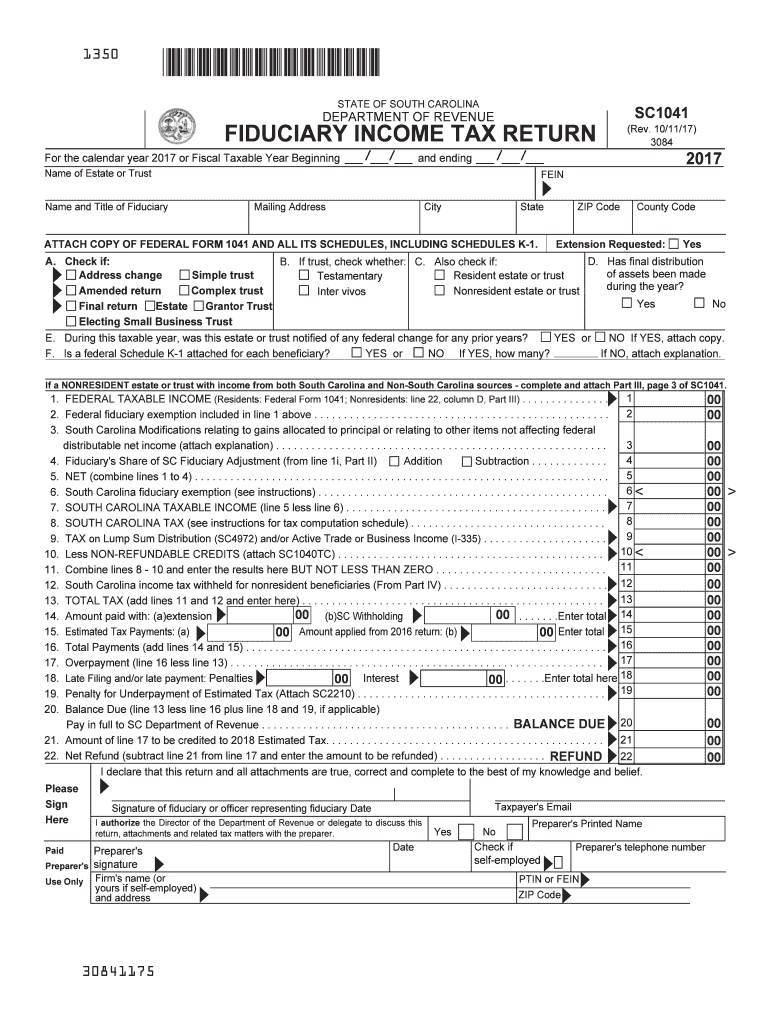

Sc 1041 Form 2017

What is the Sc 1041 Form

The Sc 1041 Form is a tax document used in the United States for reporting income, deductions, and credits for estates and trusts. This form is essential for fiduciaries who manage estates or trusts, allowing them to report the income generated by the assets held in these entities. The form must be filed annually, and it provides the Internal Revenue Service (IRS) with detailed information about the financial activities of the estate or trust during the tax year.

How to use the Sc 1041 Form

Using the Sc 1041 Form involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary financial documents related to the estate or trust, including bank statements, investment income, and any deductions applicable to the estate's expenses. Next, fill out the form by entering the required information, such as the name and address of the estate or trust, the taxpayer identification number, and details regarding income sources. After completing the form, review it for accuracy before submitting it to the IRS.

Steps to complete the Sc 1041 Form

Completing the Sc 1041 Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents related to the estate or trust.

- Obtain the Sc 1041 Form from the IRS website or a tax professional.

- Fill in the basic information, including the name, address, and taxpayer identification number of the estate or trust.

- Report all income received by the estate or trust during the tax year.

- List any deductions the estate or trust is eligible for, such as administrative expenses.

- Calculate the total income and deductions to determine the taxable income.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Sc 1041 Form are crucial to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the form must be filed by April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to stay informed about any changes to these deadlines that may arise due to legislative updates or IRS announcements.

Legal use of the Sc 1041 Form

The Sc 1041 Form is legally required for estates and trusts that have taxable income. Filing this form accurately is essential to comply with IRS regulations and avoid potential penalties. Fiduciaries must ensure that all information reported is truthful and complete, as any discrepancies can lead to audits or legal issues. Understanding the legal implications of the Sc 1041 Form helps fiduciaries manage their responsibilities effectively and maintain compliance with tax laws.

Examples of using the Sc 1041 Form

There are various scenarios in which the Sc 1041 Form is applicable. For instance, if a trust generates rental income from property it owns, the fiduciary must report this income using the form. Similarly, if an estate receives dividends from stocks, these must also be reported. Each situation may require different deductions based on the expenses incurred in managing the estate or trust, such as legal fees or maintenance costs. Understanding these examples aids in the proper completion and submission of the form.

Quick guide on how to complete sc 1041 2017 2019 form

Your assistance manual on how to prepare your Sc 1041 Form

If you’re curious about how to generate and dispatch your Sc 1041 Form, below are a few concise instructions on how to facilitate tax submission.

To begin, you merely need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to modify, create, and finalize your tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to modify information when necessary. Streamline your tax oversight with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Sc 1041 Form in no time:

- Establish your account and start working on PDFs in moments.

- Utilize our library to obtain any IRS tax form; explore versions and schedules.

- Click Get form to access your Sc 1041 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes using airSlate SignNow. Please remember that paper filing can lead to increased return errors and delayed refunds. Certainly, before e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc 1041 2017 2019 form

FAQs

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

How do I fill out the IGNOU admission form for the B.Sc in physics 2019 July session?

Now-a-days admission in IGNOU is very easy. Everything is online now.. you have to visit IGNOU website for the same. Go to admission section and follow step by step process to fill online application form.

Create this form in 5 minutes!

How to create an eSignature for the sc 1041 2017 2019 form

How to generate an electronic signature for the Sc 1041 2017 2019 Form online

How to create an electronic signature for the Sc 1041 2017 2019 Form in Chrome

How to create an eSignature for signing the Sc 1041 2017 2019 Form in Gmail

How to make an electronic signature for the Sc 1041 2017 2019 Form right from your mobile device

How to create an eSignature for the Sc 1041 2017 2019 Form on iOS

How to generate an eSignature for the Sc 1041 2017 2019 Form on Android

People also ask

-

What is the SC 1041 Form?

The SC 1041 Form is used for the Income Tax Return for Estates and Trusts in South Carolina. This form is essential for reporting income generated by estates or trusts. Understanding the SC 1041 Form is crucial for ensuring compliance and accurate tax reporting.

-

How can airSlate SignNow help with the SC 1041 Form?

airSlate SignNow provides a secure and efficient way to electronically sign and send the SC 1041 Form. With our easy-to-use platform, you can complete and share the form quickly, simplifying the process for estate and trust management. This helps ensure that your filings are timely and accurate.

-

Is airSlate SignNow compatible with the SC 1041 Form?

Yes, airSlate SignNow is fully compatible with the SC 1041 Form. You can easily create, edit, and eSign the SC 1041 Form directly within our platform, streamlining your tax submission process. Our solution is designed to support various document types, including tax forms.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individual users and businesses alike. Our plans allow you to choose the features that best suit your requirements for handling documents like the SC 1041 Form. You can start with a free trial to explore our features before committing.

-

What features does airSlate SignNow offer for completing the SC 1041 Form?

airSlate SignNow provides features such as electronic signatures, templates, and document management that are beneficial for completing the SC 1041 Form. You can easily store and retrieve your documents, track signatures, and ensure compliance with tax regulations. These features enhance your productivity and accuracy.

-

Can I integrate airSlate SignNow with other software for handling the SC 1041 Form?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage the SC 1041 Form alongside your other tools. Whether you use accounting software or project management platforms, our integration capabilities ensure a seamless workflow. This enhances your efficiency when handling documents.

-

What benefits can I expect from using airSlate SignNow for the SC 1041 Form?

Using airSlate SignNow for the SC 1041 Form offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows for quick eSigning and document sharing, so you can complete filings faster. Additionally, our secure system ensures that sensitive information remains protected.

Get more for Sc 1041 Form

- Www dentalboard state mn us portals 3 selfassessment sa final form

- Lcc 107 form

- Entity ehs incident report form form g adwea

- Civ 560 service instructions for writ of execution civil forms courts alaska

- Declaration of conversion to islam bskylawnbbnetb form

- Mv1 online application form

- Membership form bethel mar thoma church sydney

- Rugby league sports injury rehabilitation claim form

Find out other Sc 1041 Form

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure