40A102 09 Commonwealth of Kentucky DEPARTMENT of REVENUE APPLICATION for EXTENSION of TIME to FILE INDIVIDUAL, GENERAL PARTNERSH Form

Understanding the 40A102 09 Application for Extension

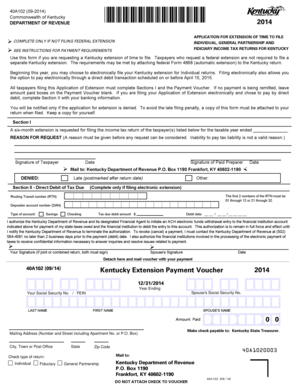

The 40A102 09 Commonwealth of Kentucky Department of Revenue Application for Extension of Time to File Individual, General Partnership, and Fiduciary Income Tax Returns is a crucial document for taxpayers needing additional time to submit their tax returns. This form is specifically designed for individuals and entities that are not filing a federal extension. It allows taxpayers to request an extension for filing their Kentucky income tax returns, ensuring compliance with state regulations while providing the necessary time to prepare accurate filings.

Steps to Complete the 40A102 09 Application

Completing the 40A102 09 form involves several key steps:

- Gather all necessary personal and financial information, including income details and any deductions.

- Clearly indicate the type of taxpayer you are: individual, general partnership, or fiduciary.

- Provide your Social Security number or Employer Identification Number (EIN) as required.

- Specify the reason for requesting an extension, if applicable.

- Sign and date the application to certify the information provided is accurate.

Legal Use of the 40A102 09 Form

The 40A102 09 form is legally valid when completed and submitted in accordance with Kentucky state tax laws. It is essential for taxpayers to ensure that all information is accurate and complete to avoid potential penalties. Electronic signatures are acceptable, provided they comply with the necessary legal frameworks, ensuring that the form is recognized as a legitimate request for an extension.

Filing Deadlines and Important Dates

Taxpayers must be aware of the filing deadlines associated with the 40A102 09 form. Generally, the application for an extension must be submitted by the original due date of the tax return. Failure to file the application on time may result in penalties and interest on any taxes owed. It is advisable to check the Kentucky Department of Revenue’s official website for the most current deadlines and any updates related to tax filings.

Required Documents for Submission

When submitting the 40A102 09 Application for Extension, taxpayers should prepare the following documents:

- Completed 40A102 09 form.

- Any supporting documentation that may justify the need for an extension.

- Payment details for any taxes owed, if applicable.

Application Process and Approval Time

The application process for the 40A102 09 form is straightforward. Once the form is completed, it can be submitted electronically or via mail. The approval time for the extension request is typically quick, allowing taxpayers to proceed with their tax preparation without undue delay. However, it is essential to keep a copy of the submitted form for personal records.

Quick guide on how to complete 40a102 09 2014 commonwealth of kentucky department of revenue 2014 application for extension of time to file individual general

Effortlessly Prepare 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSH on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSH on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Edit and eSign 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSH with Ease

- Find 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSH and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, either via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSH and assure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 40a102 09 2014 commonwealth of kentucky department of revenue 2014 application for extension of time to file individual general

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an e-signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSHIP AND FIDICIARY INCOME TAX RETURNS FOR KENTUCKY?

The 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSHIP AND FIDICIARY INCOME TAX RETURNS FOR KENTUCKY is a form used by individuals and entities filing taxes in Kentucky to request an extension on their tax returns. This form is crucial for ensuring compliance with state regulations when additional time is needed to prepare taxes.

-

Who should use the 40A102 09 form?

The 40A102 09 form should be used by individuals, general partnerships, and fiduciaries who require an extension of time to file their Kentucky income tax returns. It is specifically designed for those who are not filing a federal extension and need to maintain compliance with Kentucky's tax laws.

-

What are the benefits of filing the 40A102 09 application?

Filing the 40A102 09 application allows taxpayers to avoid penalties by securing extra time to gather necessary documents and complete their tax filings adequately. This proactive measure ensures that proper attention is given to tax returns, which can lead to accurate reporting and potential savings on tax liabilities.

-

How can I file the 40A102 09 application using airSlate SignNow?

With airSlate SignNow, you can easily complete and eSign the 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSHIP AND FIDICIARY INCOME TAX RETURNS FOR KENTUCKY online. Our platform streamlines the process, allowing you to fill out the form quickly and securely from any device.

-

Is there a fee associated with filing the 40A102 09 application?

Typically, there is no fee for filing the 40A102 09 application itself; however, any potential taxes owed should be paid by the original filing deadline to avoid interest and penalties. airSlate SignNow offers affordable pricing plans that make it cost-effective to manage document signing and submission.

-

What features does airSlate SignNow offer for the 40A102 09 application?

airSlate SignNow provides a user-friendly interface, eSignature capabilities, and integration with popular applications to make filing the 40A102 09 application seamless. You can collaborate in real time, track document status, and ensure your forms are safely stored and easily accessible.

-

How long does it take to process the 40A102 09 application?

Processing time for the 40A102 09 application varies, but once submitted correctly, it is usually processed swiftly by the Kentucky Department of Revenue. Making use of airSlate SignNow can expedite your application by providing a clear and organized document submission.

Get more for 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSH

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return north form

- Letter from tenant to landlord containing request for permission to sublease north carolina form

- North carolina damages form

- North carolina sublease form

- North carolina landlord 497316954 form

- Nc landlord 497316955 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497316956 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement north carolina form

Find out other 40A102 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL, GENERAL PARTNERSH

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed