Sc656 2018-2026

What is the SC656?

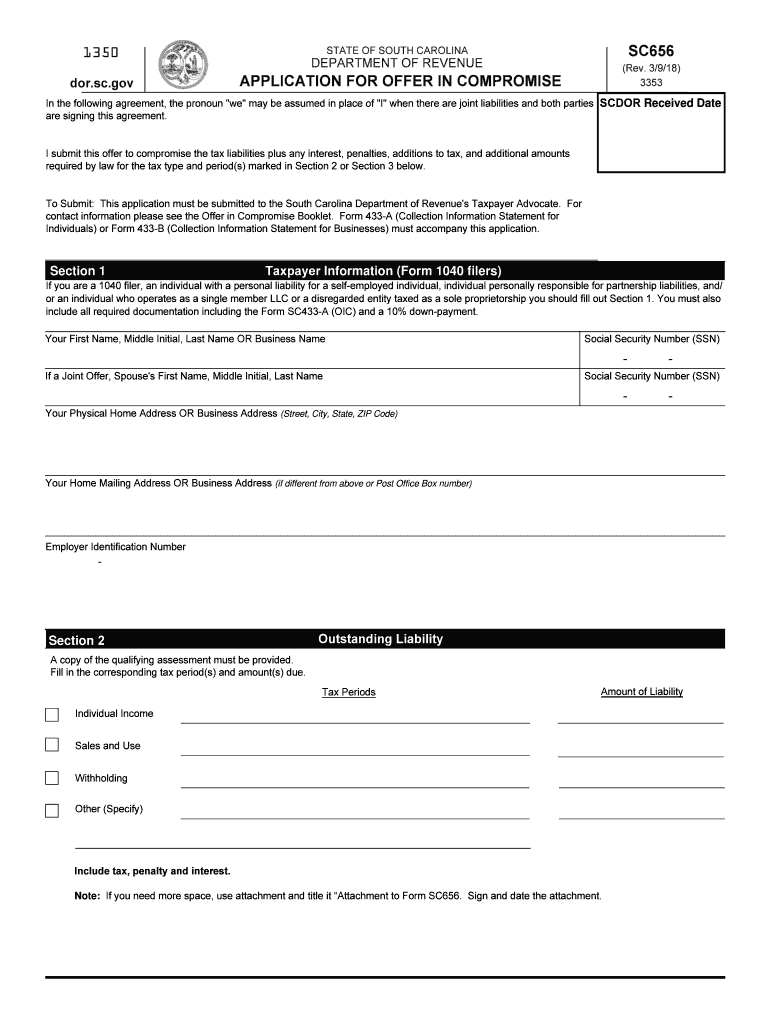

The SC656 form, also known as the Revenue Form SC656 Offer Compromise, is a document used by taxpayers to propose a settlement with the state regarding their tax liabilities. This form allows individuals or businesses to negotiate a reduced amount owed to the state, providing a potential relief option for those facing financial difficulties. Understanding the purpose and function of the SC656 is crucial for taxpayers seeking to manage their tax obligations effectively.

How to Use the SC656

Using the SC656 involves several key steps to ensure that the form is completed accurately and submitted properly. Taxpayers must first gather all necessary financial information, including income, expenses, and assets. This data will help in determining a reasonable offer amount. After completing the form, it should be reviewed for accuracy before submission. It is advisable to keep a copy of the completed form for personal records.

Steps to Complete the SC656

Completing the SC656 requires careful attention to detail. Begin by filling out personal information, including your name, address, and Social Security number. Next, provide a detailed account of your financial situation, including income sources, monthly expenses, and any outstanding debts. Ensure that all calculations are accurate. Finally, sign and date the form before submitting it to the appropriate state department. Following these steps can help facilitate a smoother process.

Key Elements of the SC656

Several key elements must be included in the SC656 to ensure its validity. These elements consist of personal identification details, a comprehensive financial disclosure, and a proposed offer amount. It is also important to include any supporting documentation that substantiates the financial claims made in the form. Properly addressing these components can enhance the likelihood of acceptance by the state.

Legal Use of the SC656

The SC656 is legally recognized as a formal request for compromise in tax liabilities. When completed and submitted according to state guidelines, it provides taxpayers with a lawful means to negotiate their tax debts. Understanding the legal framework surrounding the SC656 is essential for ensuring compliance and protecting taxpayer rights throughout the process.

Filing Deadlines / Important Dates

Timeliness is critical when submitting the SC656. Taxpayers should be aware of any specific filing deadlines set by the state to ensure their offer is considered. Typically, these deadlines align with the tax year or specific state regulations. Keeping track of these important dates can help prevent any complications that may arise from late submissions.

Quick guide on how to complete sc form 656 2018 2019

Your assistance manual on how to prepare your Sc656

If you're curious about how to create and transmit your Sc656, here are a few brief guidelines on how to simplify tax submissions signNowly.

To begin, you merely need to set up your airSlate SignNow account to transform your online document management. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to alter, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and return to modify information as needed. Enhance your tax administration with advanced PDF editing, eSigning, and simple sharing.

Follow the steps below to complete your Sc656 in just a few minutes:

- Create your account and start editing PDFs within moments.

- Utilize our library to obtain any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Sc656 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can raise return errors and slow down reimbursements. Additionally, before e-filing your taxes, verify the IRS website for declaration rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc form 656 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

-

How do I fill out the IGNOU admission form for the B.Sc in physics 2019 July session?

Now-a-days admission in IGNOU is very easy. Everything is online now.. you have to visit IGNOU website for the same. Go to admission section and follow step by step process to fill online application form.

Create this form in 5 minutes!

How to create an eSignature for the sc form 656 2018 2019

How to create an eSignature for your Sc Form 656 2018 2019 online

How to create an electronic signature for the Sc Form 656 2018 2019 in Chrome

How to create an electronic signature for putting it on the Sc Form 656 2018 2019 in Gmail

How to create an eSignature for the Sc Form 656 2018 2019 from your smart phone

How to create an eSignature for the Sc Form 656 2018 2019 on iOS devices

How to make an eSignature for the Sc Form 656 2018 2019 on Android OS

People also ask

-

What is Sc656 in relation to airSlate SignNow?

Sc656 refers to a specific feature set within airSlate SignNow that enhances document management and electronic signatures. This feature allows users to streamline their workflow by providing a secure and efficient way to send, sign, and manage documents online.

-

How much does it cost to use Sc656 features in airSlate SignNow?

The pricing for Sc656 features in airSlate SignNow varies based on the plan you choose. Generally, airSlate SignNow offers flexible pricing options that cater to different business sizes, ensuring you get the best value for the advanced capabilities of Sc656.

-

What are the main benefits of using Sc656 with airSlate SignNow?

Using Sc656 with airSlate SignNow offers numerous benefits, including increased productivity, reduced turnaround times for document signing, and improved collaboration among team members. This feature empowers businesses to manage their documents more effectively, which ultimately leads to enhanced operational efficiency.

-

Can I integrate Sc656 with other software applications?

Yes, Sc656 within airSlate SignNow can seamlessly integrate with various software applications such as CRM systems, document storage solutions, and accounting software. This ensures that your workflow remains uninterrupted as you can utilize Sc656 alongside your existing tools.

-

Is Sc656 secure for sending sensitive documents?

Absolutely, Sc656 features in airSlate SignNow prioritize security, employing industry-standard encryption to protect your sensitive documents. This means you can confidently send and eSign important paperwork knowing that your data is safe and compliant with regulations.

-

How user-friendly is the Sc656 feature in airSlate SignNow?

The Sc656 feature in airSlate SignNow is designed with user experience in mind, making it incredibly easy to navigate. Even those who are not tech-savvy can quickly learn to send and eSign documents, thanks to the intuitive interface and helpful resources available.

-

What types of documents can I manage with Sc656 in airSlate SignNow?

With Sc656 in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to handle all their documentation needs efficiently, ensuring that they can eSign and send any type of document with ease.

Get more for Sc656

- Child blood lead test compliance form

- Hockey tournament form

- Qap f23 form

- Sky zone waiver erie county new york www2 erie form

- Fillable 45070212 adjustment of records change of records form

- Playgroup enrolment form shearwater the mullumbimby

- Sunshine coast region school sport regional trial permission form

- Department of mines industry regulation and safety mines safety and inspection regulations 1995mines safety and inspection form

Find out other Sc656

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later