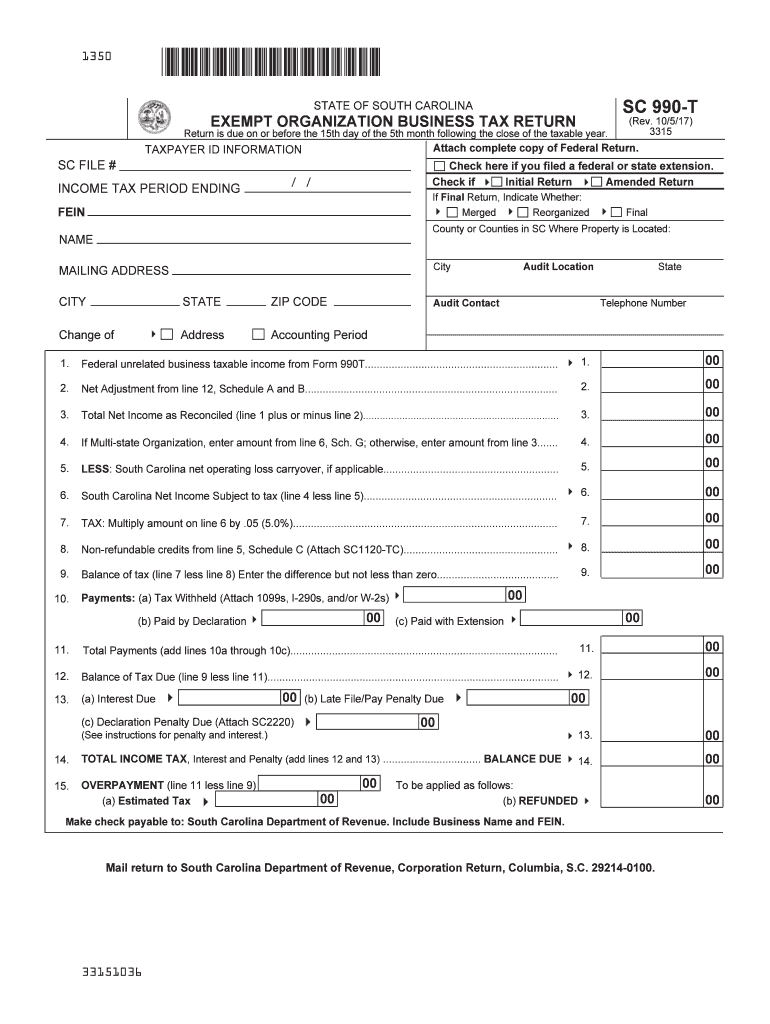

Sc 990 2017

What is the SC 990?

The SC 990 is a tax form used in South Carolina for reporting income and other financial information by certain organizations. This form is specifically designed for non-profit entities, including charitable organizations, that are required to disclose their financial activities to the South Carolina Department of Revenue. The SC 990 helps ensure transparency and compliance with state tax laws, allowing the government to monitor the financial health and operational integrity of these organizations.

Steps to Complete the SC 990

Completing the SC 990 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, balance sheets, and expense reports. Next, fill out the form by providing detailed information about the organization’s income, expenditures, and assets. It is important to accurately report all sources of revenue and any applicable deductions. After completing the form, review it for any errors or omissions. Finally, sign and date the form before submission to the appropriate state agency.

Legal Use of the SC 990

The SC 990 must be used in accordance with South Carolina tax laws and regulations. Organizations are legally required to file this form annually if they meet specific criteria set by the state. Failure to file or inaccuracies in reporting can result in penalties, including fines or loss of tax-exempt status. It is crucial for organizations to understand their legal obligations and ensure they are compliant with all filing requirements to maintain their good standing with the state.

Filing Deadlines / Important Dates

Filing deadlines for the SC 990 are critical for compliance. Typically, organizations must submit their SC 990 by the fifteenth day of the fifth month following the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the SC 990 would be due by May 15 of the following year. It is important to keep track of these deadlines to avoid late fees or penalties. Organizations may also request an extension if needed, but this must be done prior to the original deadline.

Form Submission Methods

The SC 990 can be submitted through various methods, including online filing, mail, or in-person submission. Online filing is often the most efficient option, as it allows for immediate processing and confirmation of receipt. For those opting to mail the form, it is advisable to use certified mail to ensure it is delivered on time. In-person submissions can be made at designated state offices, providing an opportunity to ask questions or clarify any concerns directly with state officials.

Key Elements of the SC 990

Key elements of the SC 990 include sections for reporting income, expenses, and net assets. Organizations must detail their revenue sources, including donations, grants, and any earned income. Additionally, the form requires a breakdown of expenses, such as program costs, administrative expenses, and fundraising costs. Understanding these elements is essential for accurate reporting and helps organizations maintain transparency with stakeholders and the state.

Quick guide on how to complete sc 990 2017 2019 form

Your assistance manual on how to prepare your Sc 990

If you’re curious about how to finish and submit your Sc 990, below are a few brief guidelines on how to simplify tax processing.

To begin, simply register your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a highly user-friendly and powerful document solution that permits you to modify, create, and finalize your income tax documents with ease. With its editor, you can switch between text, checkboxes, and eSignatures and return to adjust information as necessary. Streamline your tax oversight with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to accomplish your Sc 990 in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse different versions and schedules.

- Click Get form to access your Sc 990 in our editor.

- Complete the required fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, submit it to your intended recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Please keep in mind that filing by hand can increase return errors and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc 990 2017 2019 form

FAQs

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

How do I fill out the IGNOU admission form for the B.Sc in physics 2019 July session?

Now-a-days admission in IGNOU is very easy. Everything is online now.. you have to visit IGNOU website for the same. Go to admission section and follow step by step process to fill online application form.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the sc 990 2017 2019 form

How to make an electronic signature for the Sc 990 2017 2019 Form in the online mode

How to create an electronic signature for the Sc 990 2017 2019 Form in Chrome

How to generate an eSignature for signing the Sc 990 2017 2019 Form in Gmail

How to create an eSignature for the Sc 990 2017 2019 Form from your smartphone

How to make an eSignature for the Sc 990 2017 2019 Form on iOS devices

How to create an eSignature for the Sc 990 2017 2019 Form on Android OS

People also ask

-

What is SC 990 T and how does it relate to airSlate SignNow?

SC 990 T is a form used for reporting tax-exempt organizations. airSlate SignNow simplifies the process of signing and sending SC 990 T documents securely, allowing users to manage their tax documentation efficiently.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business sizes. Users can select a plan that best suits their needs, whether they are filing an SC 990 T or managing other essential documentation.

-

Can I eSign my SC 990 T documents using airSlate SignNow?

Yes, you can easily eSign your SC 990 T documents using airSlate SignNow. The platform ensures that your eSignature is legally binding and compliant with relevant regulations, streamlining your filing process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These tools help you manage documents like the SC 990 T more efficiently.

-

Is airSlate SignNow easy to integrate with other applications?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, allowing users to streamline their workflow when dealing with documents like the SC 990 T. This enhances productivity and keeps your processes organized.

-

What benefits does using airSlate SignNow provide for my business?

Using airSlate SignNow speeds up the document signing process, reduces paper usage, and enhances compliance. This is especially beneficial when managing important forms like the SC 990 T, ensuring you meet deadlines efficiently.

-

How secure is airSlate SignNow when handling sensitive documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to ensure that documents, including the SC 990 T, are protected from unauthorized access and bsignNowes.

Get more for Sc 990

- Cna epack extra renewal application management liability form

- Lesson 21 solve equations with rational coefficients hasdk12 form

- Statement of legal residence form

- Police report form 14931380

- Ambulatory surgery face sheet form

- Homeless verification letter 407719306 form

- Editable sample inheritance acceptance letter fill out best form

- Employee internal transfer form pjdcommy

Find out other Sc 990

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will