule CT 1040AW involves several key steps:

- Gather all income documents for the tax year.

- Determine the dates of residency in Connecticut.

- Calculate total income earned during the year.

- Allocate income based on the residency periods.

- Fill out the form with the allocated amounts.

- Review the completed form for accuracy.

- Submit the form along with the main tax return.

Key elements of the Schedule CT 1040AW, Part Year Resident Income Allocation

Key elements of the Schedule CT 1040AW include sections for reporting total income, deductions, and the allocation of income based on residency status. Taxpayers must provide detailed information about their income sources and the periods they were residents. Additionally, the form may require information on any credits or adjustments applicable to part-year residents. Understanding these elements is essential for ensuring compliance and accuracy in tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CT 1040AW typically align with the federal tax filing deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary. It is important to file the Schedule CT 1040AW along with the main Connecticut income tax return to avoid penalties and ensure timely processing. Keeping track of these dates helps taxpayers remain compliant with state tax regulations.

Penalties for Non-Compliance

Failure to file the Schedule CT 1040AW when required can result in penalties imposed by the state of Connecticut. These penalties may include fines and interest on any unpaid taxes. Additionally, not properly allocating income can lead to overpayment or underpayment of taxes, which can complicate future filings. Understanding the consequences of non-compliance emphasizes the importance of accurately completing and submitting this form.

Quick guide on how to complete ct 1040aw

Complete ct 1040aw effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage ct 1040aw instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and eSign ct 1040aw without any hassle

- Obtain form ct 1040aw and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with the tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you’d like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching through forms, or errors that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign ct 1040aw instructions and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form ct 1040aw

Create this form in 5 minutes!

How to create an eSignature for the ct 1040aw instructions

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

How to generate an e-signature for a PDF on Android

People also ask form ct 1040aw

-

What are the CT 1040AW instructions for completing my form?

The CT 1040AW instructions provide a clear guideline on how to fill out the form accurately. It includes step-by-step directions, filling tips, and necessary information to ensure compliance. Following the CT 1040AW instructions closely can help avoid common mistakes and facilitate a smooth filing process.

-

Where can I find the latest CT 1040AW instructions?

You can find the latest CT 1040AW instructions on the official state website or tax authority portal. These resources are regularly updated to reflect any changes in tax laws. Accessing the most current CT 1040AW instructions is essential for accurate tax reporting.

-

Are there any additional fees associated with using airSlate SignNow for CT 1040AW eSignatures?

Using airSlate SignNow for eSigning your CT 1040AW form is a cost-effective choice. Our pricing plans are transparent with no hidden fees, ensuring you only pay for what you need. Engaging with airSlate SignNow streamlines the signing process while helping you comply with CT 1040AW instructions.

-

What features does airSlate SignNow offer that assist in following CT 1040AW instructions?

airSlate SignNow provides user-friendly features like document templates, reminders, and eSignature options that facilitate the completion of your CT 1040AW form. Our platform ensures that you can easily navigate through the CT 1040AW instructions and stay organized. This minimizes errors and helps you manage your documents efficiently.

-

Can I integrate airSlate SignNow with other software to assist with the CT 1040AW instructions?

Yes, airSlate SignNow offers integrations with various software solutions, enhancing your workflow while following CT 1040AW instructions. You can seamlessly connect with accounting tools, CRM systems, and more. This allows for streamlined data entry and management tailored to the CT 1040AW filing requirements.

-

What benefits does airSlate SignNow provide for accessing CT 1040AW instructions?

airSlate SignNow simplifies the process of accessing and following CT 1040AW instructions through easy document sharing and collaboration features. Users can communicate with team members or tax professionals directly on the platform. This collaborative environment aids in ensuring the CT 1040AW form is completed correctly.

-

Is there customer support available for questions about the CT 1040AW instructions?

Absolutely, airSlate SignNow provides dedicated customer support to assist you with any questions regarding the CT 1040AW instructions. Our team is ready to help you navigate any issues you might face while using our platform. We value your experience and strive to ensure you follow the CT 1040AW instructions successfully.

Get more for ct 1040aw instructions

Find out other ct 1040aw

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement