KF, Beneficiary 's Share of Minnesota Taxable Income a Landowner Guide to Minnesota S Sustainable Forest Incentive Act, Produced Form

What is the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota's Sustainable Forest Incentive Act

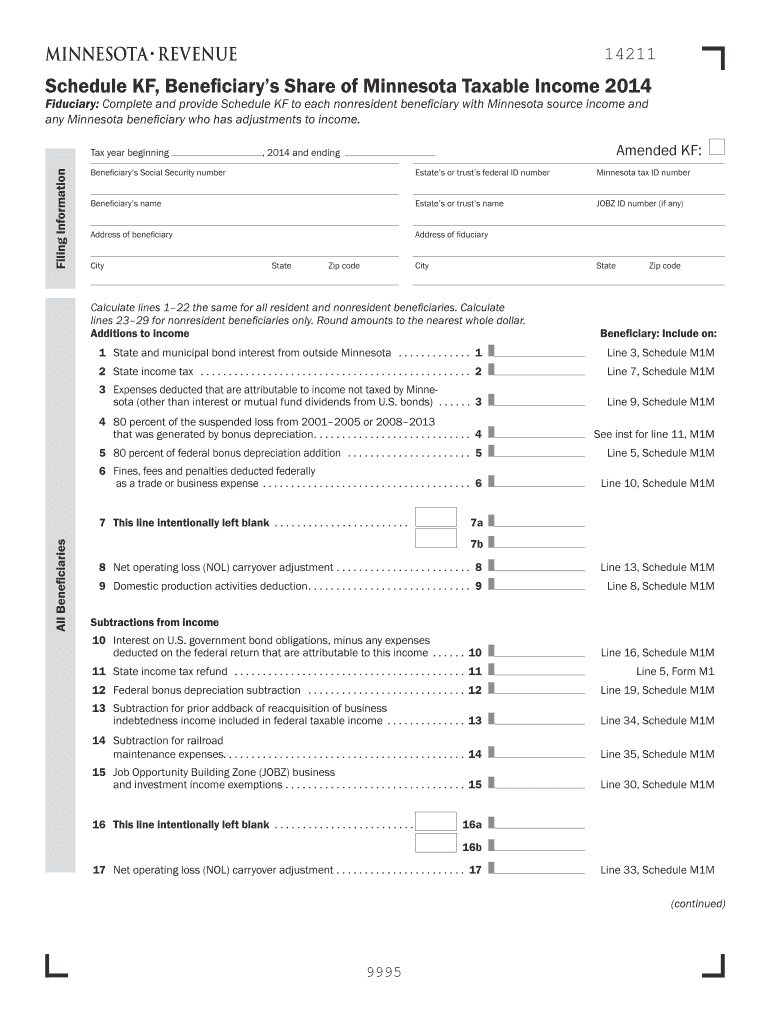

The KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota's Sustainable Forest Incentive Act is a crucial document for landowners participating in Minnesota's Sustainable Forest Incentive Act (SFIA). This guide outlines how beneficiaries of a land trust or estate can report their share of Minnesota taxable income derived from sustainable forestry practices. It serves as a resource for understanding eligibility, tax implications, and the benefits associated with sustainable land management. The guide is produced by the University of Minnesota to assist landowners in navigating the complexities of tax reporting related to sustainable forestry.

Steps to Complete the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota's Sustainable Forest Incentive Act

Completing the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide involves several key steps:

- Gather necessary documentation, including income statements and records of forestry activities.

- Review the guidelines provided in the document to understand eligibility criteria and reporting requirements.

- Fill out the form accurately, ensuring all information reflects the current financial year.

- Sign the document electronically using a secure eSignature platform to ensure compliance with legal standards.

- Submit the completed form by the designated deadline, either online or by mail, as specified in the guidelines.

Legal Use of the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota's Sustainable Forest Incentive Act

The KF, Beneficiary's Share Of Minnesota Taxable Income guide is legally binding when completed and submitted according to Minnesota state regulations. It is essential for landowners to adhere to the legal requirements outlined in the SFIA to avoid penalties. The use of electronic signatures, when executed through compliant platforms, ensures that the document meets the legal standards set forth by the ESIGN Act and UETA. This legal framework supports the validity of eDocuments, making them enforceable in a court of law.

Eligibility Criteria for the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota's Sustainable Forest Incentive Act

Eligibility for the KF, Beneficiary's Share Of Minnesota Taxable Income guide is determined by several factors:

- The land must be enrolled in the Sustainable Forest Incentive Act program.

- Beneficiaries must hold a legal interest in the land, such as ownership or a beneficial interest in a trust.

- Forestry practices must align with sustainable management standards as defined by the Minnesota Department of Natural Resources.

- Landowners must comply with all reporting and documentation requirements to qualify for tax benefits.

Examples of Using the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota's Sustainable Forest Incentive Act

Examples of how the KF, Beneficiary's Share Of Minnesota Taxable Income guide can be utilized include:

- A landowner who has harvested timber sustainably can report their income share to maximize tax benefits.

- Beneficiaries of a trust can use the guide to ensure accurate reporting of income derived from managed forest land.

- Landowners seeking to qualify for state tax incentives can reference the guide for compliance and documentation needs.

Form Submission Methods for the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota's Sustainable Forest Incentive Act

The KF, Beneficiary's Share Of Minnesota Taxable Income guide can be submitted through various methods:

- Online submission via the Minnesota Department of Revenue's e-filing system, which is secure and efficient.

- Mailing the completed form to the appropriate state office, ensuring it is postmarked by the submission deadline.

- In-person submission at designated state offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete 2008 kf beneficiary s share of minnesota taxable income a landowner guide to minnesota s sustainable forest incentive act

Complete [SKS] effortlessly on any device

Virtual document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes requiring new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to KF, Beneficiary 's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota S Sustainable Forest Incentive Act, Produced

Create this form in 5 minutes!

People also ask

-

What is the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota S Sustainable Forest Incentive Act?

The KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota S Sustainable Forest Incentive Act is a comprehensive resource produced by the University of Minnesota that provides detailed information about tax benefits for landowners participating in sustainable forestry programs. This guide helps landowners navigate the complexities of Minnesota's tax laws and maximize their potential earnings.

-

How can the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide assist landowners?

This guide assists landowners by outlining key information about eligibility for tax incentives related to sustainable forest management. It includes strategies for landowners to leverage these incentives effectively, ensuring they understand their rights and responsibilities under Minnesota law.

-

What features are included in the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide?

The guide includes detailed explanations of tax implications, eligibility criteria, and application processes for landowners. It also offers practical examples and case studies to illustrate how to benefit from the Sustainable Forest Incentive Act effectively.

-

Is the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide available digitally?

Yes, the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide is available in a digital format, making it easily accessible for landowners. This format allows users to download, share, and reference the guide from any device, enhancing usability.

-

Are there any costs associated with accessing the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide?

Access to the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide is typically offered at no cost through the University of Minnesota's resources. However, certain supplementary materials or consultations may have applicable fees.

-

How does the guide help with integration into existing land management systems?

The KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide provides best practices for integrating sustainable forestry incentives into existing land management systems. By following the guide, landowners can streamline their processes and ensure compliance with tax regulations.

-

Who created the KF, Beneficiary's Share Of Minnesota Taxable Income A Landowner Guide?

The guide was produced by the University of Minnesota, which is renowned for its research and educational programs in sustainable forestry and land management. Their expertise provides credibility and ensures the quality of the information provided.

Get more for KF, Beneficiary 's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota S Sustainable Forest Incentive Act, Produced

- Form 4 206

- Wr 02d office of the state engineer ose state nm form

- Printable w 9 nm 2012 form

- New mexico report of adoption form

- Nm 1915b medicaid bh waiver renewal nm behavioral health bhc state nm form

- Employee address change form supreme court state of ohio supremecourt ohio

- Saampi form 2012xls sai ok

- Oklahoma corporation commission form 1006b

Find out other KF, Beneficiary 's Share Of Minnesota Taxable Income A Landowner Guide To Minnesota S Sustainable Forest Incentive Act, Produced

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF