Ohio Tax Return Form

What is the Ohio Tax Return

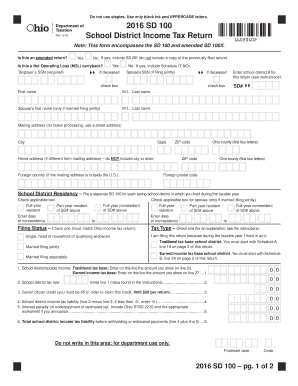

The Ohio tax return is a document that residents of Ohio must complete to report their income and calculate their state tax liability. This form is essential for individuals and businesses to comply with state tax laws. It includes various sections that capture personal information, income details, deductions, and credits applicable to the taxpayer. The Ohio tax return helps the state assess how much tax is owed or if a refund is due.

Steps to complete the Ohio Tax Return

Completing the Ohio tax return involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, fill out the Ohio tax return form by entering your personal information and income details. Be sure to claim any applicable deductions and credits to reduce your taxable income. After completing the form, review it for accuracy before submitting it. Finally, choose your submission method, whether online, by mail, or in person.

Required Documents

To complete the Ohio tax return, certain documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest or medical expenses

- Proof of any tax credits claimed

- Identification information, such as your Social Security number

Having these documents ready will streamline the completion process and help ensure that you do not miss any important information.

Form Submission Methods

There are several methods for submitting the Ohio tax return. Taxpayers can choose to file online through the Ohio Department of Taxation’s website, which offers a convenient and efficient way to submit forms electronically. Alternatively, forms can be mailed directly to the appropriate tax office. For those who prefer face-to-face interaction, in-person submissions can be made at designated locations. Each method has its benefits, so choose the one that best suits your needs.

Legal use of the Ohio Tax Return

The Ohio tax return is legally binding once it is signed and submitted. It is essential to ensure that all information provided is accurate and complete to avoid legal repercussions. Filing a false return can lead to penalties, including fines and potential legal action. To ensure compliance, it is advisable to use a reliable electronic signature solution when submitting the form digitally. This adds an additional layer of security and legal validity to the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio tax return are crucial for taxpayers to keep in mind. Typically, the deadline for submitting the Ohio tax return is April 15 of each year, aligning with the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any updates or changes to these dates annually to avoid late filing penalties.

Quick guide on how to complete ohio state tax return form

Complete ohio state tax return form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Handle ohio state tax return form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign ohio tax return form with ease

- Locate ohio tax return and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark important sections of your documents or hide sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the data and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign 2016 ohio state tax forms and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ohio state tax return form

Create this form in 5 minutes!

People also ask 2016 ohio state tax forms

-

What is the purpose of the Ohio state tax return form?

The Ohio state tax return form is used by residents to report their income and pay any state taxes owed. It's essential for compliance with state law and helps ensure that taxpayers receive any potential refunds. By accurately filling out the Ohio state tax return form, individuals can streamline their tax filing process.

-

How do I obtain the Ohio state tax return form?

You can easily obtain the Ohio state tax return form from the Ohio Department of Taxation's official website or through tax preparation software. airSlate SignNow can assist with electronic filing, ensuring your form is submitted securely and efficiently. Make sure to check for the most recent version of the Ohio state tax return form each tax season.

-

Is airSlate SignNow compatible with the Ohio state tax return form?

Yes, airSlate SignNow is compatible with the Ohio state tax return form, allowing you to easily fill out, sign, and submit it electronically. This functionality improves efficiency and reduces the chances of errors in your tax submissions. With airSlate SignNow, you can manage all your tax documents in one place.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features like electronic signatures, document templates, and secure cloud storage for managing tax documents. These features simplify the process of using forms like the Ohio state tax return form, helping you stay organized. Additionally, you can track document status, ensuring timely submissions.

-

Are there any costs associated with using airSlate SignNow for the Ohio state tax return form?

airSlate SignNow offers a cost-effective solution with various pricing plans to fit different business needs. You can use its services to handle forms like the Ohio state tax return form without incurring unnecessary expenses. Check the website for detailed pricing information and what’s included in each plan.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow integrates with various accounting and tax software, making it easier to file your Ohio state tax return form. This integration streamlines your workflow, allowing you to access all your necessary documents and tools in one place, which enhances your productivity during tax season.

-

What are the benefits of using airSlate SignNow for the Ohio state tax return form?

Using airSlate SignNow for the Ohio state tax return form offers numerous benefits, including increased efficiency, reduced paper use, and enhanced security. The platform allows for quick electronic signing and real-time updates on document status. This not only saves time but also minimizes the stress associated with tax filing.

Get more for ohio state tax return form

- Class d update for casino operators form

- State of iowa iowa department of public health idph state ia form

- 470 2486 form

- Community service printable form

- Business privilege licensegross bb city of radcliff cityof radcliff form

- Affirmative action plan baltimore maryland form

- Boiler permit application state of michigan form

- Geography all form

Find out other ohio tax return form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later