Michigan Individual Income Tax E File Payment Voucher Michigan Individual Income Tax E File Payment Voucher Michigan Form

What is the Michigan Individual Income Tax E file Payment Voucher?

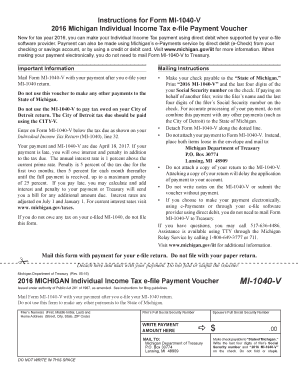

The Michigan Individual Income Tax E file Payment Voucher is a form used by taxpayers in Michigan to submit their income tax payments electronically. This voucher serves as a record of payment and is essential for those who file their taxes online. It ensures that the payment is correctly attributed to the taxpayer's account and facilitates the processing of their tax return. Understanding this form is crucial for compliance with state tax regulations.

How to use the Michigan Individual Income Tax E file Payment Voucher

Using the Michigan Individual Income Tax E file Payment Voucher involves a few straightforward steps. First, ensure that you have completed your tax return electronically. After filing, generate the payment voucher to accompany your electronic payment. This voucher typically includes important details such as your name, address, Social Security number, and the amount being paid. It is vital to keep a copy of this voucher for your records, as it serves as proof of payment.

Steps to complete the Michigan Individual Income Tax E file Payment Voucher

Completing the Michigan Individual Income Tax E file Payment Voucher requires careful attention to detail. Here are the steps to follow:

- Access the voucher through your tax preparation software or the Michigan Department of Treasury website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying and ensure it matches the amount due on your tax return.

- Review the information for accuracy before submitting.

- Print the voucher and keep a copy for your records.

Legal use of the Michigan Individual Income Tax E file Payment Voucher

The Michigan Individual Income Tax E file Payment Voucher is legally binding when completed correctly. It must be signed and dated by the taxpayer to validate the payment. Electronic signatures are accepted, provided they comply with the relevant eSignature laws. This ensures that the payment is recognized by the state and that the taxpayer meets their legal obligations.

Key elements of the Michigan Individual Income Tax E file Payment Voucher

Several key elements are essential for the Michigan Individual Income Tax E file Payment Voucher to be valid:

- Taxpayer Information: Accurate personal details, including name and Social Security number.

- Payment Amount: The exact amount being submitted for tax payment.

- Date: The date on which the payment is made, which is crucial for record-keeping.

- Signature: A signature or electronic signature to authenticate the voucher.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Michigan Individual Income Tax E file Payment Voucher. Typically, individual income tax returns are due on April fifteenth. If you are making an electronic payment, ensure that it is submitted by this date to avoid penalties. Additionally, if you are requesting an extension, be aware of the extended deadlines for filing and payment to remain compliant with state tax regulations.

Quick guide on how to complete 2016 michigan individual income tax e file payment voucher 2016 michigan individual income tax e file payment voucher michigan

Complete Michigan Individual Income Tax E file Payment Voucher Michigan Individual Income Tax E file Payment Voucher Michigan effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Michigan Individual Income Tax E file Payment Voucher Michigan Individual Income Tax E file Payment Voucher Michigan across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Michigan Individual Income Tax E file Payment Voucher Michigan Individual Income Tax E file Payment Voucher Michigan effortlessly

- Locate Michigan Individual Income Tax E file Payment Voucher Michigan Individual Income Tax E file Payment Voucher Michigan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate the worry of lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Modify and eSign Michigan Individual Income Tax E file Payment Voucher Michigan Individual Income Tax E file Payment Voucher Michigan and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2016 michigan individual income tax e file payment voucher 2016 michigan individual income tax e file payment voucher michigan

How to make an e-signature for a PDF file in the online mode

How to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the Michigan Individual Income Tax E file Payment Voucher?

The Michigan Individual Income Tax E file Payment Voucher is a document that allows taxpayers in Michigan to electronically file and pay their individual income tax. This voucher simplifies the payment process, ensuring timely submissions without the need for physical paperwork. Using the Michigan Individual Income Tax E file Payment Voucher Michigan can help streamline tax responsibilities for individuals.

-

How can I obtain a Michigan Individual Income Tax E file Payment Voucher?

You can obtain the Michigan Individual Income Tax E file Payment Voucher through the Michigan Department of Treasury's website or by using tax preparation software that includes this feature. Many platforms like airSlate SignNow provide the ability to easily generate and fill out this voucher. This allows for a hassle-free filing experience.

-

Are there any fees associated with filing the Michigan Individual Income Tax E file Payment Voucher?

Generally, the use of the Michigan Individual Income Tax E file Payment Voucher itself does not incur a fee; however, you may encounter service fees if you use specific e-filing services. It is important to review the pricing structure of the e-filing service you choose. airSlate SignNow offers competitive pricing for using its eSignature solutions when filing your taxes.

-

What are the benefits of using airSlate SignNow for the Michigan Individual Income Tax E file Payment Voucher?

Using airSlate SignNow for the Michigan Individual Income Tax E file Payment Voucher provides a cost-effective and user-friendly experience. It allows for secure document transmission and eSigning, minimizing delays and errors. Additionally, airSlate SignNow supports various integrations that can facilitate the overall tax filing process.

-

Can I eSign the Michigan Individual Income Tax E file Payment Voucher with airSlate SignNow?

Yes, you can easily eSign the Michigan Individual Income Tax E file Payment Voucher using airSlate SignNow. The platform offers a simple and intuitive eSigning process that ensures your voucher is completed quickly and securely. This feature eliminates the need for printing and physical signatures, making the process more efficient.

-

Is the Michigan Individual Income Tax E file Payment Voucher available for business taxes?

The Michigan Individual Income Tax E file Payment Voucher is specifically designed for individual taxpayers. However, businesses may have different forms and vouchers for their tax obligations. For business taxes in Michigan, it is important to refer to the Michigan Department of Treasury for the appropriate forms.

-

How does airSlate SignNow ensure the security of my tax information when using the Michigan Individual Income Tax E file Payment Voucher?

AirSlate SignNow prioritizes the security of your tax information through industry-standard encryption and compliance with data protection regulations. When using the Michigan Individual Income Tax E file Payment Voucher, your sensitive data is kept secure throughout the signing and filing process. This commitment to security helps provide peace of mind for users.

Get more for Michigan Individual Income Tax E file Payment Voucher Michigan Individual Income Tax E file Payment Voucher Michigan

- Flood zone statement and authorization north dakota form

- Name affidavit of buyer north dakota form

- Name affidavit of seller north dakota form

- Non foreign affidavit under irc 1445 north dakota form

- Owners or sellers affidavit of no liens north dakota form

- North dakota affidavit form

- Complex will with credit shelter marital trust for large estates north dakota form

- Nd separation form

Find out other Michigan Individual Income Tax E file Payment Voucher Michigan Individual Income Tax E file Payment Voucher Michigan

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form