201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule to Report Minnesota Income Tax Withheld Re Form

What is the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2

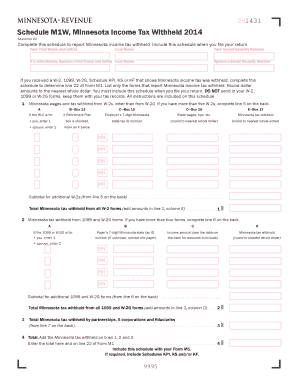

The 201431 Schedule M1W is a form used by taxpayers in Minnesota to report income tax withheld from their wages or other compensation. This schedule is specifically designed for individuals and businesses to ensure that the correct amount of state income tax is reported and remitted to the Minnesota Department of Revenue. It is essential for compliance with state tax laws and helps taxpayers accurately reflect their tax obligations on their annual returns.

How to use the 201431 Schedule M1W

To use the 201431 Schedule M1W effectively, taxpayers must gather all relevant information regarding their income and the taxes withheld throughout the year. This includes W-2 forms from employers and any other documentation that reflects income sources. Once the necessary information is collected, taxpayers can fill out the schedule by entering the amounts withheld in the appropriate sections. This schedule should then be submitted along with the Minnesota income tax return to ensure accurate reporting.

Steps to complete the 201431 Schedule M1W

Completing the 201431 Schedule M1W involves several key steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Enter your personal information at the top of the form, including your name and Social Security number.

- List all sources of income and the corresponding amounts withheld for each source.

- Calculate the total amount of Minnesota income tax withheld.

- Review your entries for accuracy before submitting the schedule with your tax return.

Legal use of the 201431 Schedule M1W

The 201431 Schedule M1W is legally binding when completed and submitted according to Minnesota state tax regulations. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The schedule serves as a formal declaration of income tax withheld and must be retained for record-keeping purposes, as it may be requested by tax authorities in the future.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 201431 Schedule M1W. Typically, the deadline for submitting this form coincides with the annual income tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to verify specific dates each tax year to ensure timely submission.

Form Submission Methods

The 201431 Schedule M1W can be submitted in several ways, including:

- Online through the Minnesota Department of Revenue's e-file system.

- By mail, sending the completed form to the appropriate address provided by the state.

- In-person at designated tax offices, if preferred.

Choosing the right submission method can help ensure that the form is processed quickly and accurately.

Quick guide on how to complete 201431 schedule m1w minnesota income tax withheld 2014 sequence 2 complete this schedule to report minnesota income tax

Complete 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule To Report Minnesota Income Tax Withheld Re seamlessly on any device

Online document management has become prevalent among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule To Report Minnesota Income Tax Withheld Re on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule To Report Minnesota Income Tax Withheld Re effortlessly

- Locate 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule To Report Minnesota Income Tax Withheld Re and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule To Report Minnesota Income Tax Withheld Re and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2?

The 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 is a form used to report income tax withheld for Minnesota tax purposes. Completing this schedule accurately ensures compliance with state tax regulations and helps prevent any penalties. Using airSlate SignNow allows you to fill and eSign this schedule seamlessly.

-

How can airSlate SignNow help with the 201431 Schedule M1W?

airSlate SignNow provides an easy-to-use platform to eSign and send the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2. Our solution streamlines the process, ensuring that you can efficiently manage and submit your tax documents while maintaining compliance. Additionally, you can track the status of your submissions in real time.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. These plans provide a cost-effective solution for managing documents, including the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2. You can choose the plan that best fits your business size and document volume.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow features include eSigning, document templates, real-time collaboration, and secure cloud storage. These features make it easier to manage documents such as the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2, allowing businesses to work efficiently. Our platform also integrates seamlessly with various business applications to enhance your workflow.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with numerous applications, enhancing your experience in managing documents. This includes accounting software and project management tools that can help streamline your filing of the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2. Simply connect your existing tools for a more efficient workflow.

-

Is my information secure when using airSlate SignNow?

Absolutely, airSlate SignNow prioritizes the security of your documents and personal information. Our platform employs advanced encryption and security measures to protect your data while you manage forms such as the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2. You can trust that your documents are safe with us.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 provides numerous benefits, including time savings, convenience, and enhanced accuracy. Our platform reduces manual errors and simplifies the signing process, allowing you to focus on your business. Experience the ease of document management with our solution.

Get more for 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule To Report Minnesota Income Tax Withheld Re

Find out other 201431 Schedule M1W, Minnesota Income Tax Withheld Sequence #2 Complete This Schedule To Report Minnesota Income Tax Withheld Re

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF