Schedule CT 1040AW, Part Year Resident Income Allocation Part Year Resident Income Allocation Ct Form

What is the Schedule CT 1040AW, Part Year Resident Income Allocation

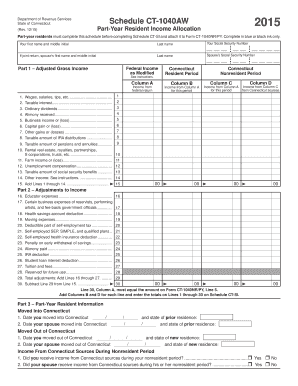

The Schedule CT 1040AW is a tax form specifically designed for part-year residents of Connecticut. This form allows individuals who have lived in the state for only part of the year to allocate their income appropriately for tax purposes. It is crucial for accurately reporting income earned while residing in Connecticut, ensuring compliance with state tax laws. The form helps to determine the portion of income that is taxable in Connecticut, which is essential for filing state income taxes correctly.

Steps to Complete the Schedule CT 1040AW

Completing the Schedule CT 1040AW involves several key steps:

- Gather necessary documentation, including W-2s and any other income statements for the period you resided in Connecticut.

- Determine the total income earned during your residency in Connecticut and any income earned outside the state.

- Fill out the form by reporting your Connecticut income and allocating any other income based on your residency status.

- Review the completed form for accuracy, ensuring all calculations are correct and all necessary information is included.

- Sign and date the form before submission.

How to Obtain the Schedule CT 1040AW

The Schedule CT 1040AW can be obtained through the Connecticut Department of Revenue Services website. It is available as a downloadable PDF, which can be printed and filled out by hand. Additionally, many tax preparation software programs include the Schedule CT 1040AW, allowing users to complete the form digitally. Ensure you have the most recent version of the form to comply with current tax regulations.

Legal Use of the Schedule CT 1040AW

The Schedule CT 1040AW is legally binding when completed accurately and submitted in accordance with Connecticut tax laws. It is essential for part-year residents to use this form to report their income correctly to avoid potential penalties. The form must be signed and dated by the taxpayer, and electronic signatures are acceptable if using a compliant eSignature solution. Compliance with state regulations ensures that the form is recognized by tax authorities as valid and enforceable.

State-Specific Rules for the Schedule CT 1040AW

Connecticut has specific rules regarding the use of the Schedule CT 1040AW. Part-year residents must adhere to the guidelines set forth by the Connecticut Department of Revenue Services, which include determining residency status and accurately reporting income. The state provides detailed instructions on how to allocate income based on the number of days spent in Connecticut versus other states. Familiarity with these rules is crucial to ensure correct tax reporting and avoid discrepancies.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Schedule CT 1040AW. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply to part-year residents and ensure timely submission to avoid penalties.

Quick guide on how to complete schedule ct 1040aw 2015 part year resident income allocation 2015 part year resident income allocation ct

Effortlessly Prepare [SKS] on Any Device

Online document administration has become increasingly favored by companies and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Easily Modify and eSign [SKS]

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to finalize your changes.

- Choose your preferred method of sharing your form, whether via email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule CT 1040AW, Part Year Resident Income Allocation Part Year Resident Income Allocation Ct

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1040aw 2015 part year resident income allocation 2015 part year resident income allocation ct

The way to generate an e-signature for a PDF file online

The way to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

What is Schedule CT 1040AW, Part Year Resident Income Allocation?

Schedule CT 1040AW, Part Year Resident Income Allocation is a form used by part-year residents in Connecticut to allocate their income correctly. This form helps determine the correct amount of state tax owed based on income earned while a resident of the state. Completing this schedule accurately ensures compliance with state tax regulations and helps avoid potential penalties.

-

How can airSlate SignNow assist with completing Schedule CT 1040AW?

airSlate SignNow offers a user-friendly platform to eSign and send your completed Schedule CT 1040AW, Part Year Resident Income Allocation efficiently. The software streamlines document management, ensuring you can fill out and submit your forms securely. This eliminates the hassle of manual processing and enhances your overall tax filing experience.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides features such as customizable templates, easy eSigning capabilities, and secure document sharing, all of which are essential for managing tax documents like Schedule CT 1040AW, Part Year Resident Income Allocation. Users can also track document status in real-time, ensuring a smooth filing process. These features save time and improve efficiency when handling tax-related paperwork.

-

Is airSlate SignNow a cost-effective solution for filing tax forms?

Yes, airSlate SignNow is a cost-effective solution for individuals and businesses that need to eSign and send documents, including Schedule CT 1040AW, Part Year Resident Income Allocation. With various pricing plans available, users can choose an option that suits their budget. The investment in this software can lead to signNow time savings and reduce the risk of errors in tax filing.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to transfer data directly into your tax forms, including the Schedule CT 1040AW, Part Year Resident Income Allocation. These integrations enhance workflow efficiency and ensure that all necessary information is readily accessible during the filing process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, such as Schedule CT 1040AW, Part Year Resident Income Allocation, provides multiple benefits. The platform enhances security with encrypted signing and document storage, ensures compliance with legal requirements, and simplifies the entire signing process. This allows users to focus on their taxes rather than the logistics of document handling.

-

Is airSlate SignNow secure for submitting tax forms?

Yes, airSlate SignNow is highly secure and ensures that your tax forms, including Schedule CT 1040AW, Part Year Resident Income Allocation, are transmitted safely. The platform complies with the highest security standards, including data encryption and secure server storage, to protect sensitive personal information. Users can trust that their documents are handled with care.

Get more for Schedule CT 1040AW, Part Year Resident Income Allocation Part Year Resident Income Allocation Ct

- Gws 45 general purpose water well permit application colorado form

- Gws 12 registration of existing well colorado division of water form

- Gws 64 colorado division of water resources form

- Colorado intent form

- Pump installation and test report colorado division of water form

- Armed merchant guard training denver form

- Income verification amp eligibility form city and county of denver denvergov

- Runneragency authorization form

Find out other Schedule CT 1040AW, Part Year Resident Income Allocation Part Year Resident Income Allocation Ct

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online