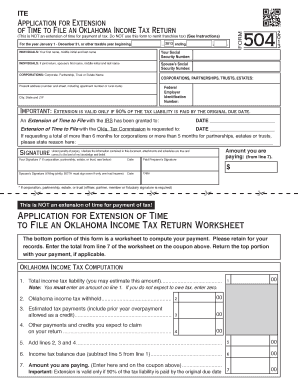

ITE Application for Extension of Time to File an Oklahoma Income Tax Return This is NOT an Extension of Time for Payment of Tax Form

Understanding the Oklahoma Tax Extension Application

The ITE Application for Extension of Time to File an Oklahoma Income Tax Return is designed for individuals seeking additional time to submit their tax returns. It is important to note that this application does not extend the time for payment of any taxes owed. The extension applies to tax years ending on December 31 or other taxable years as specified. This application is crucial for individuals who may need more time to gather necessary documents or complete their tax filings accurately.

Steps to Complete the Oklahoma Tax Extension Application

Completing the ITE Application requires careful attention to detail. Follow these steps to ensure your application is filled out correctly:

- Obtain the ITE Application form from the Oklahoma Tax Commission website or local tax office.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are requesting the extension.

- Sign and date the application to certify its accuracy.

- Submit the completed application by the original due date of your tax return to avoid penalties.

Eligibility Criteria for the Oklahoma Tax Extension

To qualify for the Oklahoma tax extension, you must meet certain eligibility criteria. Generally, any individual who is required to file an Oklahoma income tax return may apply for an extension. However, the extension is contingent upon the timely submission of the application. Additionally, it is essential to ensure that any taxes owed are paid by the original due date to avoid interest and penalties.

Filing Deadlines for the Oklahoma Tax Extension

The deadline for submitting the ITE Application aligns with the original due date of your income tax return. For most individuals, this is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to submit your application on or before this date to ensure that you receive the extension without incurring penalties.

Required Documents for the Oklahoma Tax Extension

When applying for the Oklahoma tax extension, you may need to provide specific documents to support your application. While the form itself is the primary document, having your previous year's tax return and any relevant financial documents can help ensure accuracy. If you owe taxes, be prepared to include payment information or documentation of any estimated payments made.

Penalties for Non-Compliance with the Oklahoma Tax Extension

Failing to file your Oklahoma income tax return by the extended deadline can result in penalties. The Oklahoma Tax Commission may impose a late filing penalty based on the amount of tax owed. Additionally, interest may accrue on any unpaid taxes from the original due date until the date of payment. Understanding these potential consequences emphasizes the importance of timely filing and payment.

Form Submission Methods for the Oklahoma Tax Extension

You can submit the ITE Application for Extension of Time to File your Oklahoma Income Tax Return through various methods. Options typically include online submission via the Oklahoma Tax Commission website, mailing a physical copy to the appropriate address, or delivering it in person at a local tax office. Each method has its own processing times, so consider your circumstances when choosing how to submit your application.

Quick guide on how to complete oklahoma income tax

Complete oklahoma income tax effortlessly on any device

Digital document handling has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your papers swiftly without any holdups. Manage oklahoma tax extension on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign oklahoma income tax extension with ease

- Locate tax extension form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Edit and eSign oklahoma income tax rate and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to oklahoma income tax extension

Create this form in 5 minutes!

People also ask oklahoma income tax

-

What is an Oklahoma income tax extension?

An Oklahoma income tax extension allows taxpayers to postpone their tax filing deadline for up to six months. It’s important to note that while this extension gives you more time to file, any taxes owed must still be paid by the original due date to avoid penalties.

-

How do I apply for an Oklahoma income tax extension?

You can apply for an Oklahoma income tax extension by submitting Form 504, Application for Extension of Time to File. This form can be filed electronically through your tax software or manually through the mail, and it must be submitted before the original due date of your income tax return.

-

Is there a fee to file for an Oklahoma income tax extension?

No, there is no fee to file an Oklahoma income tax extension. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Filing this extension will simply give you more time to prepare your tax return.

-

Will I still owe taxes if I file an Oklahoma income tax extension?

Yes, even if you file for an Oklahoma income tax extension, you are still responsible for paying any taxes owed. The extension only allows you more time to file your return, not to pay your tax bill. It’s advisable to estimate your tax liability and make a payment to avoid penalties.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as eSigning, document templates, and secure cloud storage, which simplify the management of tax-related documents. These features are especially useful when handling documents related to your Oklahoma income tax extension, ensuring that everything is organized and readily accessible.

-

Can airSlate SignNow integrate with accounting software for tax filing?

Yes, airSlate SignNow can seamlessly integrate with various accounting software platforms. This integration allows users to easily manage documents related to their Oklahoma income tax extension and streamline the filing process, making it more efficient and less time-consuming.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and a cost-effective solution. It enables businesses to eSign documents securely, which is particularly advantageous when managing the paperwork associated with an Oklahoma income tax extension.

Get more for income tax rate in oklahoma

Find out other income tax rate oklahoma

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free