Single If You Can Be Claimed on Another Person S Tax Return, Use Filing Status 6 Form

What is the Single If You Can Be Claimed On Another Person's Tax Return, Use Filing Status 6

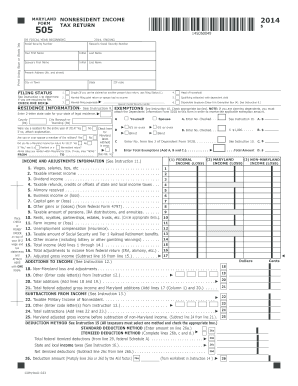

The "Single If You Can Be Claimed On Another Person's Tax Return, Use Filing Status 6" is a specific tax filing status used by individuals who are eligible to be claimed as dependents on someone else's tax return. This status is designed for those who do not qualify for other filing statuses, such as Head of Household or Married Filing Jointly. By selecting this filing status, individuals may benefit from a simplified tax process while ensuring compliance with IRS regulations.

How to Use the Single If You Can Be Claimed On Another Person's Tax Return, Use Filing Status 6

To utilize this filing status, taxpayers must first determine their eligibility. If you can be claimed as a dependent by another person, you should select Filing Status 6 on your tax return. It is important to accurately report your income and any applicable deductions. This status typically results in a lower standard deduction compared to other statuses, so understanding its implications is crucial for effective tax planning.

Steps to Complete the Single If You Can Be Claimed On Another Person's Tax Return, Use Filing Status 6

Completing your tax return with Filing Status 6 involves several steps:

- Gather all necessary documents, including W-2s and 1099s.

- Determine your eligibility to be claimed as a dependent.

- Select Filing Status 6 on your tax return form.

- Fill out your income information accurately.

- Complete any applicable deductions and credits.

- Review your return for accuracy before submission.

Legal Use of the Single If You Can Be Claimed On Another Person's Tax Return, Use Filing Status 6

The legal framework surrounding Filing Status 6 is defined by IRS guidelines. This filing status is valid as long as the taxpayer meets the criteria for being a dependent. It is essential to maintain accurate records and documentation to support your filing status if questioned by the IRS. Using this status incorrectly can lead to penalties or audits, so understanding the legal implications is vital.

Eligibility Criteria for the Single If You Can Be Claimed On Another Person's Tax Return, Use Filing Status 6

To qualify for Filing Status 6, individuals must meet specific criteria:

- You must be single and not married.

- You can be claimed as a dependent on someone else's tax return.

- Your income must fall below certain thresholds set by the IRS.

- You should not qualify for other filing statuses, such as Head of Household.

IRS Guidelines for Filing Status 6

The IRS provides clear guidelines regarding the use of Filing Status 6. Taxpayers must ensure that they are accurately reporting their status and income. The IRS also outlines the standard deduction associated with this filing status, which is lower than that of other statuses. Familiarizing oneself with these guidelines can help prevent errors and ensure compliance during tax season.

Quick guide on how to complete single if you can be claimed on another person s tax return use filing status 6

Complete [SKS] effortlessly on any device

Digital document management has become increasingly prevalent among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, since you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

Steps to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive data using tools that airSlate SignNow provides for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device. Modify and eSign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6

Create this form in 5 minutes!

How to create an eSignature for the single if you can be claimed on another person s tax return use filing status 6

How to create an e-signature for your PDF online

How to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an e-signature for a PDF on Android

People also ask

-

What does 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6' mean?

'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6' refers to a specific tax situation where individuals must choose this filing status if someone else claims them as a dependent. Understanding this status is crucial when filing taxes to ensure you meet legal requirements and maximize your financial benefits.

-

How can airSlate SignNow help me with tax documents related to 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6'?

airSlate SignNow streamlines the process of sending and eSigning tax documents by providing an easy-to-use platform. You can efficiently manage necessary forms associated with 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6', making it easier to ensure compliance and accuracy in your filings.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of individuals and businesses alike. Each plan provides essential features for handling documents, including those concerning 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6', at competitive rates to fit any budget.

-

What features does airSlate SignNow provide to support my document needs?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and real-time tracking of document status. These tools are particularly useful for managing tax-related documents including those dealing with 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6', enhancing both convenience and compliance.

-

Is airSlate SignNow easy to integrate with other software tools I use?

Yes, airSlate SignNow offers seamless integrations with various software applications to enhance your workflow. Whether it’s accounting software or CRM systems, these integrations ensure that you can manage documentation related to 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6' efficiently.

-

What are the benefits of using airSlate SignNow for tax-related documentation?

Using airSlate SignNow for your tax documentation offers numerous benefits, including expedited document processing and enhanced security. These features allow individuals facing 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6' to focus on their tax strategy while ensuring their documents are legally sound and secure.

-

Can airSlate SignNow help me stay compliant when dealing with tax regulations?

Absolutely! airSlate SignNow helps ensure compliance with tax regulations by providing secure and legally binding eSignatures. This means that when handling forms relevant to 'Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6', you can be confident in the validity of your documentation.

Get more for Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6

Find out other Single If You Can Be Claimed On Another Person S Tax Return, Use Filing Status 6

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online