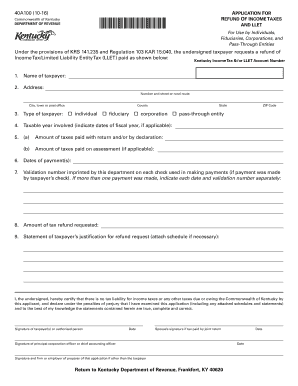

REFUND of INCOME TAXES Form

What is the refund of income taxes?

The refund of income taxes refers to the reimbursement of excess taxes paid by a taxpayer to the government. This typically occurs when the total amount withheld from an individual's paycheck or estimated tax payments exceeds their actual tax liability for the year. Taxpayers may receive a refund after filing their annual tax return with the Internal Revenue Service (IRS). The refund amount can vary based on income, deductions, credits, and other factors that influence a taxpayer's overall tax situation.

Steps to complete the refund of income taxes

Completing the refund of income taxes involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and any relevant receipts for deductions.

- Choose the appropriate tax filing method, whether online or paper filing.

- Fill out the required tax forms accurately, ensuring all income and deductions are reported.

- Calculate your tax liability to determine if you are eligible for a refund.

- Submit your tax return to the IRS by the designated deadline.

- Monitor the status of your refund through the IRS website or other provided channels.

How to obtain the refund of income taxes

To obtain a refund of income taxes, you must first file your tax return with the IRS. This can be done electronically using tax preparation software or by mailing a completed paper return. Ensure that you provide accurate information and claim all eligible deductions and credits. Once your return is processed, the IRS will issue your refund, which can be received via direct deposit or a mailed check, depending on your preference indicated during filing.

IRS guidelines for the refund of income taxes

The IRS provides specific guidelines regarding the refund of income taxes. Taxpayers should be aware of the following:

- Filing deadlines are crucial; returns must typically be filed by April 15th unless an extension is granted.

- Refunds are generally issued within 21 days for electronic filings, while paper returns may take longer.

- Taxpayers can track their refund status using the IRS "Where's My Refund?" tool.

- Any discrepancies or issues may delay the processing of your refund.

Required documents for the refund of income taxes

To successfully file for a refund of income taxes, you will need to gather several important documents, including:

- W-2 forms from employers, detailing your earnings and taxes withheld.

- 1099 forms for any freelance or contract work, showing income received.

- Records of any deductible expenses, such as mortgage interest, medical expenses, or charitable contributions.

- Previous year’s tax return for reference and to ensure consistency in reporting.

Eligibility criteria for the refund of income taxes

Eligibility for a refund of income taxes generally depends on your tax situation, including:

- Having paid more in taxes throughout the year than your actual tax liability.

- Claiming eligible deductions and credits that reduce your taxable income.

- Filing your tax return accurately and on time.

Quick guide on how to complete refund of income taxes 397785663

Manage [SKS] easily on any device

Web-based document management has gained traction among organizations and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the required form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to REFUND OF INCOME TAXES

Create this form in 5 minutes!

How to create an eSignature for the refund of income taxes 397785663

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an e-signature for a PDF on Android devices

People also ask

-

What is the process for obtaining a REFUND OF INCOME TAXES using airSlate SignNow?

To initiate a REFUND OF INCOME TAXES with airSlate SignNow, you must first complete the necessary tax forms and electronically sign them using our platform. Once your documents are ready and signed, you can submit them to the tax authorities for processing. Our user-friendly interface makes this process efficient and straightforward.

-

Are there any fees associated with eSigning documents for a REFUND OF INCOME TAXES?

airSlate SignNow offers competitive pricing with no hidden fees. You can electronically sign documents for a REFUND OF INCOME TAXES at an affordable rate, which often includes a trial period. This ensures that you can assess our features before making a financial commitment.

-

What features does airSlate SignNow provide to assist with the REFUND OF INCOME TAXES process?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and transaction management tools that simplify the REFUND OF INCOME TAXES process. Our advanced tracking system also ensures you stay updated on your document's status, enhancing your overall experience.

-

How can airSlate SignNow help businesses save time when processing a REFUND OF INCOME TAXES?

With airSlate SignNow, businesses can signNowly reduce the time spent on paperwork related to a REFUND OF INCOME TAXES. Our platform allows for the fast preparation, sending, and signing of documents, streamlining the entire process and reducing reliance on physical paperwork.

-

Is airSlate SignNow compliant with regulations for handling REFUND OF INCOME TAXES?

Yes, airSlate SignNow is fully compliant with industry regulations regarding electronic signatures and document management for a REFUND OF INCOME TAXES. Our platform ensures that your documents meet all legal requirements, providing you with peace of mind.

-

Can I integrate airSlate SignNow with other accounting software for a REFUND OF INCOME TAXES?

Absolutely! airSlate SignNow easily integrates with various accounting and tax software, enabling seamless management of documents related to your REFUND OF INCOME TAXES. This integration enhances efficiency by reducing duplicate data entry and ensuring accurate records.

-

What benefits will my business gain from using airSlate SignNow for a REFUND OF INCOME TAXES?

Utilizing airSlate SignNow for a REFUND OF INCOME TAXES provides your business with cost savings, increased efficiency, and enhanced security for sensitive documents. The ability to manage everything electronically minimizes errors and accelerates the refund process.

Get more for REFUND OF INCOME TAXES

Find out other REFUND OF INCOME TAXES

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template