R1029 2018

What is the R1029

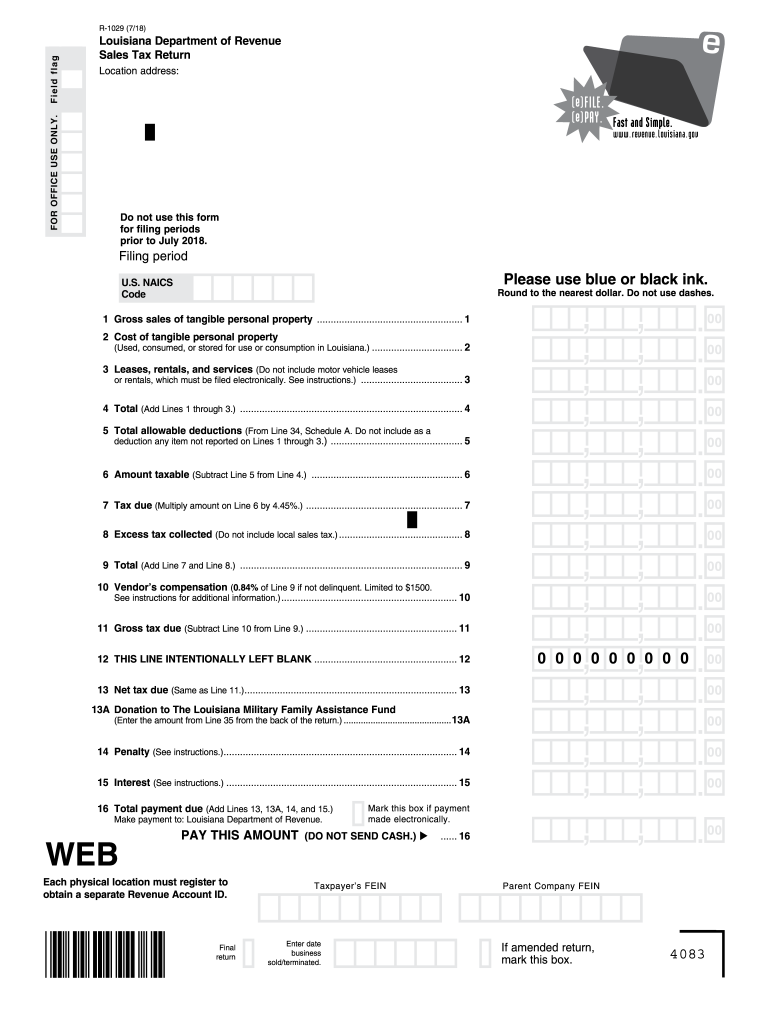

The R1029 is the Louisiana Department of Revenue sales tax return form. This form is essential for businesses operating in Louisiana to report and remit sales tax collected during a specific period. It is designed to ensure compliance with state tax laws and to facilitate the accurate calculation of sales tax obligations. The R1029 serves as a standardized format for taxpayers to provide necessary financial data to the state, helping to streamline the tax reporting process.

How to use the R1029

Using the R1029 involves several key steps. First, businesses must gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and any deductions applicable. Next, taxpayers should fill out the form accurately, ensuring that all fields are completed as required. After completing the form, it must be submitted either electronically or via mail, depending on the preferred submission method. Utilizing eSignature solutions can enhance the process, making it quicker and more efficient.

Steps to complete the R1029

Completing the R1029 involves a systematic approach:

- Collect all sales data for the reporting period.

- Determine the total sales and any exempt sales.

- Fill in the required fields on the form, including your business information and sales figures.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring it is sent by the deadline.

Legal use of the R1029

The R1029 must be used in compliance with Louisiana state tax laws. This means that businesses are required to report all applicable sales and remit the correct amount of sales tax. Failure to accurately complete and submit the R1029 can result in penalties, including fines and interest on unpaid taxes. It is important for taxpayers to understand their legal obligations regarding sales tax to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the R1029 vary based on the reporting period. Typically, monthly filers must submit their returns by the 20th of the following month, while quarterly and annual filers have different deadlines. It is crucial for businesses to be aware of these dates to ensure timely submissions and avoid penalties. Keeping a calendar with these important dates can help maintain compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The R1029 can be submitted through various methods to accommodate different preferences. Businesses can file the form online through the Louisiana Department of Revenue's website, which is the most efficient method. Alternatively, the form can be mailed directly to the department or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits the business's needs.

Quick guide on how to complete louisiana r 1029 form 2018 2019

Your assistance manual on how to prepare your R1029

If you’re looking to understand how to create and transmit your R1029, here are some straightforward instructions on how to simplify tax submission.

To start, you simply need to register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to modify responses if necessary. Simplify your tax oversight with advanced PDF modification, eSigning, and hassle-free sharing.

Follow the instructions below to complete your R1029 in no time:

- Set up your account and start editing PDFs within moments.

- Utilize our library to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your R1029 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Remember that submitting by paper can lead to more return errors and delayed refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct louisiana r 1029 form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

Create this form in 5 minutes!

How to create an eSignature for the louisiana r 1029 form 2018 2019

How to generate an electronic signature for your Louisiana R 1029 Form 2018 2019 online

How to generate an electronic signature for the Louisiana R 1029 Form 2018 2019 in Chrome

How to generate an electronic signature for putting it on the Louisiana R 1029 Form 2018 2019 in Gmail

How to generate an electronic signature for the Louisiana R 1029 Form 2018 2019 right from your mobile device

How to make an eSignature for the Louisiana R 1029 Form 2018 2019 on iOS devices

How to make an eSignature for the Louisiana R 1029 Form 2018 2019 on Android devices

People also ask

-

What is a fillable R 1029 form?

A fillable R 1029 form is a customizable document that can be electronically filled out and signed using platforms like airSlate SignNow. It simplifies the process of completing and submitting necessary information, making it an easier choice for businesses and individuals alike.

-

How can airSlate SignNow help with the fillable R 1029?

airSlate SignNow allows users to create and send fillable R 1029 forms seamlessly. With its user-friendly interface, you can easily design, share, and eSign these documents, ensuring a smooth process for signing important agreements.

-

What features does airSlate SignNow offer for fillable R 1029 forms?

airSlate SignNow provides features such as template creation, multi-party signing, and tracking capabilities for fillable R 1029 forms. These tools enhance efficiency, allowing users to manage their documents effectively while ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for fillable R 1029 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs for fillable R 1029 forms. These plans are designed to be cost-effective, making it accessible for businesses of all sizes to benefit from electronic signature solutions.

-

Can fillable R 1029 forms be integrated with other software?

Absolutely! airSlate SignNow supports integrations with numerous platforms, allowing users to incorporate fillable R 1029 forms into their existing workflows. This integration capability facilitates smoother document management across various applications.

-

What are the benefits of using fillable R 1029 forms in my business?

Using fillable R 1029 forms streamlines your document processes, reduces errors, and saves time on administrative tasks. By leveraging airSlate SignNow, businesses can enhance productivity and improve customer experiences through efficient document handling.

-

How secure are fillable R 1029 forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. Fillable R 1029 forms are encrypted and comply with industry standards, ensuring that your sensitive data remains protected throughout the signing process.

Get more for R1029

- Vfw membership application pdf form

- First consent and release form

- Tunisian tourist visa form

- Individual authorization for the use and disclosure bb kaleida health form

- Glow and grow template form

- Form it 230 separate tax on lump sum distributions tax year

- Managed network service contract template form

- Managed it contract template form

Find out other R1029

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement