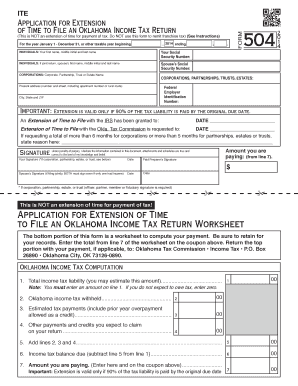

ITE This is NOT an Extension of Time for Payment of Tax Form

What is the ITE This Is NOT An Extension Of Time For Payment Of Tax

The ITE This Is NOT An Extension Of Time For Payment Of Tax form is a crucial document used by taxpayers to clarify that they are not requesting an extension for the payment of their taxes. This form serves to inform the Internal Revenue Service (IRS) that the taxpayer acknowledges their tax obligations and intends to fulfill them by the designated deadline. Understanding this form is essential for maintaining compliance with tax regulations and avoiding potential penalties.

How to use the ITE This Is NOT An Extension Of Time For Payment Of Tax

To effectively use the ITE This Is NOT An Extension Of Time For Payment Of Tax form, taxpayers should first ensure they have all necessary information at hand, including their tax identification number and details of their tax liability. The form can be filled out digitally or on paper. Once completed, it should be submitted to the IRS in accordance with the filing guidelines. This ensures that the taxpayer's intent to pay taxes on time is formally documented.

Steps to complete the ITE This Is NOT An Extension Of Time For Payment Of Tax

Completing the ITE This Is NOT An Extension Of Time For Payment Of Tax involves several key steps:

- Gather all relevant tax information, including your tax identification number and payment details.

- Access the form through the IRS website or a trusted tax software.

- Fill out the form accurately, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the appropriate deadline.

Legal use of the ITE This Is NOT An Extension Of Time For Payment Of Tax

The ITE This Is NOT An Extension Of Time For Payment Of Tax form is legally binding, provided it is completed and submitted according to IRS regulations. It is important for taxpayers to understand that submitting this form does not grant any additional time for payment; rather, it confirms their commitment to meet their tax obligations on time. Compliance with this form is essential to avoid legal repercussions or penalties from the IRS.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when submitting the ITE This Is NOT An Extension Of Time For Payment Of Tax form. Typically, the form should be filed by the original tax due date. Missing this deadline can result in penalties and interest on unpaid taxes. It is advisable for taxpayers to keep track of important tax dates each year to ensure timely compliance.

Penalties for Non-Compliance

Failure to submit the ITE This Is NOT An Extension Of Time For Payment Of Tax form by the deadline can lead to significant penalties. These may include late payment fees and interest charges on the outstanding tax amount. Additionally, non-compliance may trigger further scrutiny from the IRS, potentially leading to audits or other legal actions. Understanding these consequences emphasizes the importance of timely and accurate filing.

Quick guide on how to complete ite this is not an extension of time for payment of tax

Effortlessly Prepare [SKS] on Any Device

The management of documents online has gained signNow traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and store them securely online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

The Simplest Way to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details using the tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ITE This Is NOT An Extension Of Time For Payment Of Tax

Create this form in 5 minutes!

People also ask

-

What does ITE This Is NOT An Extension Of Time For Payment Of Tax mean?

ITE This Is NOT An Extension Of Time For Payment Of Tax refers to legal terminology clarifying that an extension does not delay the responsibility for tax payments. This means that even if you file for an extension, payments are still due on the original deadline. It's crucial for businesses to remain compliant to avoid penalties.

-

How can airSlate SignNow help with ITE This Is NOT An Extension Of Time For Payment Of Tax?

airSlate SignNow provides an efficient platform for managing and signing important tax-related documents. By utilizing our electronic signature capabilities, you can ensure that documents related to ITE This Is NOT An Extension Of Time For Payment Of Tax are swiftly signed and processed. This minimizes delays and helps maintain compliance.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax forms?

Absolutely! airSlate SignNow offers a range of pricing plans that fit the budget of small businesses managing tax obligations. By streamlining your document management process, including aspects related to ITE This Is NOT An Extension Of Time For Payment Of Tax, you can save on both time and costs associated with traditional paper handling.

-

What features does airSlate SignNow include for tax document management?

Our platform includes customizable templates, secure cloud storage, and advanced eSignature capabilities tailored for tax documents. These features are especially useful for documents concerning ITE This Is NOT An Extension Of Time For Payment Of Tax, ensuring compliance and efficiency in your document workflows.

-

Can I integrate airSlate SignNow with my current accounting software?

Yes! airSlate SignNow seamlessly integrates with various accounting software, enhancing your workflow related to ITE This Is NOT An Extension Of Time For Payment Of Tax. This integration allows for easy transfer of documents and data, simplifying the signing process of tax-related forms.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is our top priority at airSlate SignNow. We comply with industry-standard security measures to protect sensitive documents, including those related to ITE This Is NOT An Extension Of Time For Payment Of Tax. Data encryption, secure cloud storage, and user authentication protocols ensure that your information remains confidential.

-

What support does airSlate SignNow offer for users dealing with tax issues?

airSlate SignNow offers comprehensive support options including live chat, email support, and a detailed knowledge base. If you have questions related to ITE This Is NOT An Extension Of Time For Payment Of Tax or other tax documents, our team is here to help you navigate these processes efficiently.

Get more for ITE This Is NOT An Extension Of Time For Payment Of Tax

Find out other ITE This Is NOT An Extension Of Time For Payment Of Tax

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent